Introduction

A significant number of readers have asked me to clarify/expand/repeat more simply the way in which I arrived at the “back of the envelope” or “ballpark estimates” of annual Guyana Government Take, which I offered in last week’s column. Most of these requests have come from readers who have neither read, nor followed clearly, the columns in which I had estimated 1) Guyana’s petroleum reserves potential; and, 2) the consequential daily rate of production (DROP) of barrels of oil equivalent (boe) this entailed. While, I cannot repeat these columns in detail here, I summarise the estimates they offered, indicating their publication dates where appropriate.

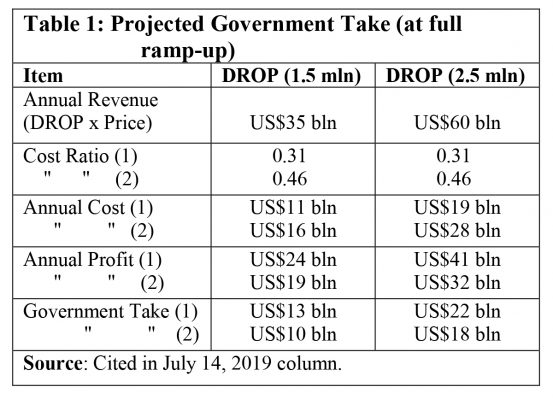

For this purpose, I proceed by way of indicating through Table 1 below (cited in last week’s column), how the projection was arrived at. To recall Table 1 indicates the results of my back of the envelope calculations, based on Rystad Energy’s analytics used for projecting Guyana’s petroleum earnings in the 2020s. These results are: 1) a DROP of 600,000 (0.6 million) boe; 2) annual revenue of US$15 billion; 3) annual total costs of US$5 billion; 4) annual profit of US$10 billion; and Government Take of 60%, leaving Contractor Take at 40%. The inferred price per boe is therefore US$75.