Dear Editor,

Permit me to respond to a letter dated August 6, 2022 written by Joel Bhagwandin, Financial Analyst, captioned,’ Guyana poised to earn close to US$5b annually when the four approved oil platforms are producing concurrently’. In that letter, it is stated that,’ Professor Hunte failed to cite the specific section that … the 14.5% take that Guyana currently gets is enshrined in the Production Sharing Agreement (PSA). The reason for his inability to show the evidence of any such clause in the contract though is because it does not exist.’.

In responding to this claim, I am reminded of a Guyanese proverb, ‘What you could see daytime, doan look fuh at night with fire stick’. So here are some issues that the Financial Analyst did not consider.

First, as Mike Persaud reminded, there is no ring fencing in this project. This implies that the company is free to cover all its costs on any new exploration activities from the existing revenue stream. Under normal circumstances, drilling costs would be covered with high-risk money, since there is no guarantee that every well drilled will yield a financially viable project. Only recently, it was reported that Tullow Oil said it would abandon its Guyana drilling operations since the results showed the well contained water and no oil. Consequently, Tullow Oil’s share value dropped on the stock exchange. If this happened with EEPGL, and they did have a few dry wells, they will have a soft landing on the current revenue stream in EEPGL. This is the benefit of no ring fencing, and a clear signal that, ‘What you could see in day time….’.

Second, no business will be financially viable, if it cannot cover all its costs; and a serious professional Financial Analyst without question will subscribe to this rubric. In this regard, limiting the total cost to 75 percent of total revenue is an obvious ploy, as the remaining 25 percent must be covered for the company to remain financially viable; otherwise, they will go out of business. Referencing section 11.3 in the PSA that the Financial Analyst quoted, it is observed that: “To the extent that in any month, Recoverable Contract Costs exceed the aggregate value of Cost Oil and Cost Gas determined in accordance with Article 13 and / or Article 12, the unrecoverable amount shall be carried forward and, subject to limitation stipulated in Article 11.2, shall be recoverable in the immediately succeeding month, and to the extent not then recovered, in the subsequent month or months.”. This condition implies that EEPGL will most likely be ramping up exploration, development and extraction, since they have a guaranteed soft landing in place that is fully covered by current revenues. It is therefore useless to write 14.5 % or any other percentage in the contract, given this extravagant gift.

Third, the Financial Analyst made the prediction that, ‘The estimated gross revenue is approximately US$177.3b (this is: 2,638 million barrels times US$67.22 per barrel); the total Government’s Take is an estimated US$49b or 28% while the Oil Companies’ Take is an estimated US$42b or 24%.’. Adding together the revenue shares of the government (US$49b) and EEPGL (US$42b), this total of US$91b falls short of the total revenue of US$177.3b by US$86.3b (48.7%). In the circumstances, the Financial Analyst must explain who is this unknown party who is receiving the largest share of the revenue (48.7%) when in fact the only two known entities in this arrangement are the government and EEPGL. I implore the Financial Analyst to shine some sunlight on this hidden entity.

