Every Man, Woman and Child in Guyana Must Become Oil-Minded – Column 157

Every Man, Woman and Child in Guyana Must Become Oil-Minded – Column 157

Introduction

Amid concerns about unresolved audit issues, mysterious tax certificates and controversial oil spill legislation, Hess Exploration Limited, a branch of a Hess subsidiary incorporated in the Cayman Islands, is the first of the Stabroek Block partners to lodge audited financial statements. The Cayman Islands company is a wholly owned subsidiary of Hess Corporation, incorporated in Delaware, USA, which is one of the most permissive jurisdictions in the United States.

Hess filed two sets of financial statements: Hess Guyana Exploration Limited, which operates the Stabroek Block as a subsidiary, and Hess Guyana (Block B) Exploration Limited, a subsidiary of a Bermuda-based company that holds a 20% interest in the Kaieteur Block. The separate external companies arrangement probably allows the two separate branches with similar names under the Guyana Companies Act. Another point of interest is that the financial statements of the Stabroek Block branch are stated in US Dollars, while those of the Kaieteur Block are stated in Guyana Dollars. Notwithstanding, both have the same Guyana auditors. The separate financial statements for this Block note that it was relinquished in 2023. There is an additional anomaly that the financial statements for the Stabroek Block are expressed in United States Dollars, while those of the Canje Block are stated in Guyanese dollars.

The rest of this column examines the financial statements of Hess Guyana’s 30% participating interest in the Stabroek Block. While the audited statements are stated in US$, we have converted these to Guyana Dollars. All Tables sourced from the Branch’s financial statements.

