With Guyana’s pensionable cohort projected to reach 20% of the total population size by 2050, a complete overhaul of its pension system is being recommended by a recent Inter-American Development Bank (IDB) Study.

“The financial sustainability of the pension scheme is at risk, and… without any major reform the increasing pension expenses…will erode the government’s ability to provide other relevant services to the population,” the study stressed, while warning that the window of opportunity for reform is closing rapidly as pension costs will continue to rise and the “demographic dividend” that could potentially alleviate the burden of the economically dependent population on the workforce erodes over the next 20 years.

The study, “Economic Institutions for a resilient Caribbean”, notes that Guyana like other Caribbean countries has maintained a defined-benefit pay-as-you-go pension system (PAYGO), such systems rely on contributions from the actively working population to support the dependent population.

They argue that while such systems are financially sustainable in countries with a high proportion of working people in the total population, they require periodic and frequent actuarial studies to assess their sustainability and amendments to key variables such as the retirement age, or to contribution rates, are advisable to maintain the financial sustainability of the schemes. “For pension schemes to be successful, they must succeed in many different ways, including their financial sustainability, the appropriateness of their replacement rates and population coverage, [and] their affordability. Failure in any one of these essential features can doom the system altogether even if it has all the other positive attributes needed for success,” they observe while advising that policymakers need to give special attention to variables such as long-term financial feasibility, anticipated replacement rates and coverage of the population.

Guyana’s National Insurance Scheme (NIS) has in recent years struggled to maintain financial sustainability following a series of bad investments in insurance company, CLICO and the Berbice Bridge Company.

The last actuarial review of NIS conducted in 2011 had predicted that the fund would be exhausted unless a series of recommendations were implemented. These included: an increased contribution rate, increased wage ceiling to $200,000, and an increase in the age of eligibility for old-age pension from 60 to 65 years.

While the insurable earnings ceiling was in 2019 raised to $256,800 per month due to an increase in minimum wage and the contribution rate was increased from 13% to 14% in 2014 the age of eligibility remains the same.

Throughout the year a total of 38,175 old-age pensions at an average of $31,642 per month was paid totaling $19.097 billion. Revenue collected equalled $23.728 billion, with a contribution rate at just above 20%.

Specifically there were 31,203 registered employers with 8,320 or 26.7% actively contributing. The total registered employees at December 31, 2019, was 741,417 with 168,847 or 22.8%, actively contributing, while 8,467 or 23.8% of 35,626 self-employed contributors were active.

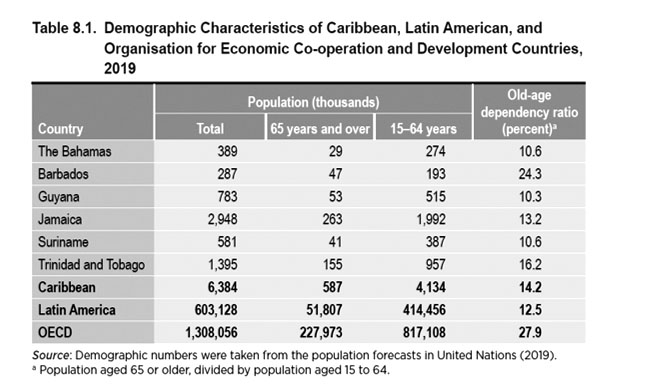

The IDB study repeatedly stated the fact that sustained increases in old-age dependency ratios negatively affect the long-term sustainability of such schemes where the income flow of the system is reduced while pension expenses keep on growing. In the case of the Caribbean generally and Guyana specifically International Monetary Fund (IMF) projections starting from 2017 have according to the study indicated substantial deficits and an eventual depletion of assets over a 13-year period.

The study stresses that if this scenario materializes without Caribbean countries undertaking any major reform of their pension schemes, governments will find themselves in the difficult position of deciding whether to finance pension benefits or allocating public resources to other priority expenditures such as health, education, or infrastructure.

Currently, spending on social protection in the region averages 2.9% of GDP but if Caribbean countries do not undertake pension reform, public pension expenditure as a share of GDP is expected to increase on average more than 100 percent between 2019 and 2050.

“While it took Europe 65 years to double its old-age dependency ratio between 1950 and 2015, the rising life expectancy and falling fertility rates in Caribbean countries are expected to double the old-age dependency ratios in only 25 years,” they observed