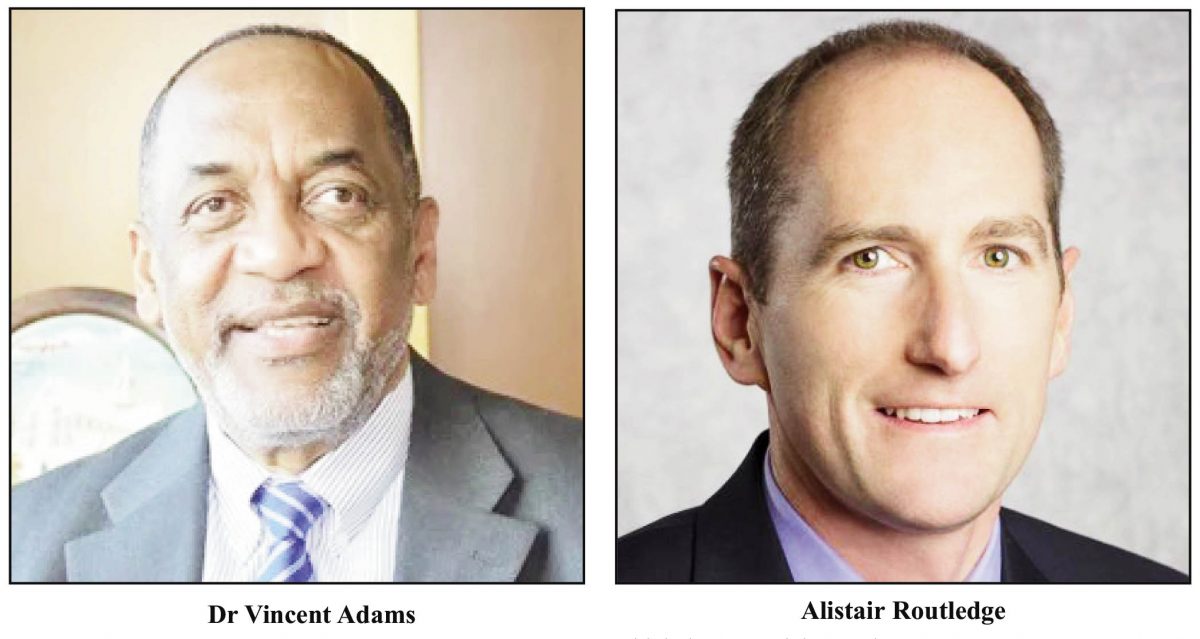

President of ExxonMobil Guyana, Alistair Routledge yesterday insisted that it has the financial capacity to meet its responsibilities in the unlikely event of an oil spill and says it is committed to paying all “legitimate” costs.

The statement came amid renewed concerns about the nature of the insurance commitment made by ExxonMobil and its partners in relation to any spill at its two functioning oil extraction platforms and a third that is currently under construction in Singapore.

The issue was raised again in the last Sunday Stabroek by the former Head of the Environmental Protection Agency (EPA), Dr Vincent Adams. He contended in a letter that ExxonMobil had agreed to an insurance sum of US$2.5b and beyond for the Liza-2 well which began operations last month.

Routledge yesterday denied that there had been an agreement for US$2.5b and did not address Adams’ contention that the company has also agree to go beyond this figure for insurance purposes.

In the statement yesterday, Routledge said that “ExxonMobil Guyana wishes to categorically state that it has insurance coverage that meets international industry standards for all of its petroleum activities in Guyana. It is important to note from the onset that our first priority for every project is to put in place mitigations and processes that help to prevent adverse events by utilizing the best technologies, equipment, and people in our operations”.

He said that ExxonMobil maintains the industry’s only sustained, dedicated and in-house oil-spill response research programme, which dates back to the 1970s.