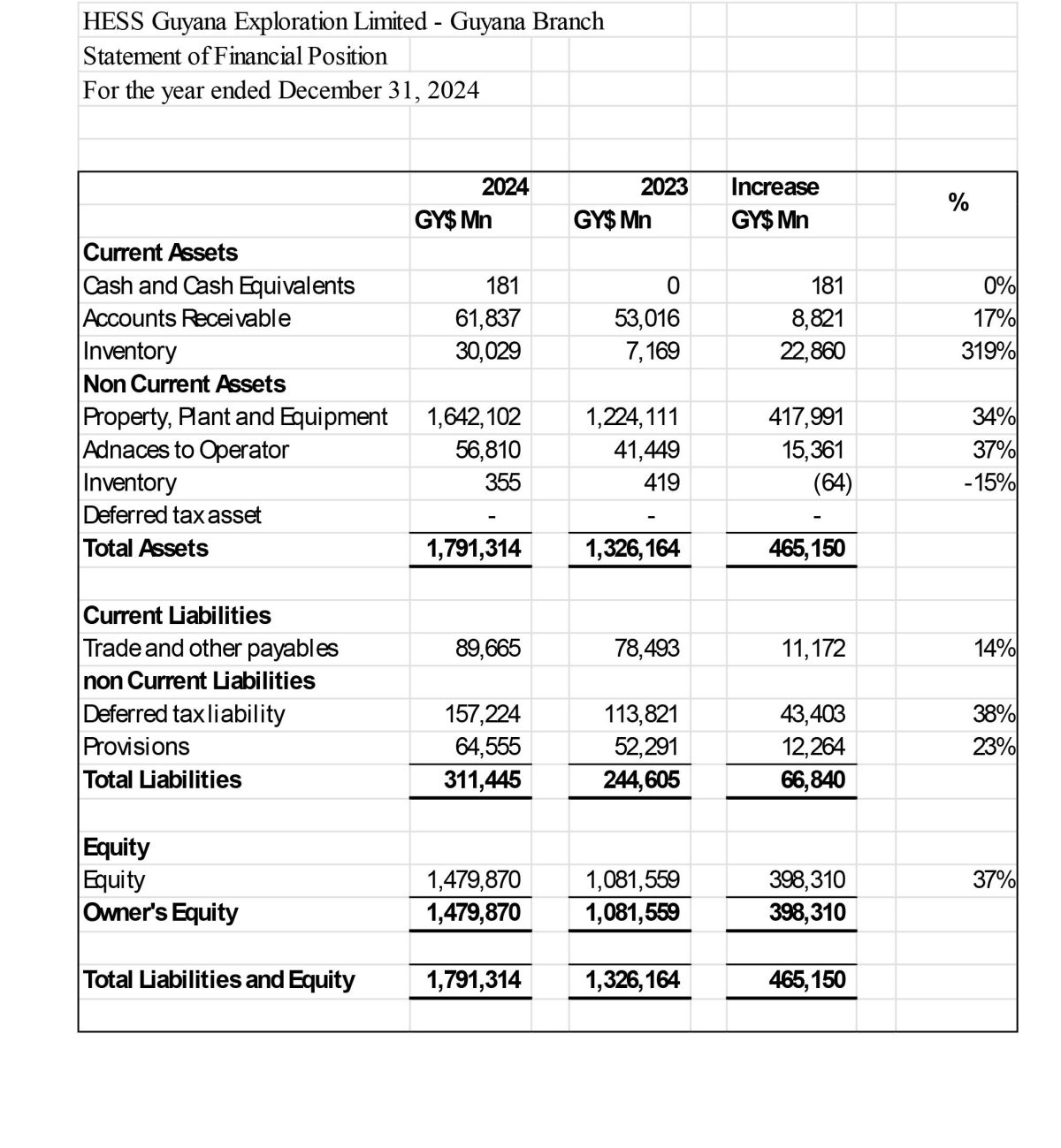

Except for the tax borne by the Government being accounted for as non-customer revenue, revenue is derived from the sale of 40 million barrels of crude oil in 2024 (up from 19 million in 2023) to a marketing subsidiary of Hess Corporation. Revenue rose by 58%, from GY$738.03 billion in 2023 to GY$1,165.51 billion in 2024. Cost of sales as a percentage of revenue fell from 11% to 8%, while Depreciation, Depletion and Amortisation accounted for 15% in 2024, up slightly from 14% in 2023. Gross margin reached 77%, up from 75%. General and Administrative expenses remained steady at 1% of revenue. Due to rounding, Operating Income was GY$880.5 billion before financing costs of GY$3.16 billion, leaving Net Income before tax of GY$877.34 billion—an increase of GY$351.10 billion or 67% over 2023.

Here comes the quirk. The Statement shows a tax expense of exactly 25% of pre-tax income, explained by Hess in a manner both confounding and misleading. Article 15.4 of the 2016 Stabroek Agreement clearly states that the Government of Guyana, not the contractor, pays the income tax liability using the State’s share of profit oil. Yet Hess describes this as a portion of “gross production,” separate from cost oil and profit oil, being used to “satisfy” the tax. This is not only misleading, it is false. There is no third allocation. The tax is paid from the Government’s share, exactly as agreed.

This dishonest accounting narrative is not the doing of local auditors or management. It originates in documents filed with the U.S. Securities and Exchange Commission and passed down to Guyana. That makes it not just a local embarrassment but an international one.

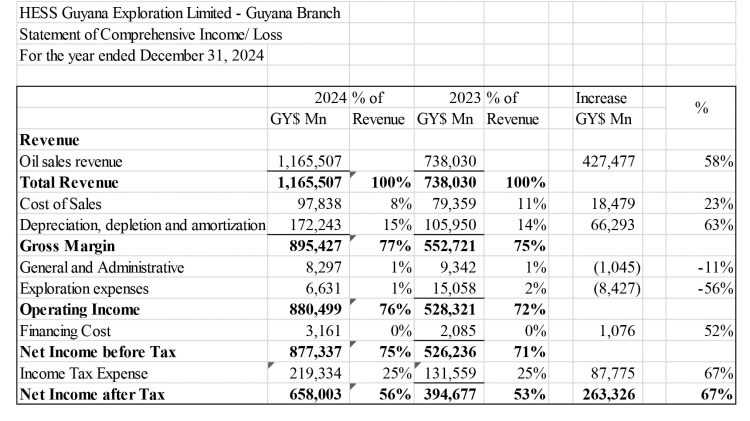

The Balance Sheet

The Balance Sheet exhibited substantial asset growth, with total assets increasing by 35% to reach GY$1,791,314 Mn at year-end 2024, an increase of GY$465 billion from the prior year. Significant additions included the purchases of Liza Destiny and Prosperity FPSOs, as well as increases in material and supplies of over US$100 million in current inventory. Receivables of $61,837 Mn were an increase of 17% over the previous year and represent amounts due from the sale of crude oil, all of which is sold to a related party.

Staggering returns

A key measure of financial performance is the return on capital, measured by income divided by average capital employed. Given that the profit before and after tax is the same (GY$ 877.34 billion), and the average of the 2023 and 2024 year-end equity figures is GY$1,280.714 million, the return on capital employed to Hess stands at a staggering 68.5%.

This means the company generated nearly 69 cents in operating profit for every dollar of equity capital deployed – an extraordinary return by global oil industry standards. Such a result confirms that HESS Guyana’s operations in the Stabroek Block are not only profitable, but exceptionally so, raising important questions about how much value is being retained by Guyana itself in this contractual relationship.

And this is the result. The Branch distributed to its head office – we are not sure which one – US$1,454,509,084! All for a 30% stake, and the extreme generosity of our politicians who accuse the nation of being “stupid” and “unable to understand.”