Introduction

In last week’s column I was able to introduce only four of the 11 reasonings, or what I have labelled as the Whys and Wherefores, which lie behind my singling out of a portion of Guyana’s windfall oil revenues for cash transfers to Guyanese households as a singularly effective policy intervention measure against income poverty. The remaining seven reasonings that I had identified are described below

Reasonings cont’d

5. It is not widely appreciated that, by and large, support for cash transfers, CTs, as a poverty policy intervention tool is mostly based on empirical studies in varied societal environments. I have found that non-specialists assume this is some new- fangled proposition I am advancing. Some even query the extensive and intensive evidence from global practice.

6. Challenges CTs face in their acceptance are based on a mixture of:

► Lack of information/understanding of their “whys & wherefores”

► Misinformation/prejudice

► The “ignar” (those who know little or nothing but are nevertheless confident they “know all”)

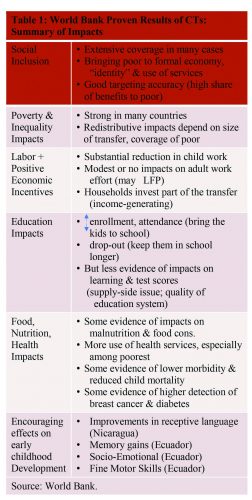

► The shallow information/opinion hucksters who lack understanding of what they repeat as “facts” and not opinions.

► The deceitful

► Prisoners of out-of-date theories/ideas of the previous Millennium

7 CTs are based on the essentially simple idea. Experience shows that:

♦ Transferring income to HH is more efficient & effective than the traditional price subsidies; food vouchers (stamps) and other such direct distribution of supplies.

♦ Traditional subsidies when given today generate dependence on similar subsidies tomorrow!

8 The World Bank displays, in a single Table, under six headings, much of the empirical basis from which it finds cash transfers useful: social inclusion; poverty & inequality impacts; labour and positive economic incentives; education impacts; food, nutrition & health impacts; and, encouraging effects on early childhood development. This Table is reproduced below, revealing the strong positive impacts on the scourge of income poverty.

9 The United Nations, Food and Agricultural Organization, FAO, has also recently observed:

“Evaluations of seven CTs in Sub-Saharan Africa has found that CTs generate a broad range of social, economic and productive impacts among poor small family farmers and — contrary to common perception — do not encourage dependency.”

“The CTs enhanced agricultural activities; … gave beneficiaries greater flexibility in labour allocation; helped them better manage risk; and CTs also benefitted the wider communities through local economic multiplier effects.”

10 To be sure, there are limits to CTs. These are:

1. $$ commitment: I have recommended a “tithe” of CT as the limit (10 percent of Government Take)

2. Institutional capability, hence my proposals on operationalizing (Part 3)

3. Ideology: All HHs benefit!

See (Wikipedia)

11 The 11th feature is a list of recommended readings citing Development Agencies in support of cash transfers as a poverty policy intervention tool. This will be carried next week

Observations

A major “appeal” of the Buxton Proposal is that it is straightforward. In comparison to other government poverty intervention programmes. It avoids having to design target groups and to control their discretionary features. This is not to deny grey areas in the practical determination of a Guyanese household. Decades of socioeconomic surveys, however, ensure this capability does reside in the BoS, which has repeatedly used the household as a cornerstone of innumerable official surveys.

Two other observations are warranted. One is a major aim of the Proposal is to reduce both poverty and inequality. Consequently, cash transfers must be large enough to have a meaningful impact. The other observation is the distinction between conditional and unconditional transfers. In the instance of the Buxton Proposal; cash transfers to all Guyanese households poses a “false dichotomy”. Thus, while all households qualify automatically for the transfer without any explicit condition, the mechanisms that effect the transfer carry, as we saw implicit conditionalities. Thus, for example, becoming a part of the formal tax system, which is important, given that a majority of Guyanese operate outside the formal tax structure. The same is true for the formal parts of the financial system, which all households shall have to become a part of, in order to receive their income transfers.

More broadly, this makes it clear that poverty policy interventions of this type reflect the workings of a social compact between citizens and the State.

Conclusion

I would be remiss, if I did not continue to bring to readers’ attention, the fact that, the 2019 Nobel Prize in Economics was awarded to three economists [Abhijit Banerjee, Esther Dufllo and Michael Kremer] for their work on poverty (breaking it down into more precise questions) and in support of universal basic income provisions. This has been heralded by Sanjay Reddy (October 22, 2019) as “economics biggest success story is a cautionary tale”.

Next week I continue with this discussion.