Introduction

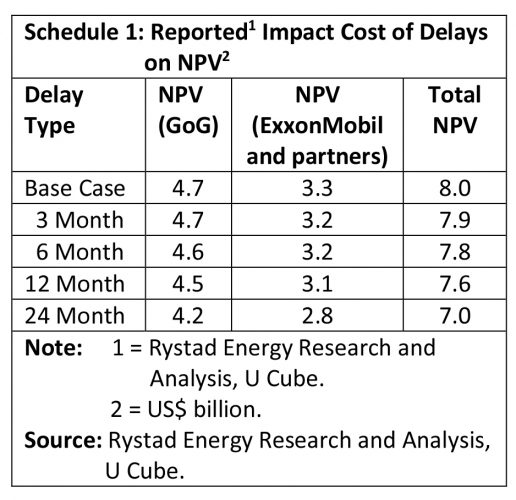

Today’s column offers a summary evaluation of results from Rystad Energy’s modelling of the cost of delay (COD) of the Payara project, as revealed in last week’s column. I had placed emphasis on those calculations of the delay cost which are demonstrated by changes in the project’s net present value (NPV). For the convenience of those readers who may not have a copy of last week’s column at hand, I reproduce below the summary Schedule showing the results I presented last week:

Readers should recall that the Payara project is a joint venture; that is a project which blends government enterprise (as the resource Owner) and the enterprise of private international oil companies (IOCs) (as the Contractor). The latter is responsible for crude oil production. For the purposes of its modelling exercise, Rystad Energy has constructed a Base Case, and four delay scenarios; namely, 3 months, 6 months, 12 months and 24 months. These scenarios constitute a geometric progression that successively doubles the delay time period for the four chosen scenarios.