A Republic Bank (Guyana) Limited customer is calling for the swift return of over $200,000 that has gone missing from his account due to unauthorised online transactions.

Kellon Rover told the Stabroek News that he found out over $200,000 was missing from his account after attempting to make a withdrawal at the end of April.

While Rover has indicated to the bank that he was not responsible for any of the transactions, he said he has been told that an investigation into the matter would take approximately three to four months. “I cannot wait three to four months for them to conclude an investigation. How am I eating? How am I living?” he questioned.

Rovers, a Communications Officer at the Department of Public Information, said he is hoping for a faster investigation and to get back every dollar that was fraudulently taken from his account.

The man explained that he made the discovery after he attempted to access his account and was unable to do so.

“I visited three ATMs—the one on Mandela, the other on Aubrey Barker Road and then I went to the one on Camp Street. I can’t remember exactly what, when I pushed in my card it was saying but it was telling me that I [could not] make any transaction,” Rover said.

He added that after his final attempt at the Camp Street ATM, he visited the accounts section of the bank to ascertain what was happening with his account. Workers at the bank, he said, alerted him that his account was hacked and online purchases were made.

This came as a shock to Rover, who stated that he had never used his account or card to shop online. “I’ve never purchased anything online with my card and they even hinted that someone took my card and did transactions,” he said, while adding that it would not have been possible for him as he had never even uncovered the CVV (Card Verification Value) number at the rear of the card until that day. The CVV number is necessary for the completion of transactions online.

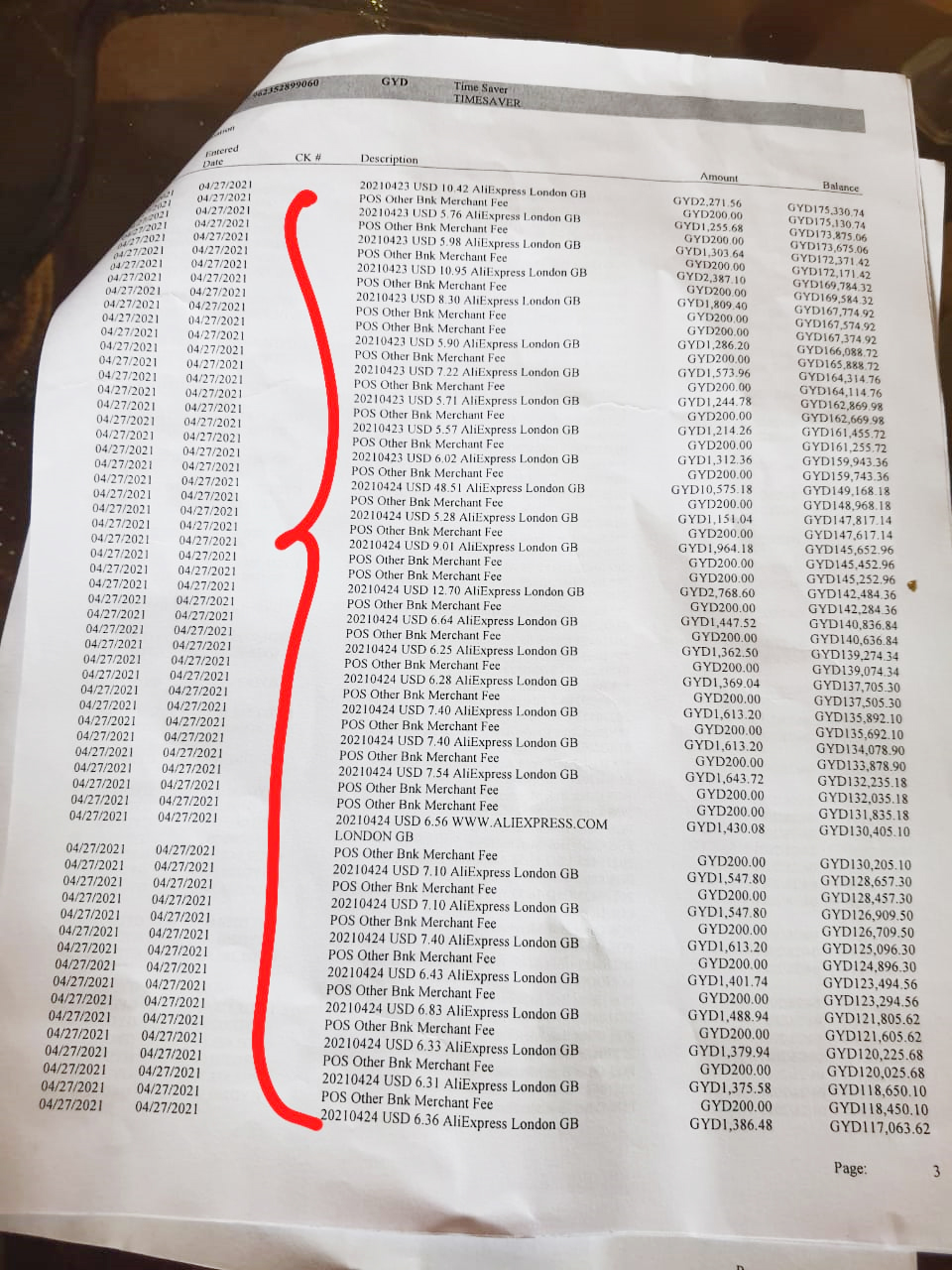

As a result, he was then given a hardcopy of the statement which did not show exactly what was purchased but gave transaction dates and amounts. These statements, which were seen by this newspaper, showed over 100 transactions which each came with a banking fee charge of GYD$200. It also showed that a majority of the purchases were made on AliExpress London, with most of the transactions being made on April 27th, 28th and 29th, 2021.

A few other transactions were discovered prior to those dates being made to Walmart and Wish.com among others. The transactions ranged between GYD$1,000 and almost GYD$5,000.

Republic Bank has been forced to reimburse millions to hundreds of its customers due to unauthorised online transactions that resulted from the compromising of their VISA debit cards in recent years.

In 2019, the bank had said there were a spate of “Brute-Force” attacks which resulted in fraudulent transactions through its international VISA OneCard.

The bank had explained then that such attacks were a trial-and-error method used by fraudsters to obtain, within seconds, payment card information, such as an account number and card expiration date.

“Once that information is obtained, the fraudsters attempt numerous transactions at online merchants globally,” it had said.

In the following year, bank once again announced that some of its customers’ accounts had been compromised and their accounts debited as a result of fraudulent online card payment activity.