“Here in Guyana, we adhere to an internationally accepted, tiered response system used to determine the requirements of response personnel and equipment. This system remains aligned with the principles of the International Convention on Oil Pollution Preparedness, Response and Cooperation (OPRC), the Caribbean Island Oil Pollution Preparedness Response and Cooperation (OPRC), and the National Oil Spill Response Plan of Guyana to provide an efficient framework to build preparedness and response capabilities matching the oil spill risks from all types of operations”, he stated.

Routledge contended that the commentary on “full coverage” insurance and guarantees inaccurately suggest that ExxonMobil Guyana will not be able to effectively manage response activities.

“Insurance is just one source of financial assurance that could be leveraged for response activities. The value of insurance will not limit the company’s ability to respond to an event, and response activities would certainly not be delayed by discussions with insurers. We have the financial capacity to meet our responsibilities for an adverse event and we are committed to paying all legitimate costs in the unlikely event of an oil spill”, he argued.

He said that ExxonMobil’s subsidiary, Esso Exploration and Production Guyana Limited, the Operator of the Stabroek Block, was established in 1998, and had, as of year-end 2020, almost US$5.0b in assets, which he argued is a primary form of financial assurance. This is separate, he said, from the assets of the other Stabroek Block co-venturers, Hess and CNOOC who he added also have “substantial assets and share any liability for response activities”.

Routledge added “…we’re working with the Environmental Protection Agency and our co-venturers to put in place a combined US$2.0b of affiliate company guarantees, a value exceeding equivalent guarantees required by regulators in Canada, the United States and United Kingdom. Contrary to claims in the media, ExxonMobil Guyana never agreed to insurance at a value of $US2.5b with a previous EPA administration”.

He did not name Adams in his statement or attribute the claim of US$2.5b to him.

Routledge pointed out that ExxonMobil Chairman and CEO Darren Woods had stated at the recent International Energy Conference that the company is committed to Guyana for the long term.

“ExxonMobil Guyana has invested billions of dollars in multiple oil and gas projects here. We are dedicated to avoiding any spill, but should one occur we are prepared to mitigate and resolve it as quickly and comprehensively as possible”, the statement yesterday from ExxonMobil said.

Clinched

Adams had contended in his letter that he had clinched an historic deal with ExxonMobil for full coverage but was fired by the PPP/C government just shortly before the deal was signed and the matter has since not been pursued.

“Upon my becoming Head of EPA, it was made clear to Exxon that we will correct the existing flaws of the Liza-1 Permit, incorporate corrections into the Liza-2 and all subsequent Permits, and not issue the Liza-2 Permit until full liability coverage is guaranteed. After several months of push backs, Exxon gave in to our demand for full coverage, and obtained the highest insurance available on the market, to the value of $2.5 Billion USD, proclaiming it to be adequate coverage. We vehemently disagreed and pointed out that BP’s Macondo spill in the Gulf of Mexico was costing approximately $70 Billion USD; and that such a liability would bankrupt Guyana, not to mention potential law suits from neighbouring countries and other affected parties. Consequently, we demanded that the parent companies ExxonMobil, Hess and CNOOC, cover all liability costs over and above the $2.5 Billion insurance.

“During these most tense discussions, Exxon expressed that coverage by parent companies is totally unnecessary, since Exxon is, after-all Exxon, and will never walk away. Of course, we quickly seized upon the opportunity to retort that with such an avowal, there should be no problem for them to put it in writing. That ended the argument! And Exxon eventually acceded to our immovable demand for parent companies (to) cover above the $2.5 Billion insurance; but asked that we sign the Liza-2 Permit, so as to maintain confidence in their investors, while affording time for the parent companies to agree upon how they will share the liabilities”, Adams wrote.

Adams said that subsequent to the issuance of the Liza-2 Permit, regular meetings were held for several months, between attorneys of the EPA and parent companies to arrive at the Agreement as to how the parent companies would share the full coverage. This Agreement was nearing finalization when his service was terminated along with the ongoing meetings to finalize the Agreement, followed by the removal of the EPA Attorney handling the matter.