Mutually beneficial

Last week, this writer began a discussion about the 2017 Budget that was presented by the government. As a financial plan, the government’s budget deals with revenues and expenses for the period under consideration. Revenues are important to the government and how it gets them is of interest to the taxpayers of this country simply because the taxpayers are involved. Taxation is the primary means by which government raises its revenues and it does so by turning to workers, entrepreneurs and companies. For the sake of social and economic progress, that relationship needs to be cooperative and mutually beneficial. It calls for an operating environment that enables every economic actor to get on with his or her daily life.

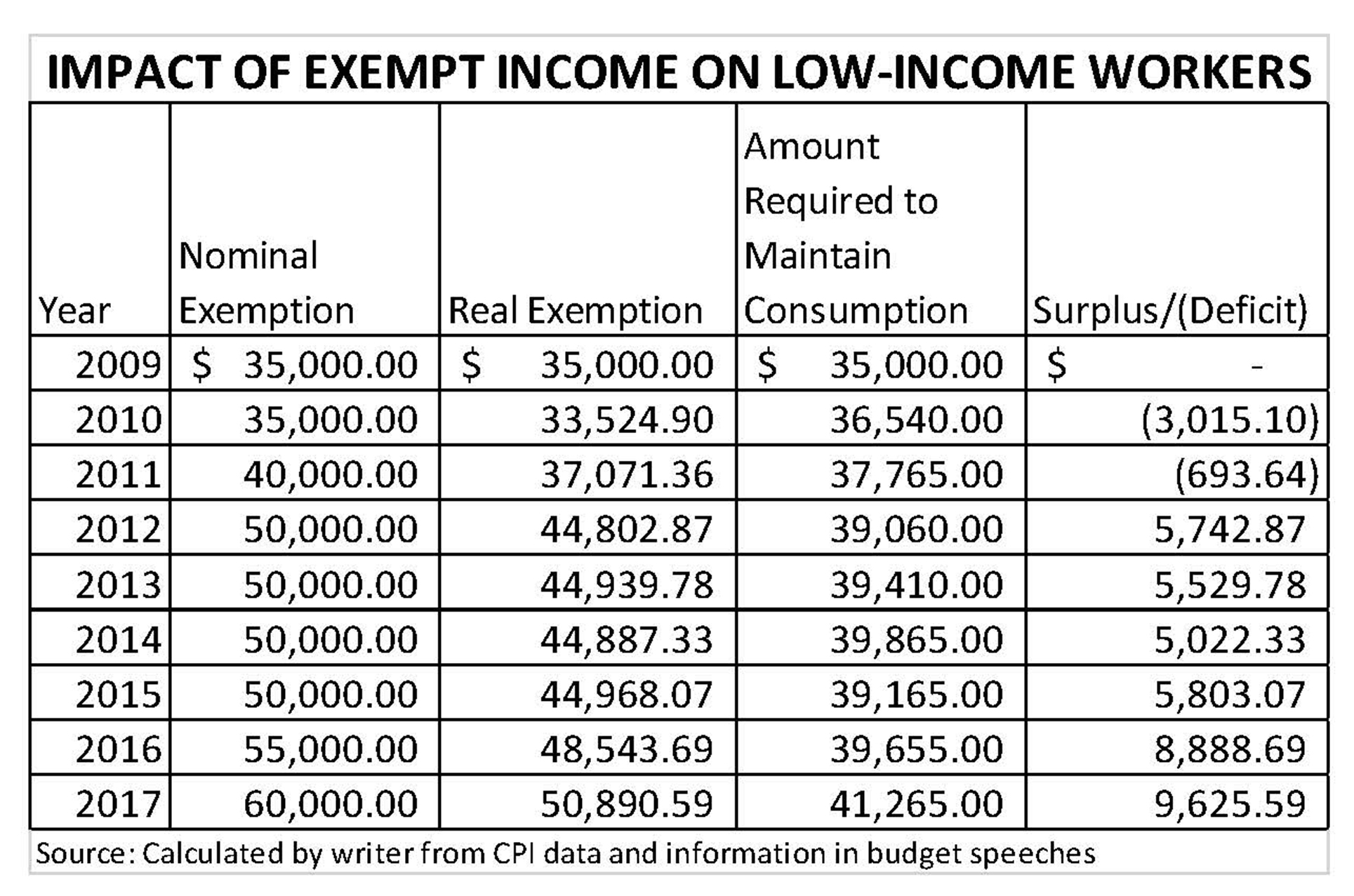

The government utilizes a group of taxes to get the amount of revenue that it is looking for from people and businesses. Collectively, these taxes are referred to as the tax structure. The mix of taxes making up the tax structure could be classified as direct and indirect taxes. It is important to understand the distinction between the direct tax and the indirect taxes. The direct taxes determine the amount of money that Guyanese have to spend and this spending money is also known as disposable income. On the other hand, the indirect taxes determine how many goods and