In two weeks Guyana will get another lift of one million barrels of oil from the Liza Unity FPSO – its second platform – and will again do its own marketing using competitive bidding, Minister of Natural Resources Vickram Bharrat disclosed yesterday.

The Minister told Stabroek News that the second lift will be “in another two weeks,” as he pointed out that there will be no third-party marketing fee.

It would mean that the spot sale system, a provision catered for under the crude lifting agreement, will again be used.

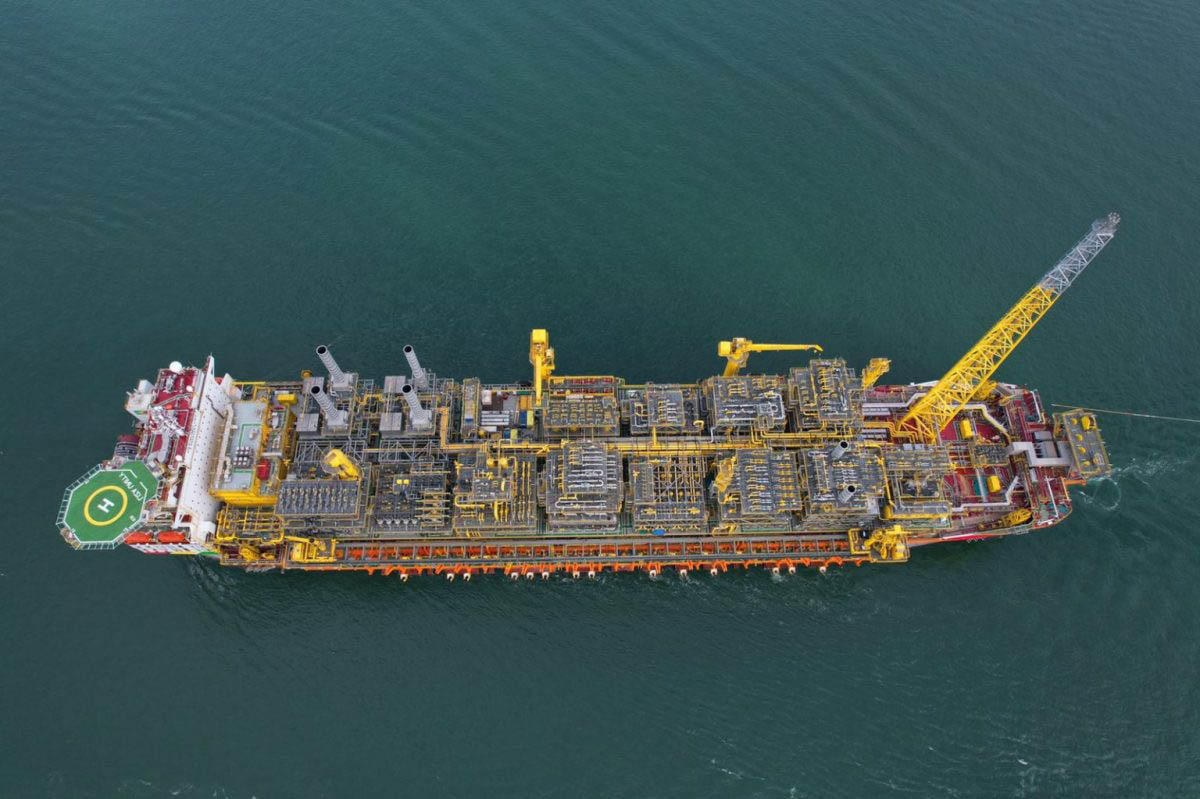

Guyana got its first one million barrels lift from the Liza Unity in April and it was expected to bring in around US$106m. The take for the second one million barrels might be even higher considering current prices. The Liza Unity is rated to produce a maximum of 220,000 barrels per day but it is unclear what its current daily production is. Guyana’s first platform, the Liza Destiny produces roughly 120,000 barrels per day.

While there is a one-year contract with Aramco Trading to market Guyana’s oil share from the Liza Destiny, which expires in August of this year, government, this newspaper understands, continues to “flesh out” how future lifts from the Unity FPSO will be sold and had in April announced that it used the spot sale system.

The Natural Resources ministry had then informed that a bid by ExxonMobil affiliate, EEPGL, was the best on the pricing differential for the crude and it would not have incurred a marketing fee by the lifter. “This lift is a one-off arrangement for the company. The GoG will be working to ensure that Guyana receives the best price for each cargo from both the Liza and Unity Gold crudes,” the statement had said.

Both President Irfaan Ali and the Natural Resources minister had emphasised that Guyana’s overall objective is to get the best value for its resource.

Bharrat had told this newspaper that government is exploring cutting out the ‘middleman’ and directly selling its oil share, with India being a prospective buyer. He did not update on how Georgetown’s discussions with New Delhi are progressing.

“That [selling to India] is something we will consider, too. But, of course, we would like it to be an open, transparent process. We have always mentioned it should be that way. We are considering the option of India but then we are looking at making it an open process.”

“What we are looking at, too, is not marketing but selling [ourselves]. In that way we save on the marketing fee. So if any country, India, or any company, is willing to do that, we may be open to talk about that. That way this country would actually save money,” he had added, while noting that government will assess the best option for this country.

However, APNU coalition partner, the Alliance for Change, had expressed concern over the prospect of the government directly marketing the country’s share of crude oil, bypassing existing established marketing mechanisms.

General Secretary of the AFC and current Natural Resources shadow minister in Parliament, David Patterson, had said such a move would not only signal a significantly frightening development, but raise questions about the policy direction, whether it has been well researched and the potential benefits quantified.

“Guyana, a new oil-producing country without the requisite industry experience, should seek partnerships to leverage our bargaining power. The PPP regime should not traverse beyond the usual bi-lateral agreement between nation-states, and all such resulting commercial contracts should be subject to parliamentary oversight and approval,” he said.

Patterson posited that the sales announcement raises doubts about the real intentions of the PPP/C government.

Former head of the Environmental Protection Agency (EPA), Dr Vincent Adams, who was fired by the PPP/C, also spoke on the issue and reiterated that the government does not have the competence or capabilities to directly sell the crude oil.

“Guyana does not have the capability for marketing. We have never done this before. It is a specialised area in the oil and gas industry,” he said, before adding that unless the government can show it has the expertise in marketing the oil, it should not take that route.

Patterson also pointed out that the issue should be looked at against the backdrop of the fact that the audit of ExxonMobil’s US$460 million in pre-contract costs remains incomplete because there is no local expertise.

Yesterday, a senior government official said that criticism by the opposition on the sale process “does not make any sense because it does not take rocket science to market yourself.”

“We sold and got Brent price and that money is in the NRF [National Resource Fund]. They can check and see it is there. Why the opposition would want us to pay a middle man to do something we can do for ourselves and save on that sum, is not a question for me, but for you to ask them…,” the official said.