Today’s column addresses the third and final policy choice that I anticipate Guyana will have to make during the next decade. That choice is whether or not to establish a National Oil Company (NOC). Two other policy choices have been appraised thus far: whether to join OPEC; and whether Guyana should aspire to become a “swing producer” in the global crude oil market. Both choices require the establishment of an NOC if Guyana is to pursue them successfully.

As matters presently stand, international oil companies (IOCs) dominate operational decision-making and control of all critical phases of Guyana’s petroleum sector; from exploration through development and planning, and up to the production and sale of output. It is expected that this profile will continue well into the coming decade, if left to run its present course. On this course, the most likely organisational change in the sector is expected to be an increasing variation in the nationalities of the IOCs involved. Only an NOC can vary this dynamic, since the Department of Energy (DoE), which presently represents Government interests, focuses on oversight functions and policy framework guidelines.

Related to this governing dynamic, readers should recall that the issue of an NOC for Guyana has been publicly discussed on several earlier occasions. It was raised in connection with whether Guyana should build a state-owned refinery. I had participated in these previous debates, when the Pedro Haas feasibility study on a project commissioned by the Government of Guyana (GoG) was presented and debated three years ago. I had strongly rejected the idea then. As it turned out, the Haas study had found such a refinery too risky, costly, expensive and uneconomic. Current global trends reveal a growing surplus of refinery capacity, which makes such an idea even more ill-advised. This issue was also addressed by a GoG invited Advisor from Chatham House, London (V. Marcel), who had advised the formation of a National Energy Company in order to embrace Guyana’s thrust in favour of renewables, as part of its Green State Development Strategy. Added to this the IMF has also recommended the formation of a State Holding Company.

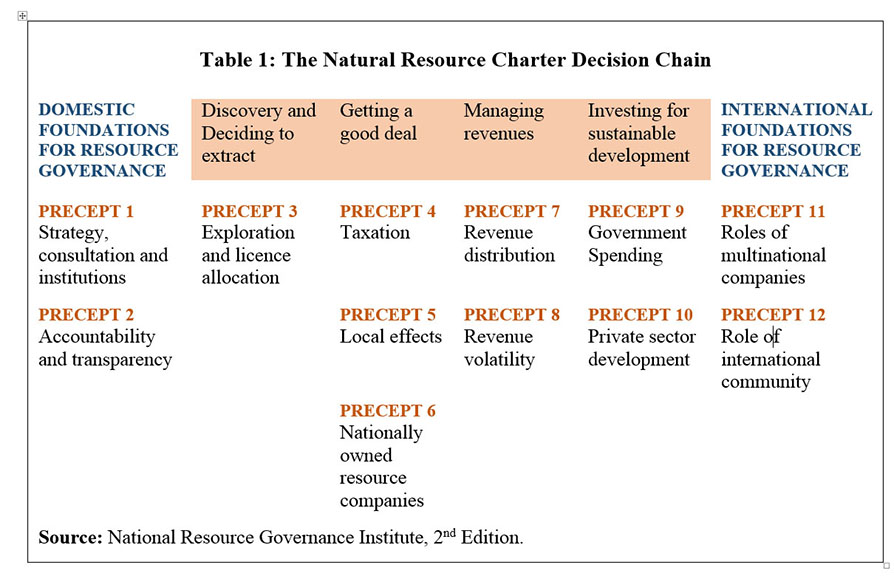

For myself, I had advocated an NOC along the lines proposed in Precept 6 of the Natural Resources Governance Institute’s (NRGI) 12 Precepts. Precept 6 of the National Resources Charter (NRC) states: “NOCs should be accountable, with well-defined mandates and an objective of commercial efficiency.” I recommend such an NOC to pursue sustainable governance of Guyana’s petroleum resources. Table 1 displays the National Resources Charter Decision Chain.

NRGI

In the NRGI precepts, the NOC is portrayed as “a key component in a strategy to harness development potential” from Guyana’s world class potential oil and gas reserves. As such it is designed to yield several benefits for Guyana. First, it seeks to capture as much as is economically efficient of the economic rent yielded by the petroleum potential. That is, it balances a trade-off between state benefits captured and losses through deterring private investment. It also recognizes that taxes may not capture all potential economic rent. Second, a NOC offers a means whereby technology can be transferred from the operating IOCs (particularly in the offshore sector) to local businesses and investors. Third, a similar facilitation is expected to occur in the form of “transfer of efficient business practices” to local commercial entities and entrepreneurs.

From the specific perspective of decision-making the nation can also benefit in other ways from an NOC. Thus, fourth, the existence of an NOC reduces the information asymmetry, which bedevils the operation of IOCs in poor countries. It is universally recognized that, when information is lacking, the best use of resources is most unlikely. Information is therefore key to the efficient use of Guyana’s petroleum resources. An NOC facilitates the flow of such information.

The above brings further immeasurable benefit. Fifthly, as the metaphor goes an NOC gives Guyana a “seat-at-the-table” of decision-making about the disposition of its natural resources. This means direct influence in operational decision making in the sector. With a seat at the Table, Guyana is positioned to influence upstream petroleum sector outcomes and therefore yield benefits from a local content policy and the construction of domestic linkages within the oil and gas sector, and between that sector and the non-petroleum sectors of Guyana.

It follows then that an NOC should be evaluated from a dynamic perspective. That is, in a context that responds to the evolution of Guyana’s petroleum sector at the global, regional, and national level. Such a development and its associated activities have to be driven by both the context and needs of the general environment in which the NOC is located. In this way great care has to be taken in assigning to the NOC its appropriate roles and responsibilities, as well as its guiding governance principles.

A close reading of the above observations suggest that, essentially, an NOC for Guyana should be viewed as an instrument for its development. Particularly, one that seeks to protect Guyana’s national interests in an environment where at present, the private commercial interests of IOCs are the main operational drivers. As I shall indicate later, it costs the State to establish an NOC. These bodies therefore carry an opportunity cost and in turn must therefore yield equivalent to or more benefit than costs to establish, in order to justify them. As I shall also observe, in seeking to achieve this, the State will incur risks!

Conclusion

I consider those issues further next week; along with, indicating the present size and importance of NOCs in today’s global energy environment.