A new report from the World Bank is projecting that based on the current trends and effects of the pandemic, global energy prices are expected to be significantly higher than last year.

The Global Economic Prospects report indicated that energy prices surged in the second half of 2021 and are currently projected to be much higher in 2022 than previously expected

“Oil prices rose to an average of $69/bbl in 2021— an increase of 67% over 2020 and $7/bbl higher than previously expected as oil demand recovered, boosted by higher natural gas prices which encouraged the use of oil as a substitute. Despite a planned increase in production by the member countries of OPEC+, global oil output rebounded more slowly than expected owing to supply outages and production constraints, in addition to a muted response to higher prices by U.S. shale oil production. Oil prices are expected to average $74/bbl in 2022 before declining to $65/bbl in 2023 as global production recovers,” the report stated.

It attributed the rise to the effects of the pandemic and its control measures. Additionally, the report said that the upside risk to energy prices is low investment in new production capacity, which may prove insufficient to keep pace with demand. It further added that to avoid future energy price spikes, investment in low-carbon sources of energy would need to increase markedly, or growth in energy demand would need to slow.

However, a Reuters report yesterday said that oil prices will power further ahead which would see it moving above US$100 per barrel. It reported that Brent crude futures traded near $85 yesterday, hitting two-month highs.

“JPMorgan analysts said in a note on Wednesday that they could see oil prices rising by up to $30 after the Energy Information Administration (EIA) and Bloomberg lowered OPEC capacity estimates for 2022 by 0.8 million barrels per day (BPD) and 1.2 million BPD respectively. However, the bank added that it also expects oil prices to “overshoot” to $125 a barrel this year, and $150 in 2023. Rystad Energy’s senior vice-president of analysis Claudio Galimberti said if OPEC was disciplined and wanted to keep the market tight, it could boost prices to $100,” the Reuters report stated.

The World Bank report said that global trade has plateaued, owing to softening growth of demand for traded goods and supply bottlenecks caused by the pandemic-related factory and port shutdowns, weather-induced logistical obstacles, and shortages of semiconductors and shipping containers. Reflecting these bottlenecks, as well as the recovery in global demand and rising food and energy prices, global consumer price inflation and its near-term expectations have increased more than previously anticipated.

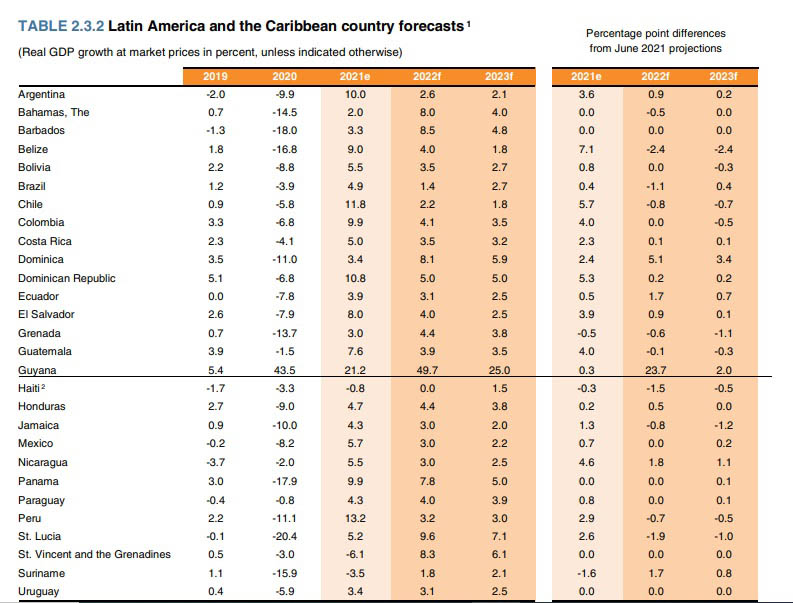

It added that the global economy is set to experience its sharpest slowdown projecting that in the Caribbean, growth is projected to be 7.3% this year and 5.9% in 2023. The World Bank added that Guyana is the largest contributor to the anticipated growth with its booming oil industry.

“Growth in the Caribbean excluding Guyana, most of which is highly reliant on tourism, is projected to be substantially weaker, at 4.6% in 2022 and 4.2% in 2023. In most tourism-reliant economies, however, growth in 2022 is projected to accelerate relative to 2021 rates, on account of the timing of the expected recovery in international arrivals,” it added.

Based on Guyana’s oil and gas industry, the World Bank also revised its growth projection for the country by 49.7% basing its projection on expected growth in real GDP.

ExxonMobil recently made two additional oil discoveries offshore Guyana adding to the estimated 10 billion oil-equivalent barrels in the Stabroek Block. The Stabroek block is 6.6 million acres (26,800 square kilometres). ExxonMobil affiliate Esso Exploration and Production Guyana Limited is the operator and holds 45% interest. Hess Guyana Exploration Ltd holds 30% interest and CNOOC Petroleum Guyana Limited holds 25% interest.

The oil discoveries and subsequent ramp-up in production is the driving force behind Guyana’s economic projections.

On Tuesday, when asked about the contents of the World Bank report and what it means for his government, President Irfaan Ali said “I have consistently spoken about what is ahead of us, not only the doubling of growth but the opportunities that lie outside of oil and gas and my deep concentration now is to ensure that we build those opportunities, we make those sectors competitive, we invest in those sectors and we create a diversified sustainable growth pathway that would sustain an ever-growing economy but more importantly create functional growth poles in every single region that future generations would enjoy.”