Part 3

Introduction

The Contingencies Fund

I now turn to the constitutional provision governing the Contingencies Fund. The position is that if Parliament decides to establish a Contingencies Fund, Article 220 permits it to do so by paying into it a specific amount, the quantum of which is determined and, therefore, limited by law in respect of any year. The article goes on to authorise the minister responsible for finance to make advances from that fund, if he is satisfied that there is an urgent need for expenditure for which no other provision exists.

Advances from the Contingencies Fund must be cleared by a supplementary estimate laid before the National Assembly as soon as practicable (see 4) below), thus replacing the amount so advanced. Section 41 of the FMAA gives effect to Article 220 by providing that:

1) The Contingencies Fund is limited to two per cent of the estimated annual expenditure of the previous financial year or such greater sum as the National Assembly may approve. It is fixed for each year, either by way of the formula or an act and the minister cannot increase it without parliamentary authority.

2) Only the Minister of Finance can authorise the release of moneys from the Contingencies Fund and must do so personally. Legally, not even the President can instruct the Minister of Finance when it comes to this fund.

3) By way of a drawing right, the minister may make an advance from the Contingencies Fund. The circumstances under which he can do so are severely limited – the overriding test is threefold: urgent, unavoidable and unforeseen. Further, he can use this fund only where no or inadequate sums had previously been appropriated, or where reallocation under the FMAA is not possible, or finally, where delay would cause injury to the public interest. He cannot use the fund to meet a promise by the President to do something or the other, or because he failed to budget properly, or because some budget agency was careless.

4) The Minister must report at the next sitting of the National Assembly all advances made out of the Contingencies Fund, specifying (a) the amounts advanced; (b) to whom the amounts were paid; and (c) the purpose of the advances.

5) On approving such advance, the National Assembly must pass a supplementary appropriation act covering the advance.

I reject what appears to be the government’s implicit assumption that Article 220 establishing the Contingency Fund somehow overrides the provisions of Articles 216-219 establishing the sanctity and unity of the Consolidated Fund, and providing an elaborate regime for expenditure of public funds. All that Article 220 does is to authorise Parliament to establish, if it wishes, a Contingencies Fund. The FMAA sets the limit on the sum of money to be paid into this fund and sets out the procedures governing the use and operation of the fund. The purpose of Article 220 is to convert the demand for money to be available for unforeseeable expenditure, which could be treated as a demand for loose or floating money, into a demand for a determinable amount of money for a specific purpose approved by law made by Parliament and by the constitution.

The purpose and combined effect of the constitutional provisions and the FMAA is that all expenditure, whether from the Consolidated Fund or its sub-fund the Contingencies Fund, must be by way of an appropriation act. This allows the National Assembly to retain control of public moneys while allowing the executive branch sufficient latitude to conduct governmental business. The limitation on the number of supplementary appropriation bills would seem designed to impose a form of financial discipline and order on the Ministry of Finance and budget agencies, in contrast to haphazard, guesswork financial management.

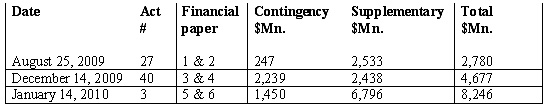

Against this constitutional and statutory background we can now consider the six Financial Papers presented to the National Assembly for 2009 for a total sum of $15,703 million. As we see from the table below, the amounts provided to clear advances from the Contingency Fund were $3,936 million while supplementary provisions amounted to $11,767 million. These were approved by way of Supplementary Appropriations Acts passed on August 25 and December 14, 2009 and January 14, 2010.

Table of Supplementary Appropriations in respect of 2009

Source: Acts and Financial Papers

1. While nothing new can be said about the failure to deposit the lotto funds into the Consolidated Fund, equally dangerously and unconstitutionally, the lotto funds are being used by the President to make payments. I have tried to ascertain the identity of the officials complicit in this illegality by trying several sources to ascertain the signatories to “account 3119.” Everyone is afraid to speak. It is no wonder that the government would not bring Freedom of Information legislation, despite the President’s commitment announced to the international press.

2. In financial paper No. 6, $1.6 billion is included as additional inflows for the Low Income Housing Programme Revolving Fund. A revolving fund can only be established under an appropriation act which specifies the purposes and draw-down limit. There is no indication when such a fund was created or its limits. No such fund appears to have existed at the beginning of 2009 and there is some mystery about its origin and operations.

3. There is some apparent misunderstanding between inflows which should be paid into the Consolidated Fund and the related expenditure which should be the subject of the appropriation act. Any money received has first to go into the Consolidated Fund. Its expenditure is an entirely different matter.

4. The Finance Minister fails consistently to bring to the next sitting of the National Assembly advances out of the Contingency Fund. As a result we have in Financial Paper #1, Contingency Fund payments for a period of six months. During that period, the National Assembly had met on more than two dozen occasions. But this is the Minister’s artful but deceptive way to circumvent the limit on the number of supplementary appropriation bills he can introduce.

5. The annual Budget never states the amount in the Contingencies Fund. While the Audit Office annually refers to the abuse of this fund, that office seems not to understand what is meant by “advances” in the context of the fund. It is meant to be an amount paid in advance of appropriation at the next sitting, not some prepayment for future expenditure.

6. Arguably most of the Contingency Fund expenditure does not meet the strict test of “urgent, unavoidable and unforeseen” set out in section 41 of the FMAA. The case of the $400 million to the GRDB as Subsidies and Contributions to Local Organisations is instructive.

7. The Contingency Fund seems routinely used to make expenditure for subsequent financial years. The Minister of Health admitted as much in the case of purchases of drugs from the New GPC.

8. Act 3 of 2010 is interesting. It indicates that the government spends moneys contrary to law, not only in respect of the Contingencies Fund but for non-urgent expenditure. And just reflect on the first paragraph of this column: that every appropriation of public moneys authorised by Parliament for a fiscal year lapses and ceases to have effect as at the end of that fiscal year. Seems to suggest that the appropriation lapsed even before the National Assembly approved it.

9. In Financial Paper 5 there is, under the Office of the President, an amount of $353 million for the installation of fibre optic cables and termination, as a Contingency Fund provision. The explanation, or justification, by no less than the President, that this is to introduce “e-government,” ie, electronic government, is as absurd and misinformed as it is wasteful.

A criticism of this less than half-baked and non-technical decription needs a separate column, but consider that the same week the announcement was made, the President was unveiling an advanced, multi-billion dollar, technically tested scheme by GT&T! Nor does the payment meet the test of “urgent, unavoidable and unforeseen,” and the Minister should be held accountable for this illegality since the law imposes on him exclusive responsibility over the Consolidated Fund.

Leading on from the issue of responsibility, next week’s concluding part will look at who is responsible and who can be penalised, and offer some of the recommendations to improve the financial management of the public finances of the country.