Dear Editor,

Does Creditinfo really facilitate access to financing in Guyana? This question has become even more relevant in light of recent discussions regarding the extent of the financial sector’s support to expanding business and personal credit. I am therefore seizing this opportunity to clarify misconceptions and share important information regarding Creditinfo’s experience in Guyana, particularly since some players in critical segments of the population view our operations as ‘complicated’. Established in 2012 and earning the license to operate in 2013, Creditinfo’s mandate in Guyana is facilitated by the Credit Reporting Act of 2010 and the Credit Reporting [Amendment] Act of 2016. Creditinfo provides intelligent information, software and analytic solutions to facilitate access to finance. We also empower companies to mitigate their risk when assessing investments and general financing requests through one or a combination of powerful risk management tools.

Use of the credit reporting mechanism is mandatory for entities aiming to offer credit facilities safely, and securely, and Creditinfo’s mandate requires a reciprocal arrangement with subscribers that include financial institutions, utility and hire purchase companies, trade creditors and other related lending agencies. Prior to the company’s launch, the mechanism for ascertaining creditworthiness of individuals and businesses required an extended, manual process which resulted in approval decisions stretching, on average, over weeks. In contrast, lenders now have the opportunity to provide instant credit decisions based on up-to-date information that is literally at their fingertips. As a result, information providing a full perspective of the financial capacity of the potential borrower, has been particularly beneficial for those data subjects [individuals and businesses] with no borrowing history. With the establishment of the credit bureau, data subjects are now able to have a full credit profile from which they can be objectively assessed for credit. This credit facilitation process is effectively supported by a sufficient database comprising 100% data from all of the main lenders in the financial sector. Creditinfo applies a multifaceted approach to facilitate access to credit for which the key beneficiaries have been individuals, financial institutions and trade creditors, among other institutions. To date, the provision of a full suite of Risk Management Solutions has supported the value of financing decisions in excess of $5.5 Billion. Further, there has been the expansion of the suite of services beyond mere credit reports, to include data analytics solutions in support of total credit risk management activities. The provision of Value-Added Services in the form of Credit Market Overview Reports provide targeted market insights; Portfolio Benchmarking Reports; Advisor Strategy Tools that support credit expansion, limit management and collections; determination of total credit exposure/expected credit losses; Automated Credit Decision Solutions as well as Digital Onboarding are but some of these expanded services currently being offered.

In addition, highlights of and inferences from the Creditinfo Data clearly indicate expanded access to financing. We have seen improved access by individuals via various promotions being offered by lending and hire purchase institutions; by auto dealers for vehicles; for guarantors of university students; and even to facilitate access to credit for medical services. Greater connectivity and engagement with data subjects/consumers utilizing technology – in the form of our online portal – have served to expand the credit bureau’s reach to consumers, and consequently engendered greater awareness of the importance of consumers monitoring their credit profiles. Notwithstanding the pandemic, Creditinfo has seen an approximate increase of 500 percent [500%] in mostly online engagements – safely facilitating queries and increasing credit report requests. Over the past year alone, an average of thirty percent [30%] of all new credit facilities were granted to persons with no previous borrowing history. Interestingly, the bureau hit rate, which represents the likelihood of finding data on individuals in the credit bureau database, has steadily increased at an average rate of 11% since 2016 – which represents a clear opportunity for the utilization of credit bureau data in the credit decision-making process. The current hit rate stands at 80%, indicating the increasing capacity of Creditinfo to assist subscribing lenders with the credit adjudication process, and support the profitable expansion of their credit portfolios.

