An oil and gas masterplan for Guyana done by the Government of Japan had concluded in 2019 that a gas to power solution based on the country’s petroleum operations is economically viable but it leaned heavily in favour of an offshore facility rather than an onshore plant.

The plan, completed in 2019 and given to the David Granger APNU+AFC administration, comprised analyses for both onshore and floating gas-to-power plants. It projected a power selling price for the onshore plant at 6.93 cents (US) per KWH compared to 7.11 cents (US) per KWH for the offshore facility.

The figures listed in the report reflect a significantly lower tariff than the current electricity rate, given as US 32 cents per KWH. The report highlighted that the decision on having an onshore or an offshore facility would be left entirely up to the country.

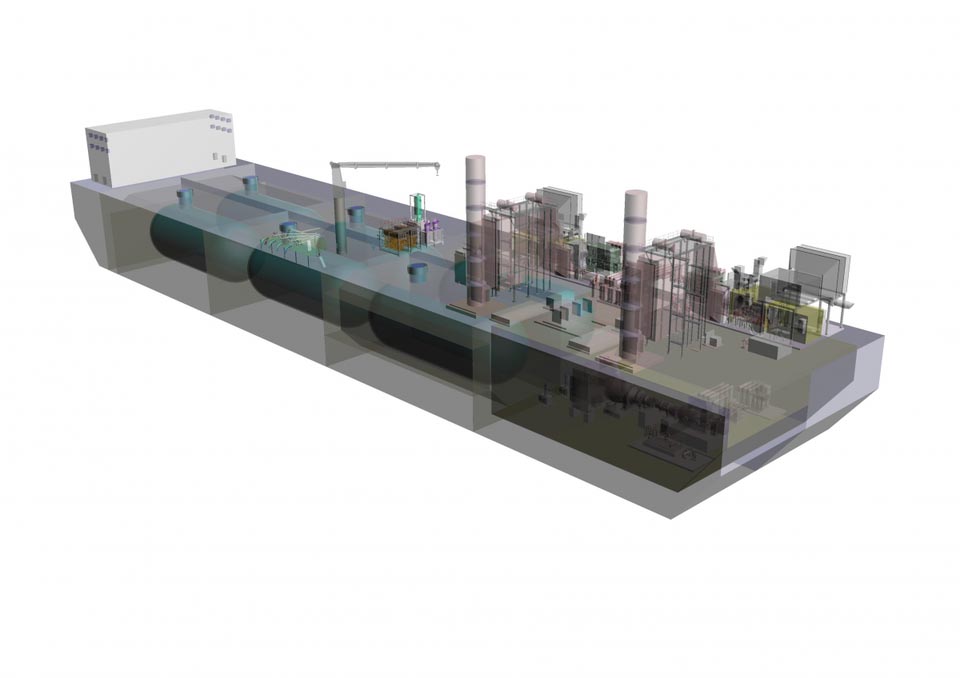

While it said that it did not find a significant difference between the two costs for the LNG (Liquefied Natural Gas) processes, the study leans heavily in support of an offshore facility and focused on the offshore set up more.

“Gas to Power solution is economically viable for Guyana…Phased development will be preferred in view of economics. Significant difference is not observed between onshore and floating solutions,” the report presented to the Granger Administration in 2018 and updated in 2019 states. The report was never presented to the public by the Granger administration.

The plan also posited that “Offshore FLNG (floating liquefied natural gas) looks (the) most preferable solution for Guyana. Considering Guy-ana’s geotechnical characteristics, offshore FLNG looks most preferable solution for Gas to LNG. Phased Development is more attractive. Phased development with smaller scale FLNG will be more appropriate than large scale FLNG.”

Offshore processing, it pointed out, would, however, come with its own cons and see a reduction in local content when compared to having it land onshore. The country, though, would not have to deal with the complications that would come from the laying of pipes and potential risks posed from them if it plans to transition to renewables in the future.

The 100-page document, seen by the Sunday Stabroek, further points out that there is “No significant difference observed in economics between onshore and floating gas to power plants. The selection will depend on the site conditions, complexity of permissions, man-power in the country, etc. Economical viability is sensitive to fuel gas price. Economical viability is more sensitive to fuel gas price than the other parameters, CAPEX (capital expenditure) and OPEX (operating expense).”

In March of 2018, the then APNU+AFC government had said that it had received an ‘Oil and Gas Master Plan’ for Guyana, which was developed and submitted by the Mitsubishi Corporation and its affiliate Chiyoda Corporation in collaboration with the Government of Japan. A meeting was held in November of the same year and confirmation of the possibility to proceed to phase two was had. Phase two was completed the next year.

The team comprised persons from the Department of Energy, the Ministry of Foreign Affairs, Japan’s Ministry of Economy, Trade and Industry METI (Japan Cooperation Center for Petroleum).

