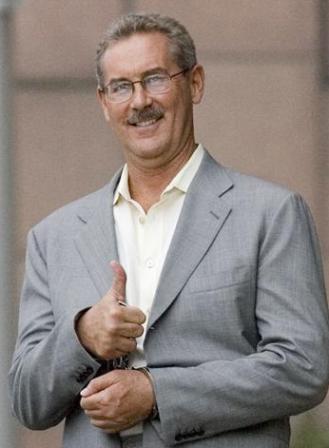

(Reuters) – Allen Stanford, accused of running a $7.2 billion Ponzi scheme, today lost his bid for a three-month delay in his criminal fraud trial, clearing the way for jury selection to begin on Jan. 23.

U.S. District Judge David Hittner in Houston called the public interest in a speedy trial “particularly acute.”

Hittner cited charges that Stanford deceived thousands of investors into buying certificates of deposit from his Antiguan bank, Stanford International Bank Ltd, leading to billions of dollars of losses. He also noted that Stanford has been in detention for 2-1/2 years since his June 2009 arrest.

“This case needs to be tried,” Hittner wrote.

Stanford had sought to delay the trial to late April. A lawyer for Stanford did not immediately respond to a request for comment.

Once considered a billionaire, Stanford, 61, had run the Stanford Financial Group, and owned luxury homes in the Caribbean, Houston and Miami.

The defendant now faces a 14-count indictment in one of the largest white-collar fraud cases since Bernard Madoff was arrested in December 2008 for his Ponzi scheme.

Criminal proceedings were delayed while Stanford was treated for an addiction to anti-anxiety medication at the same North Carolina federal correctional complex housing Madoff.

Last week, Hittner ruled that Stanford was competent to stand trial.

Stanford’s lawyers had argued that their client still suffers serious depression, as well as memory loss tied to a brain injury suffered in a September 2009 jailhouse attack.

In today’s ruling rejecting a trial delay, Hittner said Stanford has had “an extensive legal defense team,” having been represented at various times by 14 different lawyers, and “liberal” access to government evidence against him.

The judge also said a delay could add to already “massive” legal bills. He said Stanford, who claims to be indigent, is entitled to a “solid, capable, and competent defense,” not the “deluxe or ‘perfect’ defense” that he might otherwise want.

Prosecutors had said they would not oppose a four- to six-week trial delay, citing the competency hearing.

A Ponzi scheme is a fraud in which older investors are paid with money from newer investors. Stanford also faces civil fraud charges by the U.S. Securities and Exchange Commission, in a separate case being handled in Dallas.

The criminal case is U.S. v. Stanford, U.S. District Court, Southern District of Texas, No. 09-00342.