Addressing the Clico issue

Introduction

Rumours that the region’s largest conglomerate CL Financial Limited (CL) was experiencing difficulties were confirmed at a dramatic press conference in Trinidad two Fridays ago, hosted by the Governor of the Central Bank and including CL’s chairman Lawrence Duprey and Finance Minister Karen Nunez-Tesheira. At the press conference it was announced that the group, better known by its founding acronym CLICO, had approached the Government of Trinidad and Tobago for a line of credit to meet some unusually large demands for withdrawals from CLICO Investment Bank (CIB), a subsidiary of CL.

The initial deal seemed clean, clinical and simple enough. The government and the central bank would take control of CLICO Investment Bank (CIB) while the assets and liabilities of CIB and another subsidiary, Caribbean Money Market Brokers (CMMB) would be transferred to state bank First Citizens. At the same time the Minister of Finance announced that the government and the central bank would guarantee the assets of depositors and policy holders at CLICO, CLICO Investment Bank (CIB), CMMB and British American Insurance by the injection of cash. In return CL was expected to give up vast swathes of its empire including its 55 per cent stake in Republic Bank Ltd (worth billions of dollars), its interest in Methanol Holdings Trinidad Ltd, which owns and operates the world’s largest methanol plant, and share its equity interest in CLICO and British American Insurance.

Jitters and praise

The government and the central bank were praised by the TT business community for their prompt and mature response and jitters appeared calmed. But things turned a bit sour when the government sought to pass necessary legislation to provide it with the remaining powers needed to extend supervision over insurance companies and to facilitate the transaction. The country’s Opposition Leader accused the government of having engaged in a hostile takeover; the press revealed that both the central bank Governor and the Minister of Finance had been connected with cashing out of deposits with CIB; Mr Duprey brought in UK Senior Counsel to advise him on the transaction while the government brought in financial specialists to assist in the valuation of the assets and in the restructuring of the companies. It was also reported that the Memorandum of Understanding among the central bank, the government and the Group was still being “clarified.” The government did however get the legislation that it wanted.

Guyana

The guarantees of policies and deposits by the Government of Trinidad related only to third parties and only in respect of the companies with which the memorandum was to be signed. They did not extend to other subsidiaries of CL Financial including the Guyana subsidiaries and those which are indebted to CLICO Guyana. Of particular interest to Guyana therefore is the impact on policies including annuities and deposits with CLICO Guyana, and deposits with Republic Bank (Guyana) Limited (RBGL), a subsidiary of the Trinidadian parent whose majority shareholders are those entities being taken over.

Let us look at the last first. Chairman of the local RBL and Managing Director of RBL Trinidad Mr David Dulal-Whiteway announced that government’s gain of Republic Bank’s shares from CL Financial is only an interim measure to secure financial support from the state and will not involve operational control of the bank. The Guyana Association of Bankers (GAB) gave full support to RBGL in a late-night statement issued on January 30 in which it welcomed the decision of the Trinidad Central Bank to intervene to support CL Financial Limited. It noted that commercial banks locally “held excess liquid assets of $29.6B or 71.6% above the statutorily required level,” and that “depositors can feel very confident and assured that the stability and integrity of the local financial system is guaranteed.”

CLICO Guyana, in which two of the three directors are Trinidadian, issued its own statement through its CEO Ms Geeta Singh-Knight in which she announced that the statutory fund (required by the Insurance Act 1998) of the company which is a separate entity within the CL Financial Group was “in good standing”; none of its assets are intertwined with CLlCO [TRINIDAD] or CLlCO Investment Bank”; and that developments involving its parent CL Financial Limited have no financial impact.

Meeting

On the day the news broke in Trinidad, Minister of Finance, Dr Ashni Singh summoned a meeting with CEO Singh-Knight and Commissioner of Insurance Maria van Beek. He wanted to ascertain the extent of exposure, if any, of CLICO Guyana to the events in Port-of-Spain and requested the company to supply to the Commissioner of Insurance by last Monday further “information on the financial status of the Group, details of the transaction agreed with the authorities in Trinidad and Tobago, and of the implications of these developments for the operations of the Group as a whole and the Guyana company in particular.”

Nothing further has been said publicly by the Minister who appears to have committed a procedural error of judgment since the better thing to do would have been to meet with the two parties consecutively. The public has not been told whether all the information requested has been provided and analysed and the Commissioner of Insurance has been silent.

