More Guyanese are coming forward with stories on how they lost big after being lured into investments with Accelerated Capital Firm Inc (ACFI) which is now the subject of a major Ponzi scheme investigation here.

The unsuspecting were told that their monies would yield high interest from foreign exchange trading and safe overseas investments. A Ponzi scheme is an investing scam which promises high rates of return with little risk to investors. It bring returns for early investors by acquiring new investors and the longer it runs the newer investors are bilked.

“My family, with about 10 persons, have suffered losses. Only my aunt got back interest on her money and my sister got back the $500,000 she invested without interest but everybody else got nothing,” Mahaica Creek resident Yoganand Seebaran, told Stabroek News in an interview yesterday.

“They told you that they are investing in foreign exchange and US$1000 was the minimum but you would be turning big profits after three months. A lot of the persons from my area heard about it from vendors at the Mahaica Market here [at Mahaica Creek]. I know about 25-30 alone. There could be more…,” he added.

Yoganand said that it was not as if his family members did not research the company as they asked him to also assist and he found testimonies from a well-known Hindu priest along with other prominent persons.

For Mashelly Cameron and her sister Onisha, their $500,000 investment was pooled from their life’s savings, into a scheme encouraged by a friend that it was safe and they would be rewarded as she was.

“Is me $500,000 but my daughter did all the transactions. When it was time to get, they told me the money hold up and it can’t get to come in the country and next week. It turned this week, next week, next week, the other week…,” an emotional Mashelly related. “I never thought this would have happened,” she said.

Diane Ibrahim also felt compelled to invest after a trusted friend told her she was a part of the investment since 2019. The woman said that in June of this year, she parted with $1M of her savings from work over the years and to date has not seen “one dime” of her capital “much less profits”.

According to her, the company had first said that they were late on payments because of the COVID-19 pandemic. She added that when she made contact with the company for a second time she was told that they were having issues with the bank.

The woman said she asked to be released from the investment and was told that she would have to make an appointment with the company and wait until September to meet with them.

A contract shared with this newspaper states that the company “will operate in the foreign exchange market, Forex, Stocks, commodities, equities, ETFs with funds deposited therein by the contributors and this will get the profits indicated at all times by the company.”

The company said that it “operates through brokerage houses”.

The persons this newspaper spoke to are just a few of the over 17,000 persons countrywide that Guyana’s Attorney General Anil Nandlall estimates were conned out of their monies.

Sources close to the investigations told this newspaper that some local businesspersons invested tens of millions. “You have (name give) investing $150M, (name given) of Good Hope another $40M, then there is (name given) of Bel Air (with) $100M… we are talking hundreds of millions,” the investigator said.

At the centre of the scheme is ACFI which Nandlall on Saturday announced was the subject of a major investigation, having allegedly collected approximately US$20 million from would-be inves-tors. The Attorney General urged citizens who had invested in the scheme to contact their nearest police stations to report so that a database of investors and the sums invested would be set up, so that if possible those persons could be reimbursed.

BoG

A release from the Bank of Guyana (BoG) last week stated that the company and its principals, Yuri Garcia Dominguez and Ateeka Ishmael, never deposited anything near the sums it is alleged they collected. The two are currently assisting the police

with investigations and the question of where the invested money went is one of the primary concerns of investigators.

According to Nandlall, Dominguez has claimed that he holds bank accounts in Las Vegas, Nevada in the US and Germany.

Police sources told this newspaper that the duo have said that the money is being invested in Belize, France and even Switzerland.

Here in Guyana, the Bank of Guyana said that ACFI had one bank account, with the Bank of Baroda (BoB).

ACFI has no other bank account as its application for a commercial bank account was denied. Also denied was an application to the Guyana Securities Commission (GSC) for a licence to operate.

While the current balance was not revealed, the BoG, in a release noted that the highest sum ever retained in the account at one point was $14.6 million. The account has from January to February, 2020, conducted transactions totalling $21 million. This account was closed in April of this year.