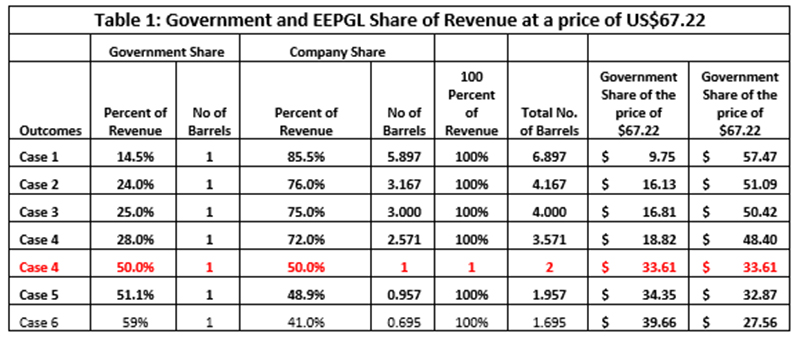

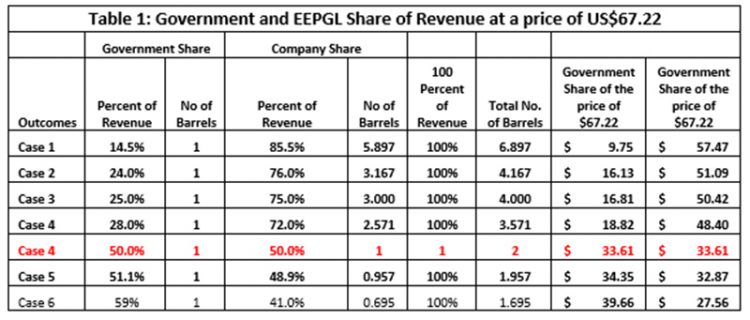

Meanwhile, one of the useful aspects about working with oil projects is the fact that all costs and revenue can be expressed in barrels of oil. For example, when it is postulated that Guyana receives 50 percent of the revenue and EEPGL receives 50 percent of the revenue, this implies that for every two barrels of oil produced, Guyana receives one barrel of oil and EEPGL receives one barrel as well. Furthermore, if the price of a barrel of oil is US$67.22, then Guyana and EEPGL receive US$33.61 each. The Financial Analyst stated that Guyana will receive 28% of the revenue. This implies that EEPGL receives 72 percent of the revenue which converts to 2.572 barrels of oil for every one barrel of oil that Guyana receives, when 3.571 barrels of oil are produced. EEPGL revenue will be US$48.40 per barrel and Guyana revenue will be US$18.82 per barrel, when the price of a barrel of oil is US$67.22 (Table 1).

If Guyana were to receive more than 50 percent of the revenue, this implies that EEPGL will receive less than one barrel of oil for every barrel of oil that Guyana receives. See the results in Table 1 for Guyana shares of 51% and 59%. Given this arrangement of more than 50 percent of revenue to Guyana, no investor will engage in such an outcome.

Fourth, it is reported in an article in Kaieteur News August 7,20222, written by Kiana Wilburg, that Financial Analyst Joel Bhagwandin objected to the government share of 59 percent of revenue made by Schreiner Parker, Rystad Energy’s Senior Vice President. The Financial Analyst contends that this share is overstated due to the fact, ‘…that taxes are included as part of what the government already gets from profit oil. He said this occurs based on the structure of the 2016 Production Sharing Agreement (PSA).’. Editor, may I remind the Financial Analyst that EEPGL do not have to pay income taxes on their profit share and the government has to provide a receipt that can be used for tax deduction purposes. Undoubtedly, issuing a government receipt for money not collected is fraud and corruption. The implication of this situation is that Government would be giving-up its sovereignty to a private company, and therefore Guyana would be a laughingstock for all time.

Finally, the Financial Analyst indicates that, ‘… the estimated reserves to be recovered is approximately 2.64 billion barrels of crude of which Liza 1 accounts for an estimated 438 million reserves, Liza 2 an estimated 600 million reserves, Payara an estimated 600 million reserves and Yellowtail an estimated 1 billion reserves.’ Given that Guyanese have been told that the estimated reserves (or oil in place or oil in the ground, as stated in the literature) is 11.0 billion barrels of oil, and ‘recoverable oil’ (the oil that can actually be extracted) is only 2.64 billion barrels (24% of the total), this is certainly a signal that Guyana has been misinformed about the expected oil wealth, for 11 billion barrels are not going to market from these projects. Incidentally, it is also reported in the literature that, ’Recoverable oil is generally between 30-37% of ‘oil in place’, although in certain difficult regions it drops to 12-16%.’. Please note that the estimated amount of 24% by the Financial Analyst falls outside these two ranges. Furthermore, given that 11 billion barrels of oil will not be extracted; that the speed of extraction is expected to increase; that the life of the 4 projects is between 8 and 11 years, as stated by the Financial Analyst, it therefore follows that the likelihood of the project being around for a few decades is a pipe dream, for ‘What you could see in the daytime, doan look fuh at night with fire stick’.

Sincerely,

C. Kenrick Hunte, Ph.D.

Professor and former Ambassador