In a forthcoming edited volume on the Caribbean Economy, (Routledge, November 2020) I have a Chapter entitled, “Guyana and the Advent of World-class Petroleum Finds”. In part, that Chapter provides a highly condensed summation of Guyana’s estimated recoverable petroleum resources. I believe that at this stage of my presentation on the intrinsic competitiveness of Guyana’s oil and gas, the main features of these estimated resources warrant re-stating for a more general readership. Today’s column is devoted to providing this.

Discoveries

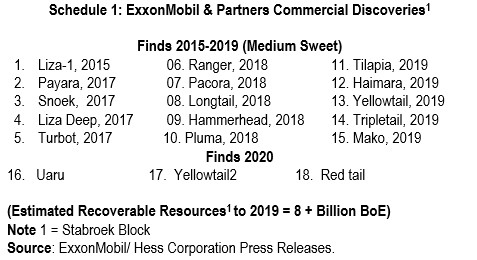

Readers should recall that ExxonMobil and partners had announced the first discovery in May 2015. This was preceded by 45 unsuccessful wells drilled over five decades. Since May 2015, 17 more discoveries have been announced; four in 2017, five each in 2018 and 2019, and three in 2020. By every metric this has been a phenomenal rate of discovery. Guyana’s creaming curve, as it is termed, has been historically unprecedented. All 18 discoveries made by the Exxon Mobil grouping are located in the Stabroek block. Further, the grouping has announced recently that, its recoverable resources total 9+ billion barrels of oil equivalent (BoE.) These data are reproduced for convenience in Schedule 1 below.

Two other joint venture groupings (JVs) have recently announced three finds. These however are based on Prospective Resource estimates totaling 5.14 billion BoE; Jethro 1, Joe 1, and Carapa wells. These estimates are obtained from an updated Competent Persons Report on Resource Prospectively in their holdings conducted by Gustavason Associates and located outside the Stabroek Block, in the Orinduk and Kanuku blocks.

Resource potential

Back in 2016, I had advanced the proposition that Guyana’s petroleum resources potential far exceeded the original ExxonMobil estimates of 600 million to 1.3 billion BoE announced soon after its 2015 Liza 1 discovery. Many thought then, and some still do so now that, my estimate of 13 to 15 billion BoE by the early 2030s, was hopelessly optimistic

My estimate remains. It is supported by two lines of argument. First, an appreciation of Guyana’s petroleum geology, as expressed in the geological principle of the “Atlantic mirror image”, and second, estimates provided by the United States’ Geological Services (USGS). Of note, Guyana’s crude is classed as “medium sweet”, with an API >35 and low Sulphur content of 0.5.

Geoscientists have posited that Guyana’s discoveries reflect the earlier drifting apart of what was originally, a unified super-continent, combining South America and Africa. A separation took place over geological time; resulting in the Guianas Equatorial Margin (encompassing offshore and onshore portions of Guyana, Suriname, French Guiana, as well as limited portions of Venezuela and Brazil). Consequently, the petroleum geology of the Guianas area closely resembles that of West Africa. It includes two sedimentary basins, namely, the Guyana-Suriname Basin and the Foz do Amazonas Basin. It is further reported that the Guianas Equatorial Margin/Guianas Basins is separated by the Demerara Plateau, which is a structurally high, thick succession of Jurassic and Lower Cretaceous carbonate-rich sediments.

This circumstance yields the thesis that, the petroleum system of the Guianas Basin is a “mirror-image” of West Africa’s petroleum system, where several large hydrocarbon accumulations have been found, including, the famed Jubilee discovery, offshore Ghana.

USGS Assessment

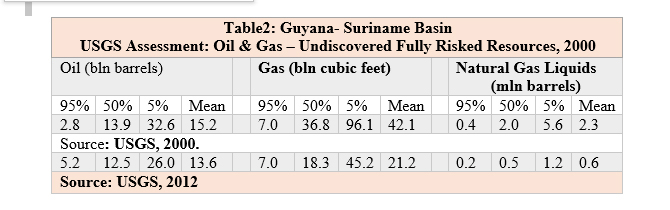

My second justification is based on two USGS’ World Energy Assessments of Undiscovered Oil and Gas Resources in Central and South America as well as the Caribbean (2000 and 2012). The information provided is “fully risked”, with estimates given, at levels of 95%, 50%, and 5% probability. The mean probability is also reported (where fractiles are additive, assuming perfect positive correlation). The estimates given for gas include all liquids. Undiscovered gas resources are the sum of non-associated and associated gas. Both Survey results are shown in Table 2.

For the 2000 assessment estimates range from 2.8 billion barrels of oil (95% likelihood) to 32.6 billion barrels (5% likelihood). The 50% likelihood is at least 13.9 billion barrels of oil equivalent and the mean is 15.2 billion barrels of oil equivalent. For the 2012 assessment estimates range from 5.2 billion barrels at 95 percent and 26.0 billion barrels at 5 percent. The 50% likelihood is 12.5 billion barrels and the mean is 13.6 billion barrels. Discoveries thus far reveal amounts considerably larger than the 95% likelihood estimate for both assessments.

Two observations are warranted. First, these estimates are for a virgin frontier region and therefore remain reliant on petroleum geology assessment. Second, the mean natural gas estimates are for 42.1 and 21.2 billion cubic feet, respectively.

How massive

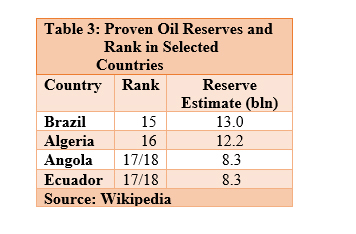

My assessment of reserves potential of 13-15 billion BoE compares to Wikipedia’s world ranking of countries with proven oil reserves, which lists Brazil 15th (with a holding of 13.0 billion BoE); Algeria is 16th, (12.2 billion BoE); and Angola and Ecuador 17th and 18th (with 8.3 billion BoE) (Table 3).

Summing up, estimates of Guyana’s recoverable reserves as provided by the IOC groupings are: 1) Exxon and partners, (8+ billion barrels) for their first 15 discoveries and 2) the others (5.14 billion barrels), based on a Competent Persons Report.

Conclusion

Next week I consider likely Government Take.