In last week’s article, we bemoaned the sad state of the Treasury, with the Consolidated Fund overdrawn by an estimated $230.892 billion at a time when the new Administration is compiling its budget for 2020. We suggested that a comprehensive review of all government programmes and activities be conducted to determine their continued relevance in terms of their outputs, outcome and impacts. This is necessary to reduce costs without compromising on the quality of public services and to move progressively towards a balanced budget, instead of a deficit one with which we have long been accustomed.

A useful report that can be used to assess the performance of the economy is the End-of-Year report prepared by the Minister for the benefit of legislators and the public at large. Today’s article highlights the key aspects of the 2019 Report that was prepared in June 2020 but is yet to be laid in the National Assembly.

Legislative requirements

Section 15 of the Fiscal Management and Accountability (FMA) Act provides for the annual budget proposals for the next fiscal year to include: (i) a review of the execution of the annual budget for the current fiscal year; (ii) a projection of the likely outcome for the full fiscal year; and (iii) explanations for any major differences between the financial plan for the current fiscal year and actual performance.

By Section 67, the Minister is to present within 60 days to the Assembly a mid-year report on the execution of the annual report and the prospects for the remainder of the fiscal year, including an update on the macroeconomic and fiscal situation. Section 68 also provides for the preparation of the End-of-Year Budget Outcome and Reconciliation Report which, along with the other audited financial statements, is due for presentation to the Assembly within nine months after the close of the fiscal year.

Background to the End-of-Year Report

It is not a legal requirement for a dedicated End-of-Year Report to be prepared on the execution of the budget and the performance of the economy since the relevant details are normally reflected in the Minister’s budget speech to the Assembly. However, since 2017, the budget has been presented to and approved by the Assembly before the fiscal year commences. Section 15 of the FMA Act contemplates this approach although Article 219 of the Constitution allows an outer limit of 90 days into the fiscal year.

Given that the Minister’s budget speech for the years 2017 to 2019 was delivered in November, much of the information referred to in his speech was based on assessments made earlier and projections to year-end. It was therefore necessary for an updated report to be prepared, hence the 2019 End-of-Report.

The End-of-Year Report contains five sections, namely, Introduction; Global Economic Development; Domestic Development; Agenda 2019; and Conclusion. In mirrors to a large extent the content of both the Minister’s budget speech and his Mid-Year report.

Global economic development

The International Monetary Fund’s assessment of the estimated global economic growth in 2019 was 2.9 percent, the lowest since 2009 when the world economy contracted by one percent in the light of the 2008-2009 global financial crisis. Due to the severe impact of the COVID-19 pandemic, the IMF has projected a contraction of 3.0 percent in the global economy in 2020, the worst since the Great Depression of the 1930s.

The report highlighted economic development in 2019 in various regions of the world, including the United Kingdom, United States, Germany, Japan and China. For the emerging markets and developing economies, the estimated growth was 3.7 percent while for the Caribbean region, growth was projected at 1.4 percent.

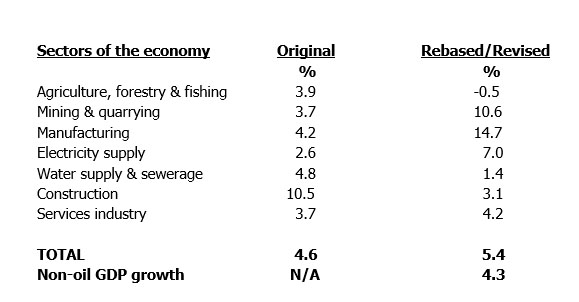

Domestic development GDP growth

At the time of the preparation of the 2019 budget, real GDP was forecasted to grow by 4.6 percent. However, by mid-year, the figure was revised to 4.5 percent. Following the Statistical Bureau’s rebasing and revision of the methodology for calculating the real GDP growth using 2012 as the new base year, growth was estimated at 5.4 percent, of which non-oil GDP growth was 4.3 percent, as summarized below:

The Minister, however, cautioned against making direct comparison of the GDP growth rate for 2019 with the earlier projections.

