Introduction

Today’s column addresses price, in the cost-price relation that Guyana’s oil and gas ‘discovery’ will likely encounter, after it comes on stream 5-7 years from today. Like last week’s treatment of cost in the relation, today’s treatment is also indicative. This underscores the difficulty of determining oil prices so far into the future.

Economists model the market price for any product (including oil) as a function of both the quantity demanded and supplied. Demand largely depends on 1) ability to purchase (in turn dependent on incomes, wealth, and so on); 2) preferences (for example, oil versus other energy products); 3) prices of those substitutes; 4) expectations; and 5) the number of potential consumers. Relatedly, the quantity supplied is primarily dependent on 1) production costs; 2) access to supplies (oil deposits); 3) expectations; and 4) total supply.

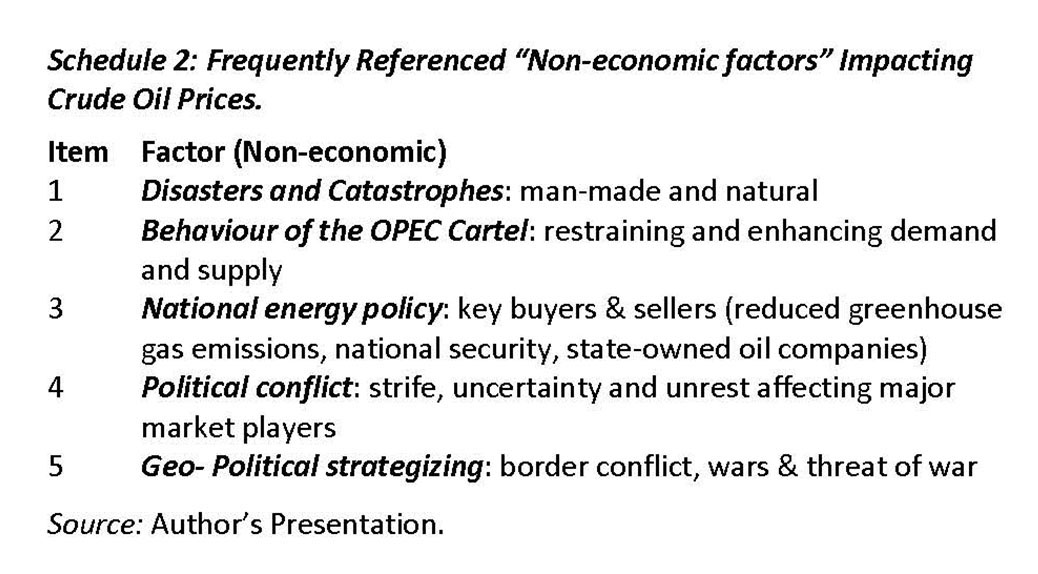

Economists expect such