Dominguez, a Cuban national who was recently naturalized, had two bank accounts; one with BoB and another with the Demerara Bank Limited (DBL).

At BoB his highest balance was $200,000 while at DBL it was $2.3 million.

Paramount

Nandlall yesterday told Stabroek News that government’s paramount priority is to locate the vast sums of monies received by this company and to ensure that the persons who lodged their monies with them are reimbursed.

“From all indications this money was received in Guyana. From the information disclosed by the central bank, it is clear that the money is not in the banking system. It is also clear that the money did not leave Guyana through the banking system nor through any other legal means. Persons are contending that the monies are in Belize, in the US, in Greece, in Germany…assuming that the monies are there, how it reached there?” he asked.

“The Bank of Guyana, the Guyana Police Force, the Guyana Securities Council and the Financial Intelligence Unit are all engaged in attempting to verify the existence of the accounts or the companies that allegedly have this money and so far the investigations are not unearthing anything,” he added.

The Attorney General said that it is significant to emphasize that this investigation did not start under his PPP/C government, which only took office on August 2nd of this year.

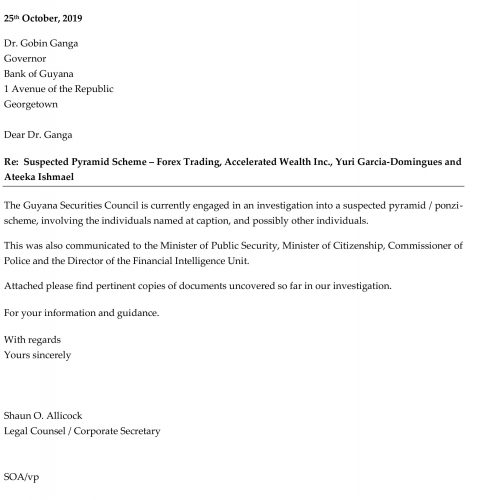

“The investigations have revealed that it started since 2018, the matter was brought to the attention of the securities council which issued public advisories informing the public that this organization was not registered or licensed to operate. When Yuri Garcia Dominguez’ application for naturalization was made public, the securities council again wrote informing them about the background of the gentleman. They did nothing!” he stressed.

“The reason why the Guyana Government became involved is because dozens of people have approached us and have complained that over the last two months, they have not been receiving promised payments from their investments. The Caribbean has an experience with Allen Stanford and Bernie Madoff and we don’t intend to have our people suffer the same fate,” he added.

Stabroek News reached out to former Minister of Public Security Khemraj Ramjattan on why after formal complaints from agencies here and allegations of persons being defrauded since 2018 that a full-fledged investigation was not carried out and how Dominguez was still able to become a naturalized citizen of Guyana.

He said that details now are blurry but he remembers that the police were asked to deal with the matter. The police, Ramjattan said, should also have flagged Dominguez’ name when his naturalization case was lodged since he had to be given a police clearance.

“They had written to me and it was sent to the police force. An investigation was supposed to be done in relation to that. I can’t remember what exactly transpired because you get these letters all the time and you send them to the investigative authorities and you let them take it from there. That is how you do it. I think it went to Special Branch [The GPF Intel Gathering Unit]. Police do the investigations in relation to those reports then goes to the relevant authorities,” Ramjattan said.

“As it relates to the citizenship, the police does recommendations. I suppose he was obviously cleared. It could be that there was a recommendation from the police,” he said.

For Nandlall, the police did not do enough since if they had, the scheme would have been uncovered and thousands of persons would not be in financial straits at this time, which he said is exacerbated by the COVID-19 pandemic.

But the Attorney General is hoping that with regional and international law enforcement cooperation, the monies would be found and can then be turned over to the state, which in turn would refund those who were scammed.

“The man is in police custody. If this money is found, in any account in any part of the world, the state through its relevant agencies, is prepared to do what is lawfully required to be done to facilitate the return of the monies to Guyana. But so far, the various agencies that have been activated have not been able to locate these monies in any of the destinations by the principals of ACFI,” he said.