The main elements of the 2020 Plan are:

Total current revenues are projected to decrease by $14,109 million to $226,476 million or by 5.9%. Of this, the Guyana Revenue Authority is expected to account for revenues of $214,548 million or 94.7% of total revenue, a decrease of $11,445 million or 5.1% when compared to 2019. 2020 will see a widening of the deficit from $40,028 million to $95,517 million.

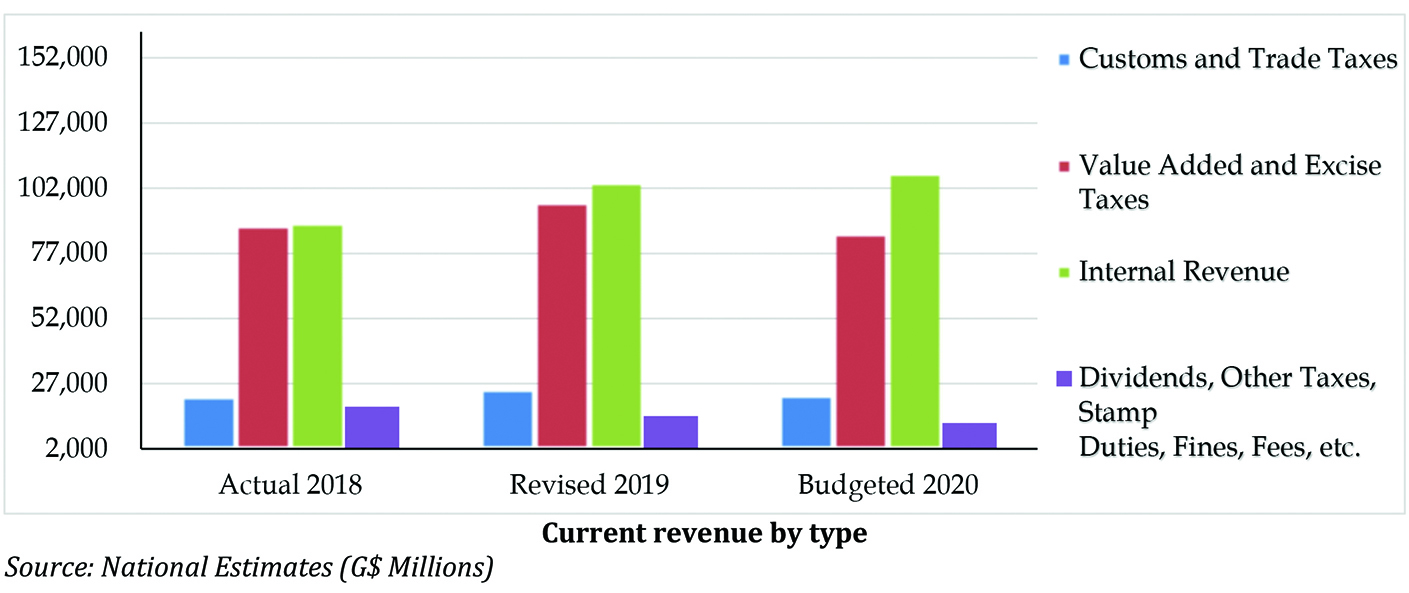

The Government envisages the decrease of tax revenue by G$ 13,509, all in light of declined business activity due to the COVID-19 Pandemic. The only source expected to see an increase is Internal Revenue which anticipates a marginal increase of $3.4M.

Of the GRA’s collections, Internal Revenue is projected to account for $107,728 million compared with $104,331 million in 2019, a 3.3% increase, while Value-Added and Excise Taxes are expected to earn $84,729 million compared to $96,547 million in 2019, a decrease of 12.2%. Collections by the Customs and Trade Administration are anticipated to be $22,691 million, a decrease of $2,424 million or 9.7%.

