(Conclusion)

Properly and effectively

In the second part of this article, this writer observed that revenue collection was not at its optimal position. To achieve optimal revenues, the existing tax structure has to work properly and effectively. As noted before, the tax structure of Guyana has five parts with some parts having simple substructures while others have complex substructures. An effort will be made to keep the discussion simple, even as one tries to explain the contribution of the various substructures in raising revenue for the government or point out their deficiencies in doing so. In order to understand the risk to optimal revenue collection from each part of the tax structure, it is necessary to talk first about the tax level and the contribution that each component of the tax structure makes to revenues.

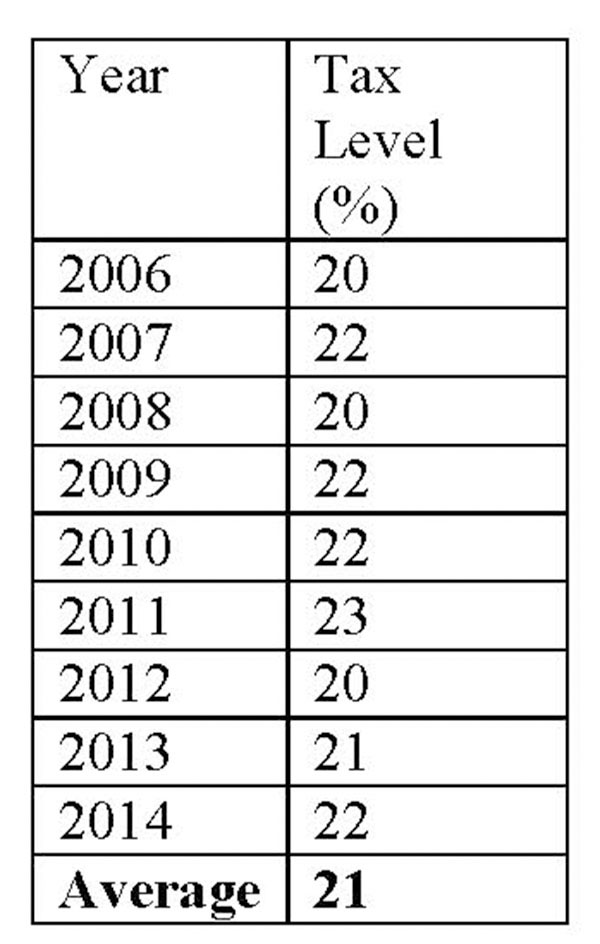

Tax level