Last week’s column briefly evaluated the perspective of private investors and their value added proposals for constructing “modular mini-refineries” utilising Guyana’s crude oil. Today’s column offers an evaluation of the Government’s “proposal” to construct a State-owned oil refinery similarly based on Guyana’s crude slate. My recommendation, expressed below, is: the latter makes no economic sense presently. Next week’s column will stipulate the decision rules to guide both public and private refinery proposals on offer.

Background

The problematic that I address today is: should the State establish a local refinery using Guyana’s crude? The prospective refinery size is about 100,000 barrels per day (BPD), functioning at a level of complexity/capability exceeding that found in typical modular mini-oil refineries. In 2017 Exxon’s Country Manager had indicated that a refinery of such size would be unprofitable! A much larger refinery was needed, in order to reap economies of scale at levels prevailing in the Western Hemisphere!

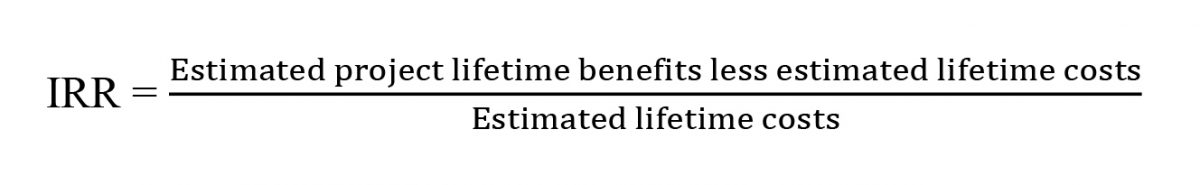

In the same year, the Ministry of Natural Resources (MoNR) authorised a feasibility study of a state-owned refinery. This task was undertaken by Pedro Haas, of Hartree Partners, who gave a PowerPoint presentation of the study on May 17, 2017. As indicated, his feasibility/cost benefit analysis was aimed at determining “the viability of the idea.” In other words, to establish whether the State should proceed or not.