Within hours of the publication of my last Sunday’s Stabroek column, where I had indicated my intention to write a “three-part review of Open Oil’s reported financial modeling exercise of Guyana’s 2016 PSA”, its Founder and Author of the exercise wrote to the Stabroek News Editor “to correct some inaccuracies” (letter published, Monday, May 7, 2018). Not to be distracted from my original aim, I will provide a detailed response to these alleged “inaccuracies”, in the last part of my “three-part review”. Today I shall concentrate on wrapping-up the first part of the review; which is, the “description of the key features and assumptions” behind the modeling exercise.

Meanwhile, the inaccuracies that were identified in the letter, include: 1) “Open Oil did not develop the FAST standard” 2) Open Oil is not an NGO, but an incorporated German Company 3) the claim that it offers “unique specialized training” is inaccurate 4) the claim also that it “offers its services for sale as an equal opportunity consulting group is a phrase it has not used” 5) further, the claim that “the model is focused on Liza I as the first field” is inaccurate 6) and finally, the use of the “February long-term forecast price by the EIA” is inaccurate. I shall fully address each of these in turn in Part 3 of the three-part review.

Today’s Column Focus

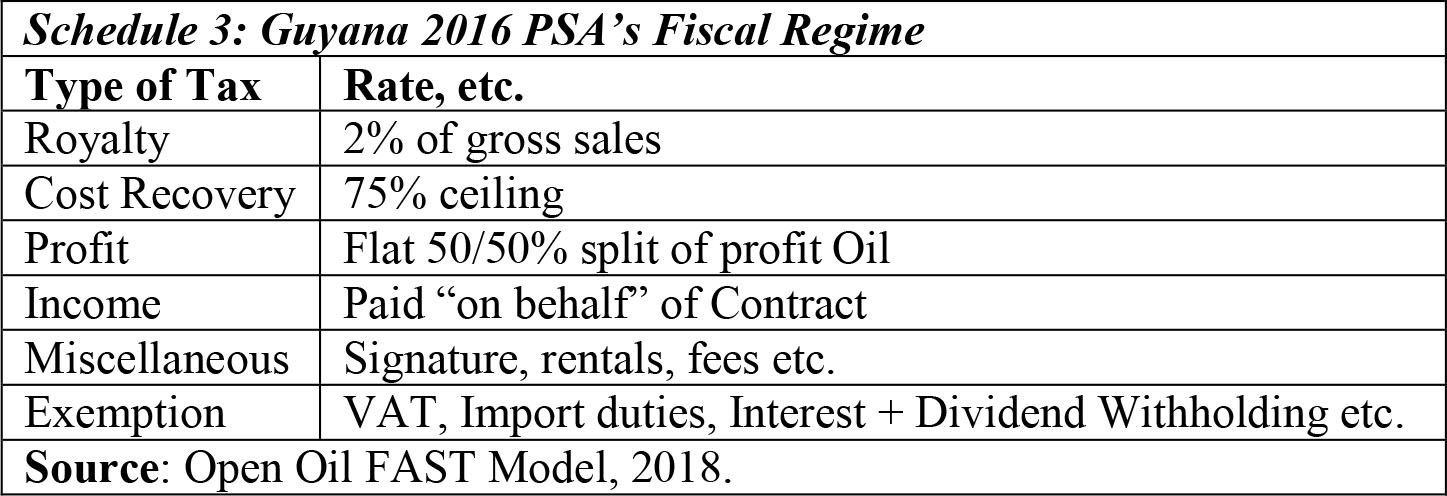

Today’s column wraps-up Part 1 of the evaluation of Open Oil’s FAST financial modeling of Guyana’s 2016 PSA. The basic aim is to summarize the key features and assumptions inputted into the model exercise.