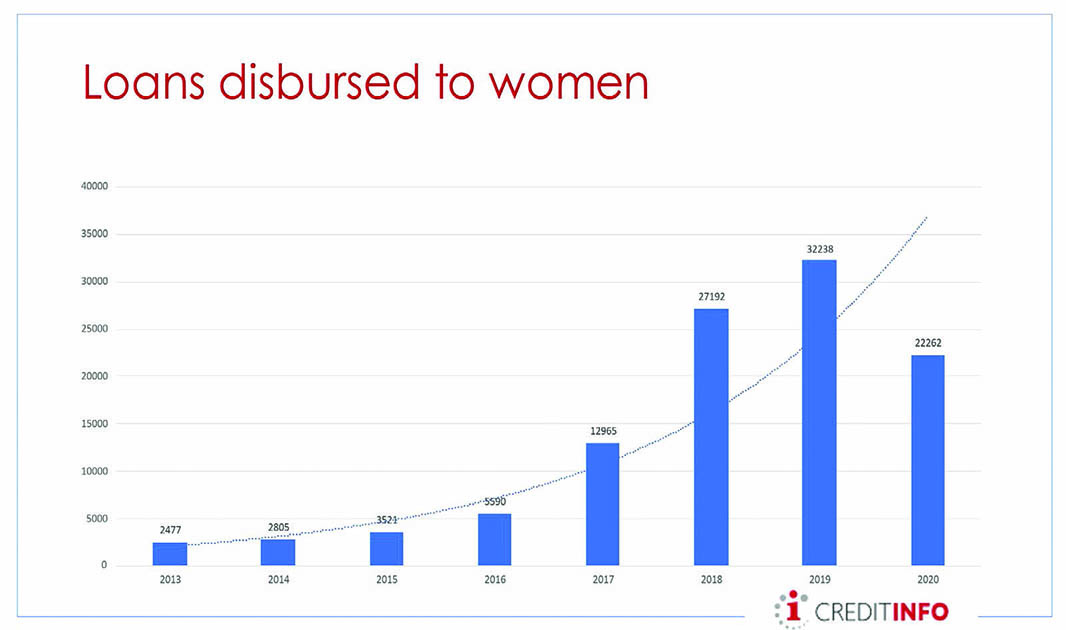

Creditinfo, having received the mandate in 2013 to operate Guyana’s first credit bureau, has benefited from the privileged position of observing first-hand how the credit industry has evolved in Guyana, as well as being able to determine where the gaps and opportunities lie. A declining trend in average delinquency rates and an increasing number of repeat borrowers are but a few of the positive insights that were observed from Creditinfo’s experience in the local market. We have also noted a commendable development, which is the increasing trend of loans being granted to women, as shown in the table below.

More recently, we have seen an upsurge in requests for credit reports by non-subscribing entities within the private sector, indicating a wider recognition of the value of the credit reporting mechanism in supporting business expansion by safely offering credit – primarily for the acquisition of vehicles and other small business loans. As an aside, this Christmas is likely to be a very bright one for quite a number of new, first-time drivers. Creditinfo is heartened by this development and would welcome the formalizing of arrangements with these and other entities in the interest of facilitating greater access to financing.

An even greater opportunity lies in supporting expansion of trade and supply chain credit as companies in the commercial sector take advantage of new and emerging opportunities. The burgeoning oil and gas industry also lends the promise of greater business opportunities; enhanced profits; more job opportunities; higher incomes; economic expansion and, in general, a better life for all. It is argued that the degree to which benefits can be derived depends heavily upon the individual and collective capacity to discern, exploit and take full advantage of the opportunities being presented. Apart from training and skills development, adequate financing is arguably one of the most critical elements of the equation to enable individuals and businesses to effectively achieve and/or benefit from these opportunities. With eight (8) years of experience in the local market, Creditinfo definitely inspires confidence in the lending process, having developed relevant data, market knowledge as well as access to local, regional and global expertise in support of local operations. On the other hand, there continues to be the lament of lack of access to financing, and this therefore begs the question, as to whether there is greater scope for the services of the credit bureau to be more fully and effectively utilized.

With the advent of the digital imperative now being further propelled by the COVID 19 pandemic, there is evidence that enterprising young entrepreneurs are moving towards establishing new peer to peer lending platforms that are likely to disrupt the current lending landscape, while at the same time underscoring the importance of digital connectivity to facilitate the credit adjudication process. As the competitive landscape rapidly changes, the benefits of digitization and digital engagements as well as the use of data and analytics cannot be overemphasized. Consequently, industry experts recommend that traditional lending institutions must embrace what they refer to as a ‘competitive mindset’ in order to ‘future proof’ their companies where new nimble market players are focusing on combining data and digital delivery to meet customer needs. Creditinfo is even now being asked to consider the potential for partnerships in supporting peer to peer lending, fintech operations as well as the new digital lending platforms – as increasing value is being placed on critical due diligence and risk management processes. As the future points to a shift to the adoption of mobile and online technologies, Creditinfo as a digital facilitator, is even more poised to support this move – and enable greater efficiencies in the lending process across the board. From our company’s perspective, where the future is seen as being insights driven, more effective utilization of the full range of credit risk management solutions would facilitate the application of useful information that identifies gaps and opportunities within the credit industry. It would serve as a good catalyst for expanding credit as well as supporting innovative credit solutions, particularly in areas where the demand is greatest.

Sincerely,

Judy Semple-Joseph

Chief Executive Officer

Creditinfo Guyana