Introduction

This was the fifth Budget by the PPP/C Government in this Twelfth Parliament. It came against the backdrop of the unjust claim by Venezuela to two-thirds of Guyana, a threat to the country’s very existence. Internationally, 2023 was described by the London Guardian as the year in which the world reached a critical milestone with the peak of global carbon emissions from energy use. The Guardian quoted the International Energy Agency as raising hopes of an end to the fossil fuel era, when it predicted for the first time that the consumption of oil, gas and coal would peak before 2030, and begin to fall as climate policies took effect.

Following two positive developments in the Philippines and Brazil in 2022 when Trumpian type leaders – Duterte and Bolsonaro respectivelya – 2023 was not a particularly good year for peace and democracy. Russia continued its invasion of Ukraine while Israel, better known as the product of the Holocaust, itself engaged in a brutal and genocidal war to erase Hamas from the Gaza Strip. Coups had also returned to the African continent, in which at least seven countries had governments which came to power because of coups in the past three years. The age of the strongman politician appears to have returned across continents, with two of the largest countries by population led by strongmen.

Perhaps for the first time in its post-independence history, Guyana itself appears to have shed its non-aligned stance, welcoming a British military vessel and a former US Army General within days of each other. But thanks to Maduro and his wild threat, again for the first time, a PPP/C Government has embraced and celebrated the Guyana Defence Force.

The Budget Speech commenced at 2:50 PM and ended at 8:15 PM. It was a combative presentation by a visibly emotional Minister. Uncharacteristically, he allowed himself to be baited into anger by members of the Opposition, doing nothing to enhance his reputation as an outstanding speaker. The thrust of his out-of-the Speech remarks was to mistake elections for democracy. But even on that score, a one seat majority can hardly justify the winner-take-all style embraced and practised by this Government at almost every opportunity.

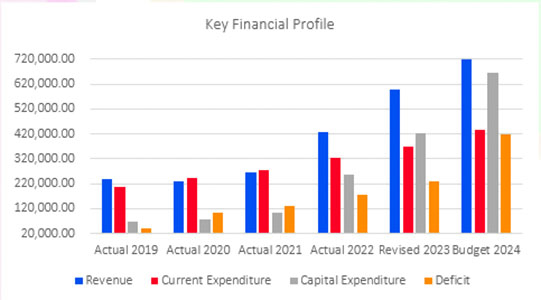

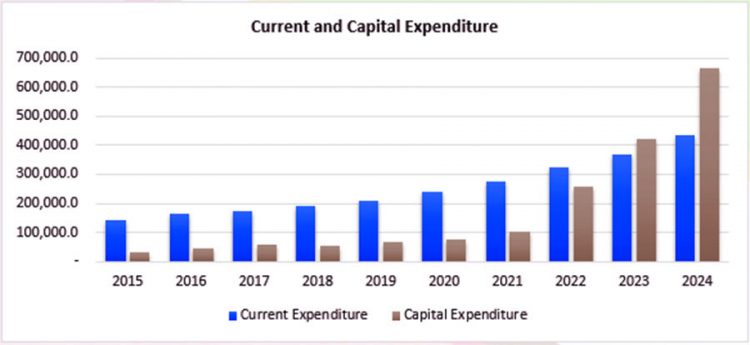

In our view, the Graph below tells the story of the current and recent Budgets. It shows four financial variables for the six years commencing in 2019 – the pre-oil year. The variables are Current Revenue, Current Expenditure, Capital Expenditure and finally, the Deficit for the year. That deficit is financed by internal/and or external loans, while surpluses could be used to pay back loans or to augment the Consolidated Fund. We consider 2019 is a useful benchmark year, being the year prior to the current government took office.

Let us look at the changes over the first and last year. Revenue has increased from $ 240,585.30 million to $717,810.60 million, by almost 200%; current expenditure has increased from $207,683.10 million to $ 434,809.90 or 109%; Capital Expenditure has increased from $66,262.40 million to $ 666,175.40 million, or 905%; and the Deficit has increased from $ 40,028 million to 420,649.7 million, or 951%. What does this mean?