Like Trinidad, CLICO Guyana takes money on deposit from the public but because of the Bank of Guyana’s interpretation of the law the company does not require a licence from the Bank of Guyana to do so. As a result the responsibility for supervising CLICO’s financial operations falls entirely under the Commissioner of Insurance and the office should have been far more proactive than it has been in this matter. There is a lot at stake, including insurance policies, annuities and pensions, and huge sums invested in the company by the NIS.

Monitoring

President Jagdeo announced that his government was watching the situation closely, and trying to put into context the scale of any potential problem the company may encounter, noting that CLICO (Guyana) makes up just three per cent of the country’s total financial assets. The President who has appointed the company’s CEO to the GuySuCo board added that the only problem he could envisage in the short term was a mismatch between liabilities and assets.

Then late on Friday Deputy Governor of the Bank of Guyana, Dr Gobind Ganga said that the central bank is “very much concerned” at the financial crisis within the CL Financial Group and confirmed that the bank is tracking every bit of information being provided on the issue as it develops – hardly a clear statement in these circumstances.

Such statements may sound good but what is needed is critical analysis of factual information, particularly given the attention span of politicians. The discussions between the government and the company seem to emphasise “investments or dealings with sister companies CIB or CLICO (Trinidad),” which can cause dealings with other related entities to be overlooked.

So far no one seems to be dissecting the 2007 financial statements, or requesting a copy of the Memorandum of Understanding and asking that the relevant transactions for 2008 be made public. It cannot be too hard to determine the liquidity situation of the company or the exposure to related parties – the issues that sparked the crisis in Trinidad. CL’s financial statements for 2008 are not yet out but the regulators in Trinidad have obviously requested and received them.

A limited financial perspective

The audit of the Guyana company’s books for 2008 is in progress and only the 2007 statements audited by Deloitte and Touche are available. I therefore sought some updated information from Ms Singh-Knight who was most forthcoming and extremely helpful.

The 2007 financial statements, which regrettably are not that reader-friendly and could benefit from significant enhancements, state that the company is a wholly-owned subsidiary of CL Financial Limited. At December 2007 it owed CLICO Trinidad $1.2 billion (representing 10% of its total assets) and reduced this balance in 2008 to $800 million. This amount is interest free but repayable on demand. Does the Memorandum of Understanding permit the deferral of the debt in the interest of the Guyana company or not?

The net assets of the company at December 31, 2007 amounted to $11.7 billion of which $1.2 billion was classified as current assets but which included accrued investment income of $500 million, largely from related parties. In the bank at that date was $127 million. Its current liabilities or payables are stated at $1.7 billion including the $1.2 billion owed to CLICO Trinidad. The company treats all policy holders’ funds as equity and these include $8.030 billion in Ordinary life policies, including annuities. The holders of these annuities can surrender their policies and expect to receive payment within one week.

