For its first year of oil production, Guyana has been placed in the “weak” performance band of the Resource Governance Index (RGI), a report issued by the independent nonprofit Natural Resource Governance Institute (NRGI) says.

A number of recommendations have been made for improvements.

The NGRI report assesses how 18 resource-rich countries (Guyana included) govern their oil, gas and mineral wealth and covers the period 2019-2020.

Guyana began oil production in December of 2019.

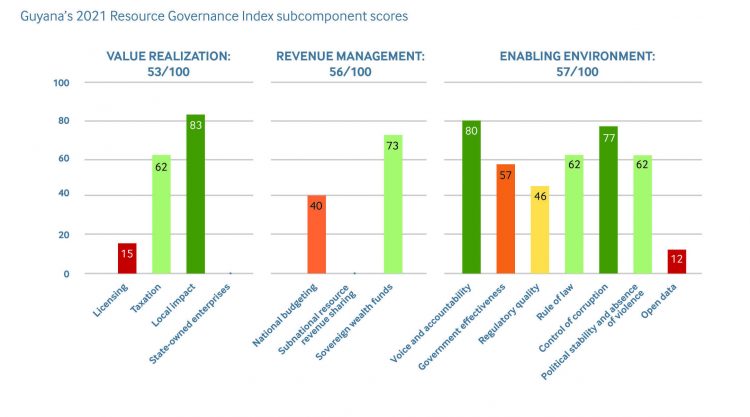

The RGI gives Guyana an overall 55/100 score with 100 being the highest and is made up of three components. Value realization (53/100) – measure of the quality of governance regarding allocating extraction rights, exploration, production, environmental protection, revenue collection and state-owned enterprises.

Revenue Management (56/100) – measure of the quality of national budgeting, subnational resource revenue sharing, and sovereign wealth funds.

Enabling Environment (57/100) – measure of the general quality of governance in the country.

These three overarching dimensions of governance consist of 14 subcomponents, which comprise 51 indicators, which are calculated by aggregating 136 questions.

Independent researchers, overseen by NRGI in each of the 18 countries, completed a questionnaire to gather primary data on value realization and revenue management. For the third component, the RGI draws on external data from over 20 international organisations.

Highlighting areas of concern, the report states, “The legal framework governing Guyana’s licensing process is cause for concern. Authorities have taken considerable time to disclose contracts, with negotiations and re-negotiations taking place behind closed doors. The absence of fiscal rules governing public spending merit attention; Guyana’s government should establish such rules as soon as possible.”

It continues, “Guyana’s enabling environment is also weak. Government effectiveness and regulatory quality are problematic, but commitment to open data standards is the most concerning indicator, with a “failing” score of just 12 points. The governance of the sector, both in terms of successful policymaking and public accountability, would benefit from an adherence to open data principles.”

However, on “the positive side”, the report notes that government manages local impacts of the sector in line with best practices and environmental and social impact assessments are publicly available.

Political instability here, according to the report, has affected different institutional decisions regarding the sector’s management, as it pointed to the no-confidence vote against the former government in 2019 generating an impasse, and a long wait for results of the general election in 2020.

Therefore, NRGI urges that “The Guyanese government should develop an institutional framework to prevent the country from becoming a new case of the “resource curse.”

Value Realization

In the area of value realization, the report says that Guyana’s governance of local impacts from oil extraction shows signs of best practice, while licensing and taxation remain concerns.

It explained that the 53 points out of 100 in the 2021 RGI’s value realization component, was mostly due to low marks registered for the licensing subcomponent, which scored only 15 points out of 100 but it was quick to point out that Guyana shows “evidence of good practice” when it comes to governance of local impacts with a score of 83.

As a consequence for this country’s Petroleum Exploration and Production Act, establishing that prospective licencees should apply through a bilateral grant system; where no biddable terms are published in advance and the minister responsible for the petroleum sector has discretion to establish the conditions by which petroleum prospecting licence applications are made, the report says that “Guyana’s framework leaves crucial fiscal terms to be determined by the production sharing agreement for each specific contract.”

It underscored that the 2016 negotiations for the first oil contract between the Guyanese government and ExxonMobil were opaque, with questionable results contributing to public mistrust.

“In 2017, and after extensive pressure to be more transparent, the government published the contract, resulting in an intense debate on its suitability and leading to demands for a renegotiation. Subsequently, the government allocated all licenses through bilateral negotiations and hasn’t allocated any licenses at all since 2019,” the report states.

