Introduction

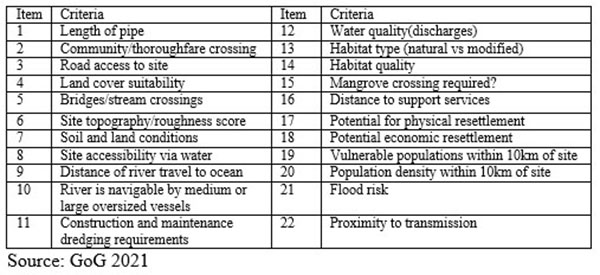

As indicated last week, due to limited space in that column, I start today’s with the promised presentation of a listing of the valuation criteria used by the Guyana Authorities to inform their decision about the site of the proposed natural gas power plant and related facilities at Wales. The country’s international partners that have been cooperating with it since 2015, in the development of local capacity to effectively manage the emerging petroleum sector have indicated thus far, no signals that they are full participants in this process. Indeed, one observes the international partner which has been leading these collaborative efforts to date, and by some distance, the Inter-American Development Bank, IADB, has publicly indicated it has played no role in the location at Wales decision.

On May 16, Stabroek News had reported the IADB as stating “while it funded studies in the use of associated gas from offshore oil for power it had no role (my emphasis) in the selection of Wales, West Bank Demerara as the site for a planned energy plant

Following presentation of the evaluation criteria below, I turn in the next section to a summary appraisal of the proposed gas to shore project.

The Project

As earlier indicated, the Authorities have defined the gas to shore project as comprising four features; namely: the pipeline; construction of a natural gas to power plant; preparation of Wales to become the site of the power plant and the production of associated natural gas liquids, NGL. The minimum commitment to natural gas usage is 50 million cubic feet per day, 50mcfd; the equivalent to providing 250 MW. It is estimated the project will be achieved in 2024. It is further claimed that the required studies are well in train to facilitate this timeline.

The main financials indicated for the project are:

1. An estimated outer limit for capital cost of US$810 to 900 million.

2. The estimated cost per kilowatt hour delivered at the power plant gate is 3.5 US cents; with the overall cost of power projected to be less than 7 US cents.

3. The power plant yields an annual national saving of roughly US$150 million.

4. The upfront financing of the plant is to be provided by ExxonMobil and repaid through cost recovery as provided in the PSA.

The main public concerns appear to hinge on the economic soundness of the proposal, calling for project evaluation studies to secure this. In the next Section I evaluate such studies.

Critiques of project modeling

It is easy to be dazzled by the numbers generated from Excel-based model calculations purporting to demonstrate that a government proposal makes good economic sense for project approval. There are in economics many reasons why readers should remain cautious. There are logical weaknesses inherent to all such modeling as well as the consideration that unscrupulous modelers will fail to declare upfront the necessary cautions, when publicizing their results. This is a real danger that non-specialists face.

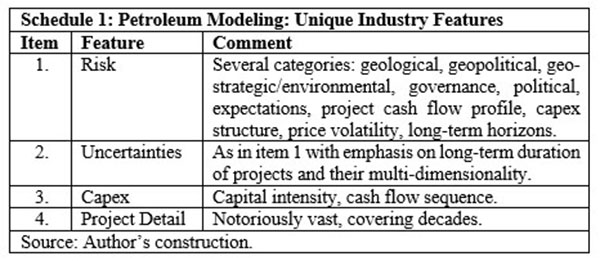

All project modeling seeks to capture the essence of whatever proposal that it is evaluating. But, given the vastness of detail involved in petroleum projects, along with their intrinsic risks and uncertainties, this reality calls for great caution about accepting their reliability and predictive power. In a much earlier presentation, I had identified several problematics that petroleum -based projects invariably encounter. These are shown in Schedule 1 below. The schedule emphasizes the enormity of risk and uncertainty.

Typically, risk and uncertainty are found in every operational dimension of a petroleum project; ranging from geological and environmental through economic/financial (prices, cash flow, capital intensity and so on) and involving socio/political risks (geo-strategic, governance/corruption). All these occur over a long-term horizon. Indeed, most gas to shore projects are evaluated over several decades.

An example may illustrate this. Recently the local news was fired up over the cyber ransom attack on a main US pipeline. Such risk will also be attached to the Guyana pipelines particularly as the dark web lists GPL as a previous site of a ransom attack.

My conclusion is that investment decision-making for petroleum projects is exceedingly complex, mainly due to the features noted in the Schedule. Economic/financial modelling aids in decision-making. However, by their very construction, all such models carry serious limitations. And, this therefore, must always be openly advised by those recommending their use. Recognizing these cautions, they can aid strategic decision making but do not substitute for it. Project evaluation studies are not silver bullets.

Conclusion

Next week I shall wrap-up this discussion of the GoG ’s gas to shore proposal.