About this Publication

This 2010 Focus on Guyana’s National Budget marks twenty years since Ram & McRae began this annual publication which highlights, reviews and comments on the major issues surrounding and raised in the National Budget. Each year, Budget Focus is circulated among politicians, the business community and the country representatives of international agencies operating in Guyana. But most importantly for us, is the wide circulation made possible by the publication, in the Stabroek News, of an abridged but comprehensive version of Focus. On behalf of the reading public, we say thank you, Stabroek News.

Introduction

Article 13 of the Constitution of Guyana requires that citizens and their organisations be provided with opportunities to participate in the management and decision making processes of the State and, more specifically, “on those areas of decision-making that directly affect their well-being”. Ram & McRae has now confirmed that the Minister ignored this constitutional obligation, the flip side of which is the fundamental right and freedom of the citizen to participate in such processes.

This right has been a feature of all budgets up to the time Dr. Ashni Singh became the minister. It is time that citizens demand that their rights be respected, particularly in a matter as wide- ranging as the National Budget.

The Budget, with the theme Consolidate, Transform, Sustain was presented on February 8, 2010, just around the same time as last year. But this is still poor budgeting, and if the Minister would care to review the World Bank’s Guyana Public Expenditure Review 2002, he would find that for the ten years 1968 – 1977, only once was the Budget presented after the beginning of the year. That was the norm, and how it should be. With far greater capacity in the Ministry of Finance, billions of dollars to spend without ever having to think about revenue shortfalls, the standard of budgeting seems to have fallen in many respects, under the stewardship of this Minister.

One feature of Dr. Singh’s budgets that bears similarities with that of the President is its heavy reliance on contingencies and supplementary funds, themselves indicators of poor, or as the World Bank has noted, “deliberately inaccurate budgeting”. While Dr. Singh does not match the record of President Jagdeo when supplemental as a percentage of Budget ran as high as 43%, Dr. Singh’s supplementaries are far greater in absolute terms. In those circumstances, the budget presented is not a good indicator of what the actual expenditure in any year will be.

After a 1.4% decline in the real GDP in the first half of the year, the economy bounced back strongly, with second half growth of 3.75%, resulting in an overall full-year growth of 2.3%. This is less than half of the projected growth of 4.7% announced in the 2009 Budget Speech and it has to be wondered how this growth was achieved while VAT collections fell by 3%. This government has an irrational fear about inflation and negative growth. The opportunities for guesswork and estimates abound in our economy, and among some sectors, they seem always to be positive.

The Minister attributed the dramatic turnaround in the second half of 2009 almost entirely to sugar, the second crop of which grew by 22.3% over the corresponding period in 2008 and a huge 80% increase over the first crop; rice, production of which at 360,000 tonnes was 9.2% higher than 2008; the hard-to-measure other crops sector by 5.8%; and gold by 14.7%. It may mean little to the single mother with children at school, the small farmer in rural Guyana, or the youth in urban Guyana, but the message in the Budget was all positive – a strong balance of payment surplus of US$234.4 million, the highest level of international reserves ever, an appreciation in the rate of the Guyana dollar for the first time in fifteen years, and the lowest rate of inflation in 8 years. Ignore that the main cause of the latter was a 36.3% fall in the average price of crude oil and forget that the country is racking up higher and higher domestic and external debts.

In respect of the national debt, it is worth updating what we said last year: the domestic debt has been climbing inexorably since 1992 when it was $18Bn and at December 31, 2009 it is $87Bn. External debt now stands at US$933 million, a 12% increase in 2009, following an increase of 18% in 2008. If we take both the domestic and foreign debt the total debt is US$1.36 billion, almost entirely incurred under Mr. Jagdeo as Minister of Finance or President. Credit is indeed given to President Jagdeo for the debt write-offs and concessions the country has received. But that does not give him and Dr. Singh the right to burden the taxpayers of this country, and future generations, with excessive borrowings that are then inefficiently utilised. Unless some brake is placed on the borrowing spree, we can soon find ourselves in the position we were in 1992 when total debt was close to US$2 billion.

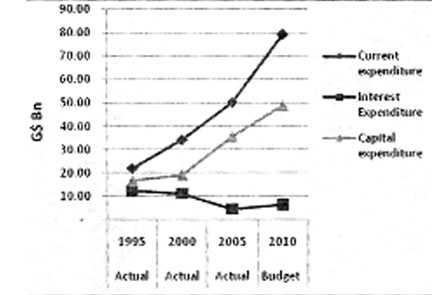

These increased borrowings and taxation have been used to finance the steep increases in public expenditure which continues to rise inexorably.

In current day value, the government has spent more than $1.290 trillion excluding VAT money, and other sums not properly accounted for, over eighteen years.

Despite VAT windfall each year revenues, the Government stubbornly refuses to reduce personal or corporate tax rates which both encourage and reward tax evasion; or to make more than a token increase in public sector wages that are far below what a family of three would require to give them a proper, balanced diet. Of course, with a fractured trade union movement, weak and divided consumer groups, and a docile private sector that says one thing in private and another publicly, the Minister and the Government are never under any pressure to make concessions to any of these groups. It is therefore hardly likely that voices will be raised that there was not a single budget measure while the personal income tax threshold remains at $35,000 for the third straight year, eroded by more than 9.8% since that level was set in 2007. In other words, the government becomes the beneficiary of inflation, at the expense of the worker.

