Functions

The tax structure is used to collect the revenues that the government utilizes in its programmes, and is a function of the historical experience of the country. As noted in Part I of this article, several of the taxes that make up the tax structure were enacted and implemented long before Guyana became independent. The tax structure is also a function of the structure of the economy. An economy with a bias towards foreign trade will most likely emphasize taxes

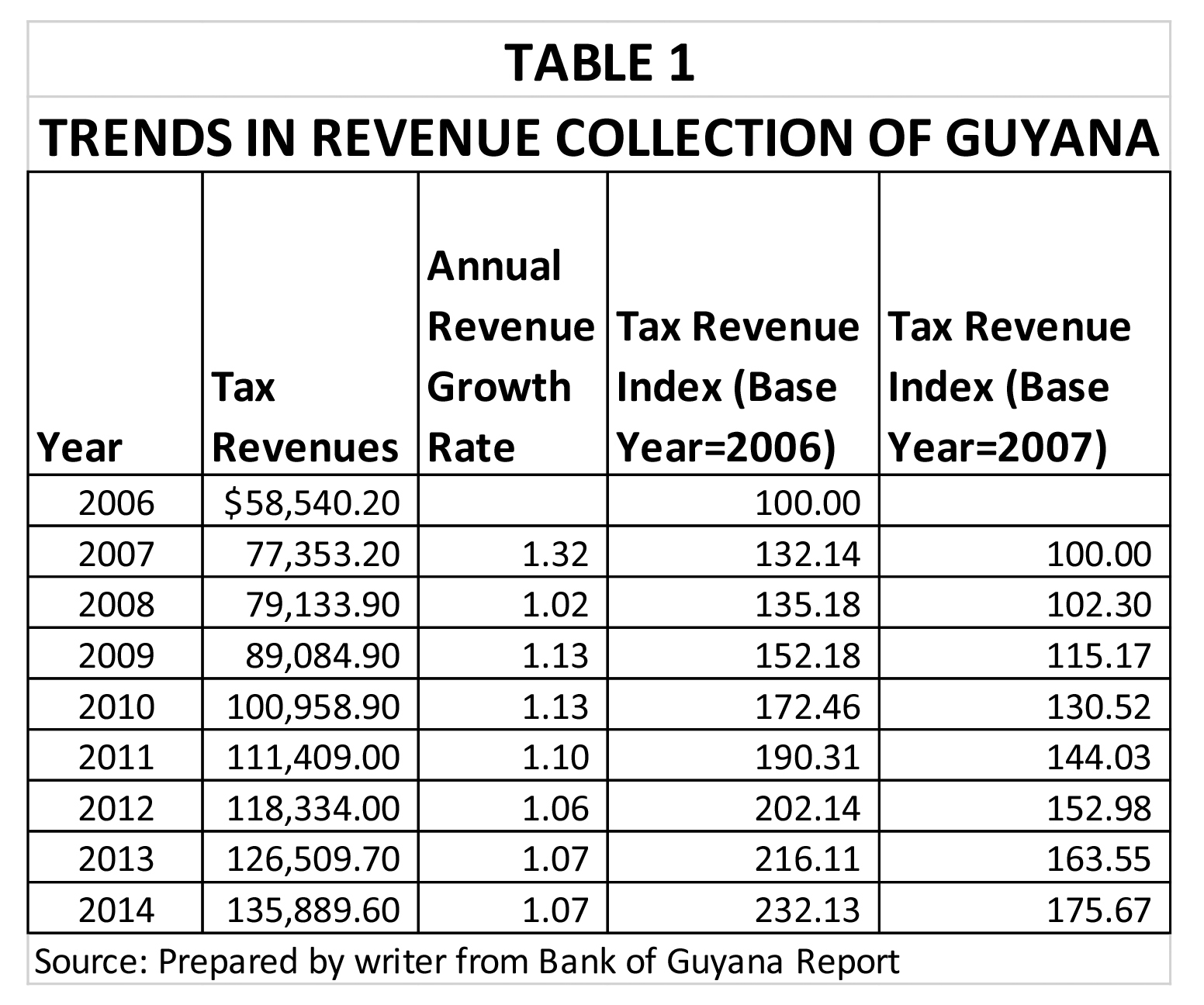

Table 1 below shows the trend in revenue collection in Guyana from 2006 to 2014.