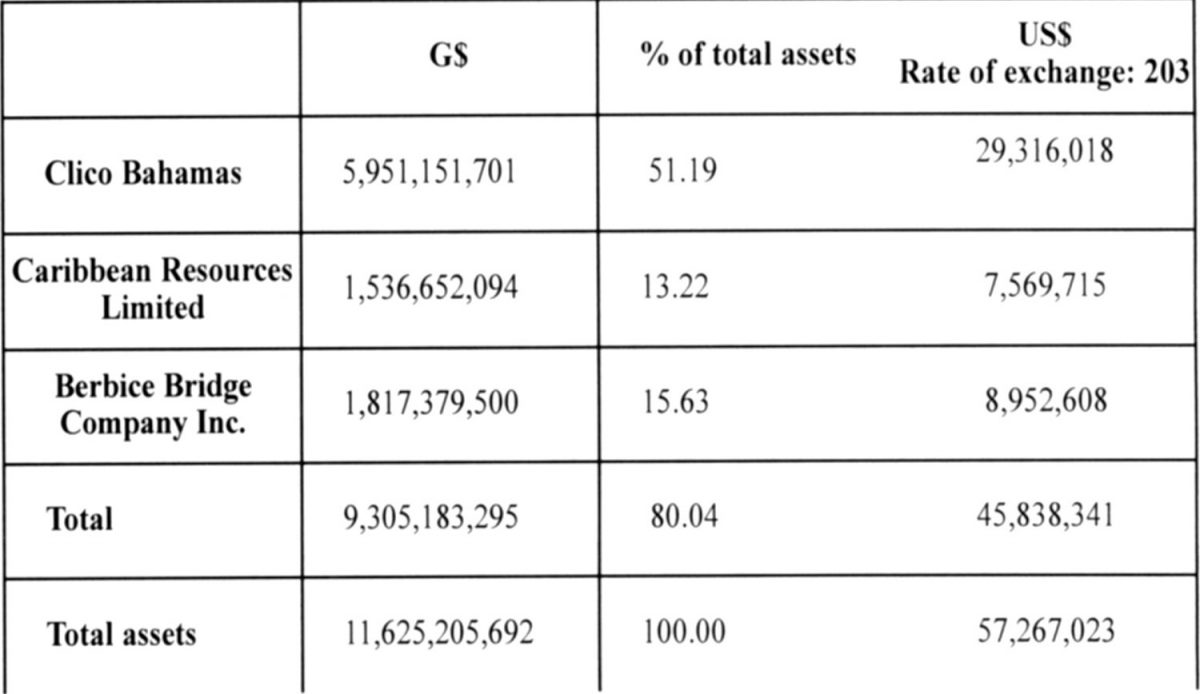

The company’s primary investments are in Caribbean Resources Limited (CRL) and CLICO (Bahamas) Limited. At December 31, 2007, investments in these entities totalled $1.5B and $6.0B or 13% and 51% of total assets respectively. Investments in the Berbice Bridge Company Inc (BBCI) total $1.8B, or 16% of total assets bringing total investments in three related entities to 80% of total assets.

The last annual return filed by CRL was for 2001 and therefore updated information was not available for our review. The investment in CLICO (Bahamas) Limited, an insurance subsidiary of CL whose 2007 financial statements are available on the internet, represents approximately 30% of that company’s assets.

The Guyana company’s financial statements describe the investments in the Bahamas company as Fixed Deposits, which is misleading since that suggests a banking type deposit. In fact, despite the auditors of the two entities bearing the same international name, the Bahamas company in its corresponding account includes the amount not in Equity but as Annuities under the broad heading Future Policy Benefit Reserves.

It is apposite to note that as the 2007 financial statements indicate, the company is in breach of section 55 of the Insurance Act 1998 which requires that 85% of the statutory fund be held in Guyana. One now has to wonder whether the company has taken steps to remedy this situation.

Bahamas company

The CRL investment is guaranteed by the troubled CL Financial group while the investment in the BBCI would clearly not be liquid. The Bahamas company too has its own problems with the auditor’s report containing an Emphasis of Matter noting that 59% of the company’s assets were invested in a related company, CLICO Enterprises Limited. The audited financial statements did not show an amount due to the Guyana company at December 31, 2007 in its related party notes, but annuities total 70.0M Bahamian dollars, of which Guyana would hold 42%.

On August 21, 2008, AM Best Company Inc, a financial services credit rating organisation, downgraded CLICO (Bahamas) Limited’s financial strength rating to B (Fair) from B+ (Good) and issuer credit rating to “bb” from “bbb-”. The outlook for both ratings is stated as “negative.” The ratings for Colonial Life Insurance Company (Trinidad) Limited were similarly downgraded on February 2, 2009 as news broke of its troubles and both companies were placed “under review.”

Conclusion

I was informed by the company’s CEO that it has met all demands for funds since the news broke. The last thing the company needs is an unusual demand from its policy holders. What is now very important is for the Minister of Finance, the government and the Office of the Commissioner of Insurance to ask the right questions and to get hard information from the company. Now that everyone has been before the cameras and has had their photo opportunities, the hard work must begin.

It is not enough to downplay the impact of any potential difficulties and we should not forget that the NIS up to December 31, 2005 (the last date for which financial statements have been released) was heavily invested (to the tune of $7.7B) in the company. Unfortunately Ms Linda Gossai, a member of the scheme’s investment committee would not disclose to me the extent of its current investment, claiming that she does not “keep those figures in her head.” Instead of simply tracking information on the issue as it develops, the Bank of Guyana needs to start thinking whether, like Trinidad, there are regulatory issues which need to be addressed with respect to what amounts to deposit taking by some insurance companies.

The Bank of Guyana should have long contacted its counterpart on a confidential basis for a copy of the Memorandum of Understanding and to have an informed basis to deal with its concern. Too many people just seem to be waiting and that is not good enough at any time, let alone now. It is also clear that the Office of the Commissioner of Insurance simply does not have the resources, the authority or apparently the will to deal with issues like these. The local authorities should act quickly by first obtaining and analysing the relevant information and having further discussions and agreement with the company, and then following this by a visit to Trinidad and The Bahamas to meet with the relevant persons. Delay only drags the situation out, which is not good for either the company or the economy.