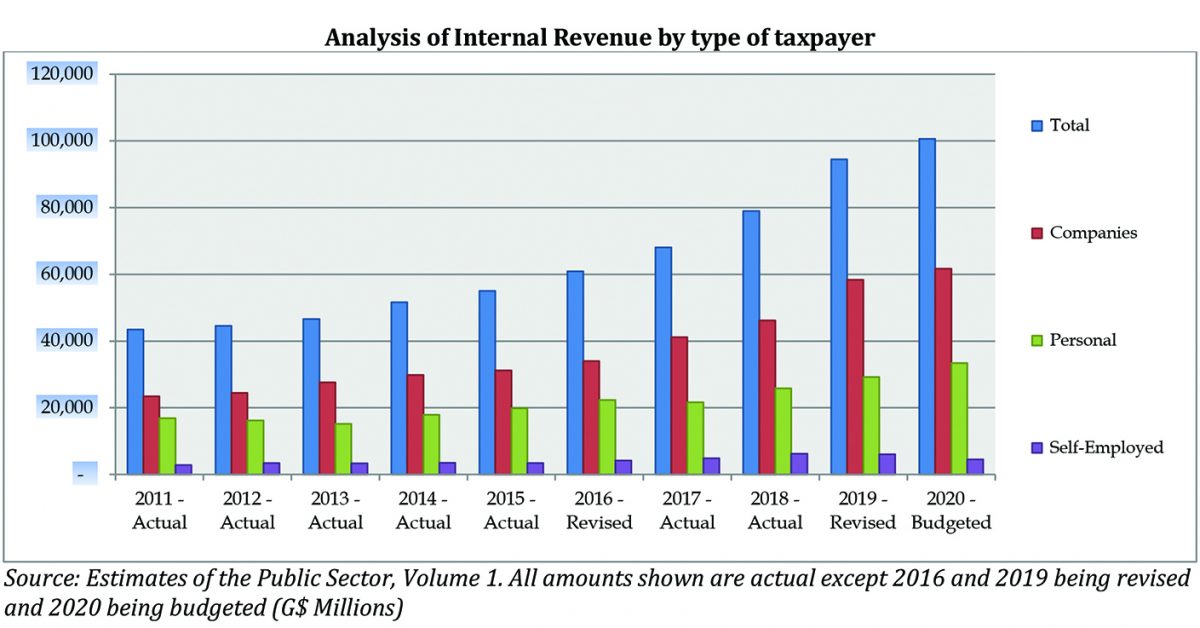

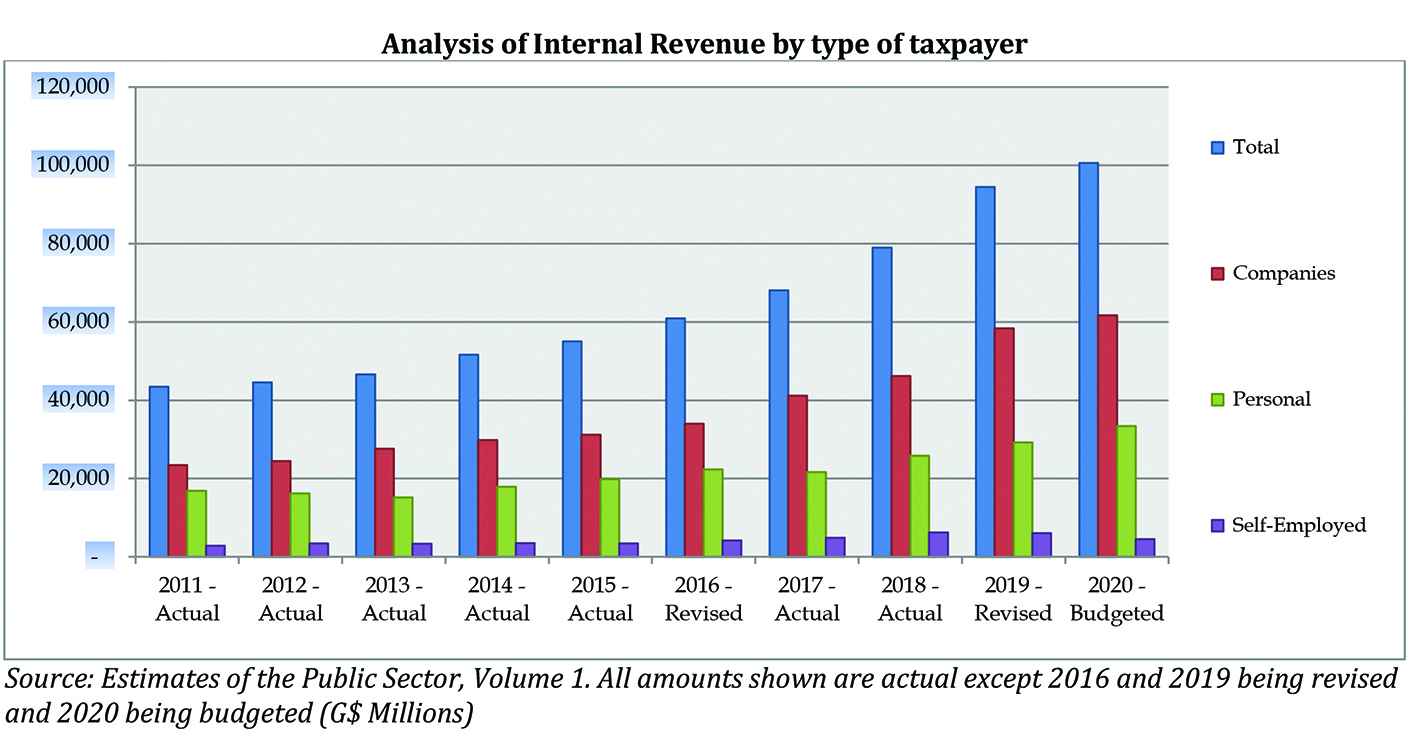

An examination of revenue projections for full year 2020 show Companies Taxes increasing by 6.42 %, Personal Tax by 5.78 % while collections from Self Employed are expected to decline by 24.7 %.

Despite the proposed changes in VAT legislation, overall VAT collections are expected to remain steady with 2019 but with Imports declining by $4 billion while VAT on Domestic supplies are expected to increase by a similar amount. The major tax change is in relation to Excise Taxes which are expected to decline by $11.8 billion or 26.9 % which the Minister explained as due to low collections from the importation of petroleum products.

Total current non-interest expenditure is projected to increase by $32,343 million from $207,683 million in 2019 to $240,026 million for 2020. Personal emoluments of $74,823 million represent an increase of 9.1% or $6,272 million over the revised figures for 2019. As a percentage of current non-interest expenditure, personnel emoluments account for 31%, Other Goods and Services 29% and Transfer Payments 40%.

Transfer payments are payments from the Government to individuals, organisations or other levels of Government made with the specific objective of furthering Government policy or programme delivery and for which the Government does not receive directly any goods or services.

Capital expenditure of $72,070 million represents a projected increase of $5,808 million or 8.8% over revised 2019 of $66,262 million. The top five ministries in terms of capital expenditure are:

1. Ministry of Public Infrastructure

2. Ministry of Finance

3. Ministry of Public Security

4. Ministry of Agriculture

5. Ministry of Presidency

Interest expenditure is projected to increase by 1.3% or $75 million to $5,946 million. Domestic interest is projected to decrease by $47 million or 4.5%, while interest on external debt is projected to increase by $122 million or 2.5%.

The principal element of debt repayments is projected at $11,514 million (2019: $11,777 million), made up of domestic debt repayments of a projected $280 million (2019: $280 million), while external debt repayments are projected to increase to $11,233 million (2019: $11,497 million).