As I advanced last week, clearly my proposal for the authorities to establish a national oil company, NOC, based on NRGI precepts, does not ipso facto constitute a recommendation favouring the creation of a state-owned and or joint venture, JV, oil refinery. I therefore repeated my earlier advice that, there is no sound economic basis for the Government of Guyana, GoG, to invest its expected petroleum revenues to create value-added refining to its crude oil exports, especially given the prevailing global and national environment. Further, there is no sound economic reasoning favouring 1] the provision of subsidies, implicit or explicit, 2] the distortion of market efficiency to support mis-guided private capital for building and /or operating same.

I have already argued this case in a substantive and strategic manner in considerable detail. Over 20 columns [May 28, 2017 to October 29, 2017] I first addressed this topic. Later I re-visited it [October 6, 2019 to November 3 2019]. I shall not therefore, repeat in any detail. The main outlines of my presentation will be briefly summarized in coming columns based on the schema below.

SCHEMA

What constitutes an oil refinery? [global continental and regional distribution, size variation, refinery capability, refinery complexity]

Local proposals. For State -owned [Performance, economics financing, joint-venture type]

Modular refineries [by type, size, economics]

Decision rules [ public, private]

Strategic: Development Paradigm

The strategic consideration is that differences over a state-owned/joint venture oil refinery lie in contending development paradigms. Economic nationalists frame the driver of Guyana’s development under the rubric: “the country should produce all it can produce”. The petroleum sector should develop, only to the extent that, Guyana can achieve this aim. Consequently, local content policies should be designed to constrain “foreign ownership/ control of decision-making, and management of the petroleum sector”. A local refinery for Guyana’s crude oil is therefore, the highest expression of Guyana’s autonomous development. Such a self-sufficiency paradigm, minimizes the developmental roles of country specialization, capacitation, comparative costs, the movement of international trade and exchange in goods, services, finance, and productive factors (including capital), as well as natural resources.

And, it is indeed the very minimization of these roles, which makes the “paradigm of autarky” unworkable in an increasingly integrated international economy, based on globalized value chains. Today, these value chains are more powerful than even the biggest global economies, where the “USA-China global trade war” testifies to its correctness.

Substantive: What is an oil refinery?

Turning to substantive issues; I treat an oil refinery as: 1] “an industrial plant that refines crude oil into a multiplicity of petroleum products” 2] thereby, adding value to the extraction of Guyana’s crude oil discoveries. 3] although located in Guyana its global context is key, as the petroleum products produced compete globally requiring the refinery to be commercially feasible. Given this I considered next: what is the state of global oil refining?

Substantive: Global refining

Presently, approximately 100 million barrels of crude oil are processed each day. There are approximately 730 odd oil refineries, worldwide. As many as 116 countries worldwide have established oil refineries! Their geographic distribution across regions is wide, including also in the Caribbean area. Thus, Asia has 316 of these, North America 190, Europe 154, South America, 53 Central America 9 and Oceania 8.

I cite these data mainly to observe that, a local oil refinery cannot be evaluated or assessed in isolation of the global market configuration. Readers are therefore reminded that, the proposed refinery, which the Government of Guyana (GoG) had commissioned in 2017 was designed to add less than 0.1 percent to total global refining capability!

Further, it should be noted also that the top ten oil refineries worldwide have capacities ranging from a low of 0.52 million barrels per day (b/d) to more than double that, 1.24 million b/d. Similarly, the top 10 countries in terms of oil refining capacity range from Canada at number 10 (2.5 million b/d) to the United States, number one, refining more than 18 million b/d.

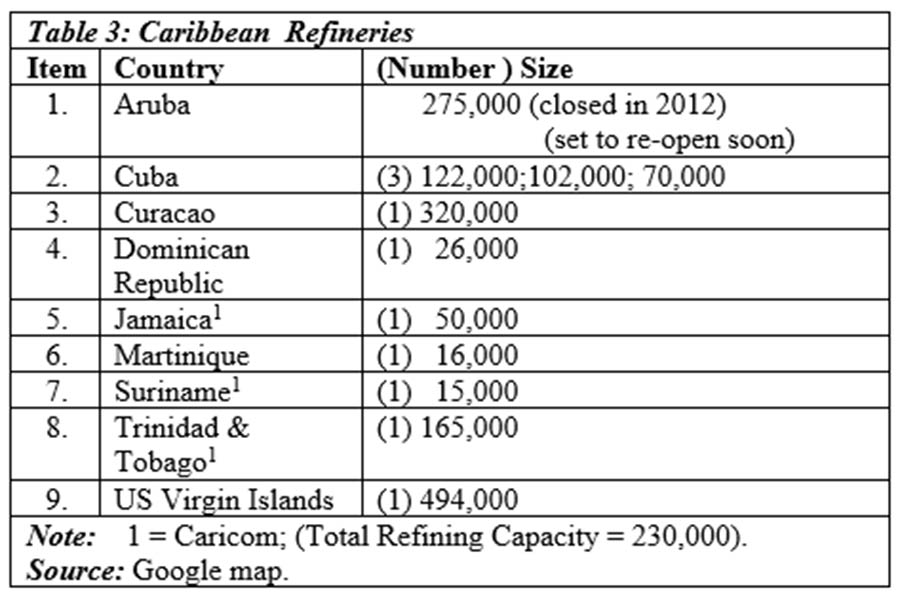

Finally, the Caribbean refineries data from Google Map are shown in Table 1

Caribbean (Caricom) oil refining

Presently, there are nine Caribbean oil refineries, with three of these located in the Caricom sub-region. Total Caribbean refining capacity is 1.3 mln b/d; and for the Caricom sub-region, 230,000 b/d. Available estimates suggest that only about 60-70 percent of this capacity has been available.

The size/range of Caribbean refineries is from a low of 15,000 in Jamaica to 320,000 b/d in Curacao. Of note, the Aruba refinery, with a capacity of 275,000 b/d was closed in 2012, but there are plans to reopen the complex. There are also plans for a second refinery to be built in Jamaica. Cuba has three refineries, with capacities of 122, 102 and 70 thousand b/d.

Usually, those Caribbean countries with smaller refineries focus on domestic markets, while those with larger refineries focus on exporting. Further, some analysts argue the region’s unique island location and proximity to global transportation routes, offer much scope for expansion of export-based oil refining!

Conclusion

Next week I address the truism that, no two refineries are the same!