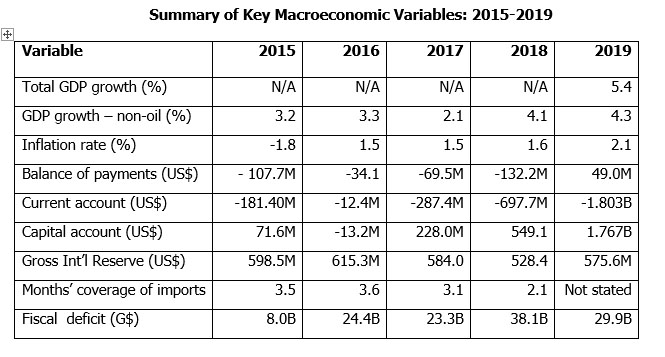

Balance of payments

The current account deficit was US$1.803 billion, and according to the report, this was 25.3 percent higher than that recorded in 2018. However, the End-of-Year report for 2018 reflected a deficit of US$697.7 million, an increase of US$1.105 billion or 158 percent. This increase was due mainly to higher payments for merchandise imports compared with export earnings.

The capital account reflected a surplus of US$1.767 billion, and according to the report, this was 36 percent higher than that recorded in 2018. However, the End-of-Year report for 2018, reflected a surplus of US$549.1 million, giving an increase of US$1.218 billion or 222 percent. This increase was due mainly to increased foreign direct investments, especially in the oil and gas sector, which accounted for US$1.696 billion.

The overall balance of payment in 2019 reflected a deficit of US$49 million, compared with a deficit of US$132.2 million in 2018. The deficit was financed by debt relief of US$50.7 million and debt forgiveness of US$45.7 million

Foreign exchange reserves

Gross international reserves at the Bank of Guyana increased from US$528.4 million in 2018 to US$575.6 million.

Inflation

Inflation was 2.1 percent, 0.5 percent higher than 2018.

Exchange rate

The exchange rate remained stable at G$208.5 = US$1. The market rate at the end of 2019 was G$214.7 = US$1.

Central Government revenues and expenditures

Revenue collections for 2019, inclusive of grants, amounted to $252.531 billion while total expenditure was $282.456, giving a fiscal deficit of $29.925 billion, representing 2.8 percent of the GDP. The fiscal deficit for 2018 was $27.286 billion.

Current expenditure totalled $216.193 billion of which employment costs accounted for $68.6 billion or 31.7 percent. Capital expenditure was $66.3 billion.

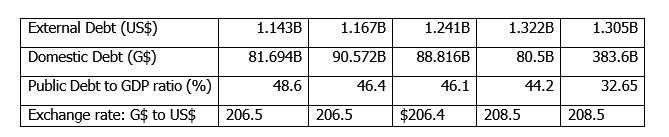

Public Debt

Guyana’s public debt as of 31 December 2019 stood at US$1.689 billion, the external portion accounting for US$1.305 billion. At the end of 2018, the external debt was US$1.332 billion.

Summary of economic performance

The following table summaries the performance of the economy in 2019, as represented by the key macroeconomic variables, with corresponding figures for the previous four years:

Concluding remarks

The 2019 budget is on track for presentation to the Assembly by 10 October, no doubt drawing heavily on the performance of the economy in 2019 as reflected in the End-of-year Report as well as the present state of affairs of the Treasury. We had hoped for an earlier presentation, considering that in accordance with sections 12 and 13 of the FMA Act, the budget preparation would have commenced since July 2019 as well as the fact that it will be in effect be a five-month budget covering the period from August to December 2020. In order to ensure that parliamentary approval is given for a budget for the entire year, revenues assessed and collected for the period January to July as well as expenditure incurred will have to be included but shown separately.

We acknowledge that the change in Administration on 2 August creates some complications for the budget process since the new Government’s priorities may be different from those of the previous Administration.

We hope also that there would a continuation of the practice of having an approved budget before the fiscal year. However, it does not appear that there will be enough time to do so in respect of the fiscal year 2021. Perhaps, a deadline of February month-end would not be an unreasonable proposition. As discussed in previous articles, there are significant benefits to be derived from having an early budget.