Last week’s column offered a brief overview of Part 2 of Guyana’s Petroleum Road Map. Part 2 covers the spending dimension of the Road Map and its five specific Guideposts. It also offered an introductory snapshot for each of the five Guideposts. Today’s and next week’s column will provide a discussion of the first Guidepost. This will centre on the estimation of a likely ratio for Government Take and petroleum revenue yield at and around the time when petroleum extraction is at full ramp-up. The other four Guideposts are presented thereafter in sequence.

Treatment of Government Take

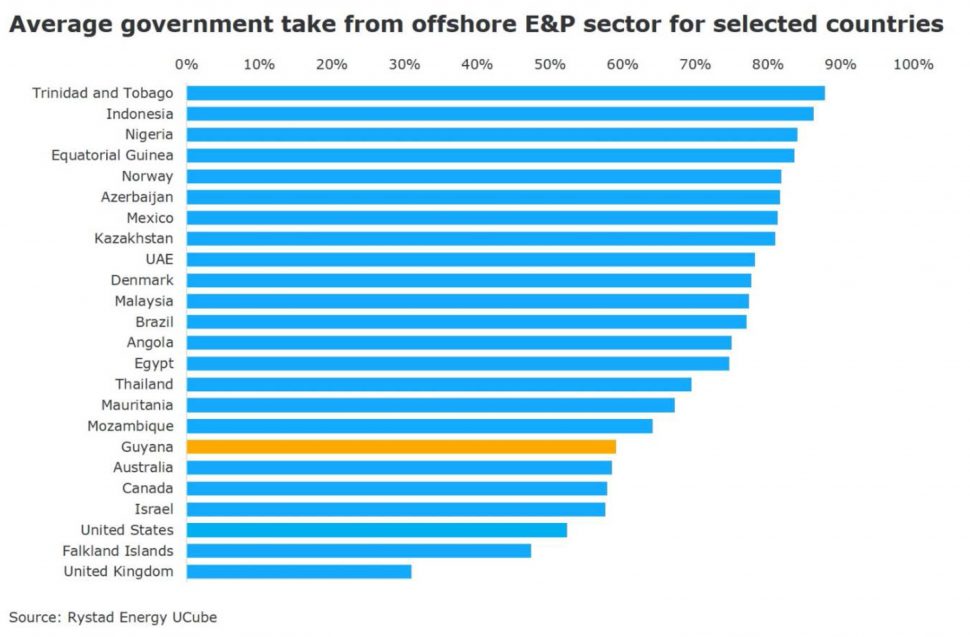

As was indicated earlier in the series of columns on Government Take, I treat this as being at its core a simple function of the relevant fiscal rules for a given petroleum contract between Government (as resource Owner) and the private company/companies as the exploration and development (E&P) Contractor. For purposes of the Road Map I intend to assume for this analysis that the Government of Guyana (GoG) and ExxonMobil (and partners) Production Sharing Agreement (PSA) is representative of all Guyana’s petroleum contracts going forward.

Having stated that, I hasten to confirm that I do expect going forward that the fiscal rules of the present PSA to evolve and, consequently, the Government Take ratio to rise. This will occur as experience suggest all petroleum contracts have proven to be dynamic, if risk and uncertainty decline. As offshore deep-water and ultra-deep-water technology and experiences grow this will reduce E&P risk and uncertainty. Guyana can expect therefore it will then no longer be treated as a high risk petroleum frontier country. Despite the sanguine outlook expressed here, I shall err on the conservative side and make absolutely no allowance in my discussion of Guidepost 1 of Part 2 for any future incremental gains in the Guyana Government Take ratio.