Dear Editor,

The Government backers of the Wales Gas to Energy project (WGTE) are promising that it will lower electricity costs by up to 50 per cent. However, all the available data shows that this is not a reasonable expectation. In fact, an analysis of the US$2 billion project shows that even at the presently high world market price of crude oil there would be minimal reduction in GPL’s power generating costs with the project in place.

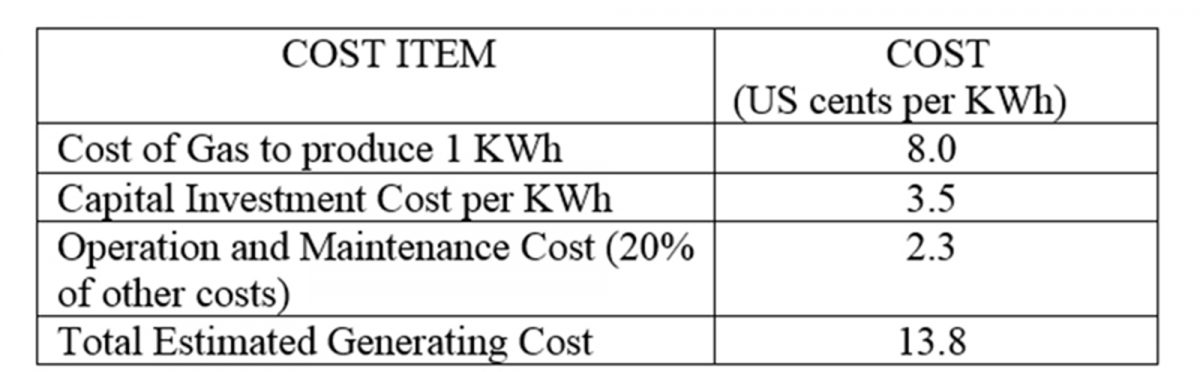

The Energy Narrative (EN) study of 2017, provides data from which it can be deduced what would be GPL’s power generating costs at different world market prices of crude oil. This data is set out in the following Table:

Source: Deducted from 2017 Energy Narrative Study data.

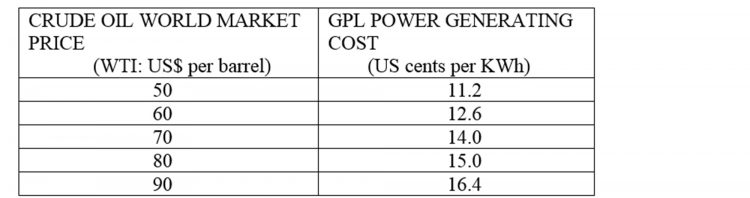

A standard financial calculation shows that with the WGTE project, GPL’s generating cost would be approximately 15 US cents per KWh, made up as shown in the following Table:

15.0Sources: (1) EN Study

(2) Calculation of cost increase based on pipeline and NGL cost of US$1.3 billion transporting 50 million standard cubic feet per day, an estimated 25 year lifespan of the pipeline, and, a conservative 10 per cent cost of capital.

Together, the above Tables show that when the world market price of crude is US$80.00 there would be zero benefit of the WGTE project. If crude prices fall below US$80.00, the project would actually increase GPL’s costs. It can also be calculated from the Tables that at the present US$86.00 prices of WTI crude, GPL’s costs would only be reduced by 5.6 per cent, a minimal amount.

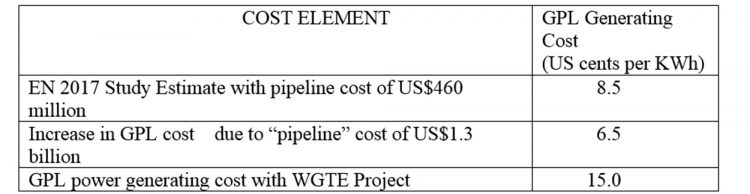

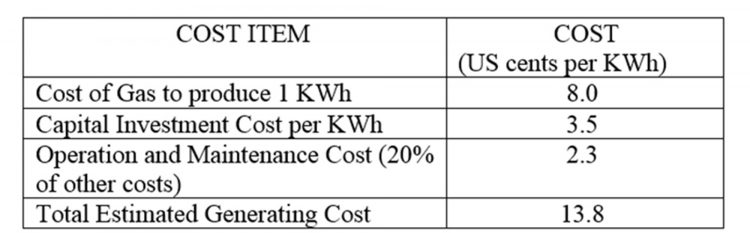

The serious problems with the viability of the WGTE project can even be demonstrated without using the EN study data. but by examining the information on the new power plant costs and the cost of pipeline gas supplying its fuel. We know that the new plant with a capacity of 300 MW should cost about US$600 million from the bids submitted. We can calculate the quantity of gas to produce a KWh of energy, which works out at approximately 10 cubic feet per KWh at 70 per cent average utilization rate of the new plant. The cost of the gas supplied by the US$1.3 billion pipeline and NGL plant works out at approximately US$8.0 per million Btu, given the information that the pipeline would be transporting 50 million standard cubic feet of gas per day and would have an estimated lifespan of 25 years. Putting this information together produces the following Table:

TABLE: Power Generating Cost of Proposed New US$600 million Plant

Source: Standard financial calculations.

This alternate method of estimating the power generating cost of the proposed new plant would suggest that at a crude oil price near US$70.00 the project would yield no benefit by using gas from the WGTE pipeline.

The conclusion from both methods of assessing the WGTE project remains the same: the project is not viable and should be halted.

“A word to the wise is sufficient”.

Sincerely,

Fitzroy Fletcher