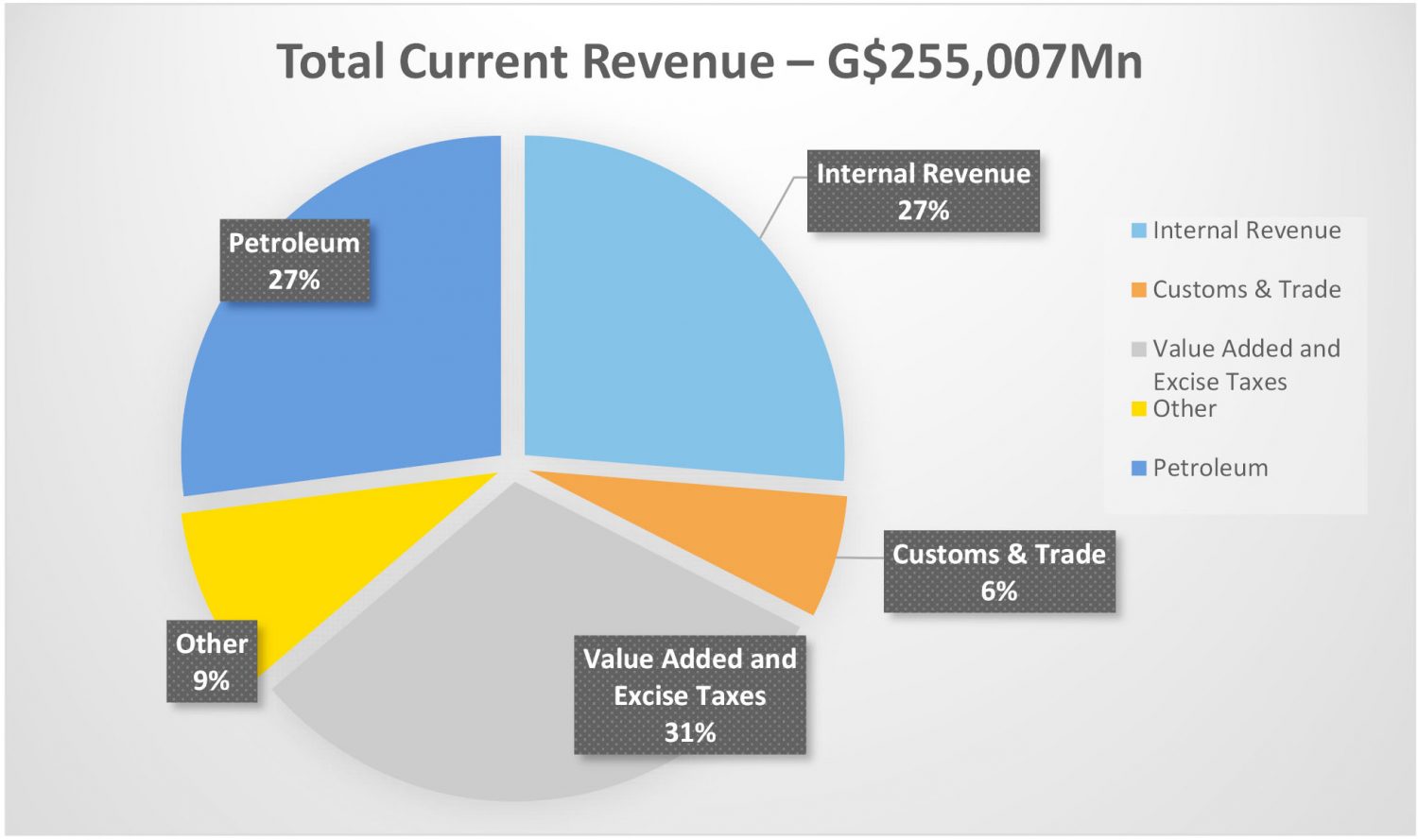

It is now just over the halfway stage of the life of the current Parliament. In about the same time into the future, Guyana will join the club of petro states, catapulting to No. 9 on the list of oil producing countries, using the metric of per capita barrel of oil per day. Ram & McRae projects that in the first full year of production, the share of government revenue from petroleum will exceed twenty-five per cent. This is huge but not unusual among oil producing countries.

Budgeted Current Revenue for 2017 – illustrative impact of Petroleum

Of course, Guyana has long been a producer of non-renewable resources earning not insubstantial revenues and foreign exchange in the process. For decades, the revenues from those sectors were substantially collected not by the central government but by statutory bodies such as the Geology and Mines Commission (GGMC), the Guyana Gold Board and the Guyana Forestry Commission, each acting both as regulator and collector of taxes and fees. These moneys therefore found themselves in the Consolidated Fund by this indirect and inefficient route.

In the two and one half years