The Minister had much to say about the Low Carbon Development Strategy and makes some lofty sounding commitments and promises on “Critical transformative infrastructure” on which the reader is left to speculate. The US$250 million dollars over five years cannot finance all the various projects which the President has identified. But it is far from clear what the Minister has in mind for 2010, to do with the Norwegian money. A separate fund, independently managed, and properly invested in sound projects may be the way to go.

Clico has now moved from “experiencing liquidity difficulties” to being a mere footnote, stalled in the courts, but the company’s depositors and insurers would be pleased that the Minister re-affirmed Government’s guarantee to honour Clico’s obligations to them. By contrast, the events at Bartica have earned the gold mining sector special attention in the Speech with its economic importance acknowledged and the Government’s longstanding relationship with the industry underscored.

The Minister announced the rebasing of the National Accounts resulting from a National Economic Survey of Business Establishments conducted by the Bureau of Statistics, and consumption data gathered in the 2006 Household Budget Survey. Using those rebased accounts, the National Estimates project that public sector investment as a percentage of GDP at current factor cost will be 17.4% compared with 12.5% for the private sector. This is as clear an indication as any that for all the talk about making the investment climate more conducive to business, and for all the tax concessions given, the private sector still does not believe that the economy and the environment are sufficiently attractive to warrant their investment. The economy is still far too dominated by public expenditure and suspect private capital.

After spending tens of millions on the World Court case with Suriname, mainly in the interest of oil, the Minister paid not even token acknowledgement to the sector, a silence that is truly deafening. Once again the Minister does not deal with poverty, unemployment, or the parallel economy but in 2010 ignores tax reform as well.

For 2010, the Minister projects non-sugar growth to be 3.4% but strengthened by sugar, the overall economy is projected to grow by 4.4%.

Conclusion

There is nothing in the budget that defines or describes an overarching vision for the country and the economy, other than as the Minister said, to maintain those same policies, which have rewarded a few at the expense of the poor and the working class. The national budget is becoming increasingly unreliable as moneys required to be put in the Consolidated Fund are either placed elsewhere or used to make unlawful payments. These are compounded by weaknesses that have again surfaced recently on poor budgeting, making the whole process highly unreliable.

It has become trite to say that there was nothing new in the budget. But in 2009, this was taken a step further by the pre-announcement of spending initiatives, such as the pension increases and the mangrove billions.

The minister already undermines the budget’s credibility by successive and huge Supplementary Appropriations. Announce-ments of expenditure subsequently revealed in a Speech that has no policy content, strip the whole process of its relevance.

It would be so much better if the Minister drastically reduces the contents of his speech, identifies the policies, strategies and outcomes expected during the short and medium terms, and addresses any proposed reforms. He can then leave for the debate the details of a road here and a bridge there.

Highlights

2009 Facts

● Growth in real GDP of 2.3% compared to 3.1% in 2008 and a target of 4.7% for 2009. Contraction of 1.4% for the first half of the year was, compensated by growth of 3.75% in the second half.

● Overall balance of payments surplus of US$234.4Mn compared with a surplus of US$5.6Mn in 2008.

● Decrease in the 91-day Treasury bill rate from 4.19% in 2008 to 4.18%.

● Inflation rate of 3.6% compared with a target of 5.2% and 6.4% in 2008. Actual in the first half of 2009 of 1.3%, and 2.3% in the second half.

● Appreciation of the Guyana dollar to the US dollar by a modest 0.97%. Average market mid-rates for US$ however depreciated by 0.26% while the Canadian dollar, Pound Sterling and the Euro depreciated by 7.95%, 6.44% and 10.06% respectively.

● Increase in Current Revenue collections by 15% from G$83.0Bn in 2008 to G$94.9Bn.

● Minimum public sector wage of $31,626 per month compared to $29,836 in 2008, an increase of 6%.

● Growth in sugar 3.3%, rice 9.2%, other crops 5.8%, livestock 2.5%, mining and quarrying 0.7% (contractions in bauxite 29% and diamonds 14.8% offset by an increase in gold declarations of 14.7%), engineering and construction 1.5%, transportation and communication 2%, distribution 6.6%, financial services 3%, rental of dwellings 2% and other services 3%. Contractions were noted in fishing 10.5% and forestry 0.6%.

● Exports and imports decreased by 4.2% to US$768.2Mn and 11.7% to US$1,169.2Mn respectively, resulting in a merchandise trade imbalance of US$401.1Mn, an improvement of 23.2% over the US$522.1Mn in 2008.

● Current account deficit of US$219.7Mn (2008 US$321.4Mn); and net inflows on the capital account of US$454.0Mn (2008 US$308.5Mn).

Size of the Budget: $142.8Bn, 10.8% increase

2010 Targets

● Inflation of 4% with growth in Real GDP of 4.4%.

● Current revenue of $98.2Bn, an increase of 3.5% over 2009.

● Balance of payment deficit of US$11.3Mn.

● Current expenditure (excluding interest) of $86.9Bn, an increase of 8% over 2009.

● Overall deficit of non-financial sector to increase from $13.5Bn (5.3% of GDP) to $14.5Bn (3.2% of GDP).

● Improvement in overall deficit after grants to $14.9Bn, or 3.3% of GDP.

● Increase in Capital expenditure is projected to increase by 4.2% to $49.0Bn.