West Bank of Demerara

The PPP/C government says it has decided on an onshore operation for gas to power and is forging ahead with studies it said it hopes to substantiate its belief that Wales, West Bank of Demerara is best suited for a project, which Vice President Bharrat Jagdeo calls “a no brainer”.

However, it is unclear if any of the data or information that formed Tokyo’s report on the sector will be incorporated or is being used for analysis. The PPP/C government has made no reference to the offshore option for gas processing and has been roundly criticised for seeming to want to establish a plant for purely political reasons and without validating studies.

With Exxon’s announcements recently that it was making amendments to bring associated gas from its Liza-1 well to shore, observers have said that the public should pay keen attention to how the PPP/C government will handle those amendments and how they will negotiate for the project.

Anticipating “significant progress” in the partnership with government in advancing the gas-to-shore project here, Exxon had last month told this newspaper that the associated gas availability from the Liza-1 field has been changed from 35 million standard cubic feet per day (mmscfd) to 50 mmscfd.

Both Guyana’s President Irfaan Ali and Vice President Jagdeo have said that the ultimate goal of the PPP/C is to have renewables as the main form of energy for this country but that since natural gas is readily available and could result in a cost of at least half of what this country currently pays, it would be prudent to pursue that while simultaneously working on plans for the adoption of renewables in the long term.

Roadmap

The Japanese team, according to the report, undertook a review and looked at various scenarios for utilization of oil and gas and a roadmap to “Guyana’s vision” was created.

Study scenarios looked at gas utilization and oil utilization where associated gas was used to deliver for domestic uses or refining crude oil here by setting up a refinery for domestic use after the gas to shore project was realized. In the study, it is assumed that Guyana’s indigenous crude oil is delivered onshore for domestic use, and the required amount is limited to as much as this country’s domestic demand.

Based on the average annual growth rate of petroleum products between 2010 and 2016, shown in a Guyana Energy Agency’s Annual Report which the report referred to, demand for petroleum was projected to see a steady growth.

Using supported data and information gathered from government and others publicly available sources, the Japanese master plan illustrated projected patterns and it assumed that heavy fuel oil for electricity generation will be replaced by gas to power generation by 2027.

Tokyo had pointed to Georgetown’s challenging situation of energy supply as it noted significant dependence on imports, vulnerability of energy security and “environment burden (such as CO2, SOX – sulphur dioxide – NOX – nitrous oxide, etc.)”

Some of the key objectives of the plan were the development of Guyana’s domestic oil industry, the creation of a balance in the domestic usage and exportation of products from indigenous oil and gas and the harmonization of the industry in keeping with Guyana’s ‘green’ development agenda.

The study encompassed surveys of public domain information which focused on the current energy situation in Guyana, analysis of the then current situation, presumption of study conditions and identification of oil and gas utilization projects.

The profile of associated gas production was provided by the Department of Energy at the kickoff meeting on May 22, 2019 and based on the profile of gas production, the study was carried out under two scenarios of utilization. The report divided needs for the associated gas and how it will be used in two phases up to 2040 when there could be a complete to switch renewables.

Noted was the assumption for the basic condition for the analysis which put the gas engine capacity at an 18MW/engine. Plant configuration for the on-shore Power Plant was set at the “18MW/engine x N engines as per power demand”.

For the floating power plant, “90MW (5 engines), 72MW (4 engines), and/or 54 MW (3 engines) as per power demand” were used for the projections with a net capacity factor that puts gas power at an 80% (at maximum) and renewable 30%.

The study suggested that construction duration would run for about three years for the onshore power plant and an additional one year for power expansion. Constructing of the floating power plant was estimated at two years.

The report said that in case the energy shift to renewables is achieved by 2035, providing for at least 65% of power supply demand, the additional power capacity from gas would be necessary only for several years after heavy fuel oil power is closed.

An effective solution may be, it posits, to then “lease a floating power plant for the duration, instead of construction of a new power plant”.

Options for excess gas, where it believes that in the early phase of gas to power and when a renewable plan is achieved the volume will be around 15~25mmSCFD, include fertilizer production.

However, the study pointed out was the fact that “the amount of excess gas is not sufficient for internationally competitive production.” When LNG production is started, it said, “The excess gas can be fed to the LNG plant,” the report said.

Based on the profile of gas production, the study was done using two scenarios of utilization: Gas to power and subsequent LNG production. It considered that for the gas to power Phase 1, associated gases of 35 mmSCFD be utilized for power generation.

With 18 oil discoveries offshore, ExxonMobil has told this newspaper that it was working to amend the development plan for the Liza-1 well area and in that amended plan the company will move to have further discussions on commercial matters surrounding the associated gas from oil extraction, which it said will ultimately determine the sales arrangements and infrastructural responsibilities of both sides.