Conclusion

Introduction

Today completes a series on the liquidation process of the insurance giant that collapsed spectacularly in early 2009 after news came out of Trinidad and Tobago that the company’s parent had been taken over by that country’s central bank following a dramatic run on the company mainly by policyholders. As we looked with amazement at the manoeuverings of those involved including President Jagdeo, Drs Ashni Singh and Roger Luncheon and Ms Maria Van Beek and Ms Geeta Singh-Knight we learnt that the Guyana subsidiary was resting on a foundation of sand, that the company had been managed recklessly, and that the regulator had failed to do its job. Then we saw what the Insurance Act and the Companies Act had intended, namely, to regulate the orderly liquidation of a failed business, turn into a series of legal and professional infractions.

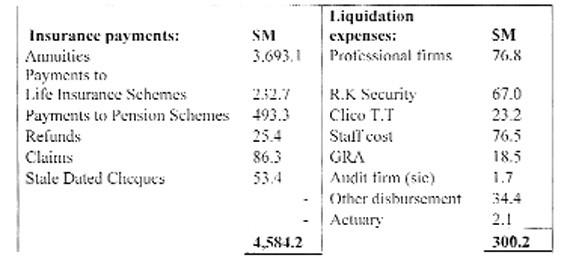

This series of three parts began following the lodging of a Liquidator’s Statement of Receipts and Payments more than one year beyond the statutory deadline. If readers thought the elementary errors in the preparation of the statement by the liquidator and his team were bad, they must now confront worse. If the high priced professionals knew what they were doing, it is not reflected in their work. Their carelessness, shoddiness and poor standard of work have done nothing to minimise, let alone reverse the massive losses to Clico’s creditors, the NIS and the country.

Today’s Business Page concludes its short series with the regret that when the