“There is still no legal stipulation that the government disclose contracts to the public after the award. But recently due mostly to public pressure, the government fully disclosed rights allocations for all assigned petroleum areas. This was a decisive step toward transparency, as all stakeholders can access information about what the government and extractive companies are doing with the nation’s natural resources and, as a result, begin to hold them accountable,” it adds.

And although the Petroleum Act establishes a framework for competitive allocation of rights, the report points out, “… in practice it is far from competitive: highly discretionary negotiations are held on a first come, first served basis. Guyana’s low score on the index’s licensing subcomponent points to the need for a reliable legal framework built on competition and transparency.”

Other licensing issues also require attention as it notes that there is no comprehensive registry of licences and/or contracts yet available on government portals and there is no comprehensive cadaster to enable civil society, oversight bodies, and the private sector to understand what rights have been allocated.

It urges that having become an Extractive Industries Transparency Initiative (EITI) candidate in 2017, “Guyana should redouble its efforts to improve the public access to information related to the allocation of resource rights and the extractive sector in general.”

Revenue Management

In terms of revenue management of the sector, NRGI gives a “weak scoring”, attributing it to a poor national budgeting assessment. “Guyana should adhere to a fiscal rule to avoid misuse of oil revenue and continue strengthening sovereign wealth fund practices,” the report advises.

“…The country’s fiscal regime was designed in the 1980s and does not reflect recent economic changes in Guyana. The absence of a fiscal rule is a major red flag. Given the prospects of high revenue in the coming years, it is crucial that Guyana has a decentralized mechanism to decide fiscal expenditures and shield them from politicized decision-making,” it adds.

On the positive side, Guyana obtained “good” scores regarding the government’s disclosure of the national budget and national debt. And in its sovereign wealth fund subcomponent, Guyana got relatively satisfactory scores with 73 points out of 100.

“The decision to create the Natural Resource Fund (NRF) in 2019, with clear withdrawal rules that control the amount that is transferred to the national budget, constitutes a step toward sound economic policy for the sector,” the report commended.

However it cautioned that if the PPP/C government decides to repeal or amend the current Bill, “it is crucial this process is transparent and inclusive so that citizens can trust any new institutional framework.”

The report points out that although oil production in Guyana started in 2019; when the 2020 RGI assessment took place in 2021, no NRF annual report accounting for the size of the fund or other relevant information had been published.

Because the legislation has not been activated and no withdrawal has taken place since production started, it noticed that international organizations and civil society are now asking the government for the early operationalisation of the fund on the basis of these two factors.

“The institutional set-up of the NRF shows that Guyana’s government intends to address volatility in commodity prices and save for the future. However, passage of the NRF bill was not smooth due to the no-confidence vote against the former government. Its approval was voted in absence of the opposition party, now in power, and uncertainty regarding its future prevails,” it observes.

Enabling Environment

The report notes that opacity, lack of citizen participation and the absence of accountability have characterised the first years of oil production, with secret contract negotiations that led to mistrust and contributed to an already uncertain political context.

It is to this end it reasons that a more stable and less polarised environment, where different stakeholders are equipped to hold government and companies accountable, will pave the way for agreement on common priorities to strengthen the management of Guyana’s oil.

Law and Practice scores

In this area, the report states that while the gap between laws and their implementation is small, Guyana must develop a stronger institutional framework as the assessment of Guyana’s oil and gas sector shows only a 1-point gap between the quality of relevant laws and their real-life implementation.

“Although it already produces oil, Guyana is behind on both legislated rules and their implementation in practice, resulting in weak governance overall. Therefore, a combination of efforts leading to a stronger institutional design, coupled with enforcement of best practice in implementation, ensured by increased capacities within the sector, would improve oil and gas governance in the interest of Guyana’s further development,” the document states.

Recommendations

From its findings, NRGI made the following recommendations:

The Ministry of Natural Resources should expedite the updating of the Petroleum Act, aiming for the adoption and enforcement of competitive and transparent licensing processes to build public trust and strengthen accountability mechanisms.

The Ministry of Natural Resources should continue disclosing contracts and maintain an up-to-date registry of licenses in line with EITI commitments.

The National Assembly, the Ministry of Natural Resources, the Guyana Energy Agency and the Ministry of Environment should prioritize a consultative discussion around Guyana’s oil and gas sector and its role in the energy transition, to adapt the institutional framework to the challenges of the changing global environment.

The National Assembly, the Ministry of Natural Resources and the Ministry of Finance should strengthen the Natural Resource Fund, to ensure transparent and accountable practices that contribute to successful revenue management. If the government decides to amend or repeal the related legislation, civil society actors and other stakeholders should be invited to actively participate in the process.