Chart showing Key Financial Profile

Source: National Estimates of the Public Sector Appendix A (G$ Millions)

The Government is clearly on a spending extravaganza, building without thinking, executing without planning and acting without analysis. That is scary. Only a couple of months ago, one of the MFI partners had cause to caution us about absorptive capacity. The media is full of reports of complaints by ministers of work not being done on time or being done very shoddily – a serious capacity and efficiency matter. If only 10% of this Budget is consumed in inefficiencies, that would be more than one hundred billion dollars.

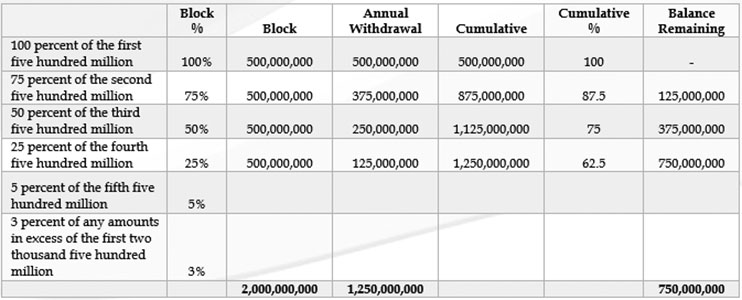

This spending spree can very well put to jeopardy the Natural Resource Fund which is weighted in favour of current spending over savings. For example, the first 500 million is available for spending via the Consolidated Fund while US$1.250 Bn. of the first US$2 Bn. or 62.5% As a sign that the Government considers this too conservative, the Minister has notified the House that he is coming back very soon to change the NRF Act to allow for more money to be spent out of the Fund.

The most striking element of this chart is that capital expenditure can soon exceed total Government revenue – an unbelievable proposition. Roads, bridges and buildings now seem more than people. What did Sir Jock Campbell say about this model? That people are more important than ships, shops and sugar estates.

It seems that it only takes an idea from one or two men to become a priority expenditure worthy of a supplementary appropriation. Words like “urgent, unavoidable and unforeseen” provided in the country’s financial management laws to define expenditure from the Contingencies Fund have lost their meaning while the term “national development priorities” used in the Natural Resource Fund Act will be interpreted very liberally and subjectively. In both cases, at the cost of accountability and good governance.

The 11 January editorial in the Stabroek News pointed to the almost mindless construction of certain hospitals across the country, in some cases in areas where new hospitals have recently been built. The plan for high span bridge across the Berbice River is another case. The problem is that the Government has no planning capability and does not seem to want one. If it did, it would not need to return to the National Assembly for supplementary funds on multiple occasions each year.

As day follows night, we can be sure that the Government will be returning to the National Assembly on more than one occasion this year for supplementary provision. After all, the Budget makes no allowance for the Vice President’s pet project Amaila Falls or Bishop Edghill’s dream office complex to house 6,000 government employees.

Debt Ceiling

As a sign of things to come, the Minister has already announced that he will be coming back to the National Assembly to raise the debt ceiling – for the third time in less than three years. Here is how the PPP/C has dealt with the debt ceiling.

Source: Taken from Order No. 2 and 3 of 2021 and Order No. 48 and 49 of 2023. (GY$ Billion)

Highlights

In this section, we set out, without analysis or comments, the key takeaways from the Minister’s review of the economy in 2023 and the policies, targets and projections for 2024.

2023 Performance

▪ Overall Growth in Real GDP of 33% compared with an initial target

of 25.1%.

The non-oil economy is estimated to have grown by 11.7%,

compared with a projection of 7.9%.

▪ Inflation of 2% compared with an initial target of 3.8%.

▪ The Central Bank rate of the Guyana Dollar to the US Dollar

at December 31,

2023 was $208.5, the same as at December 31, 2022.

▪ Current revenue of $597.9 billion, an increase of $168.4 billion, or

39.2% for the year.

▪ Non-interest Current expenditure of $369.9 billion and interest

expenditure of $11.7 billion. These represent an increase of $43.9

billion, or 13.4% and – $11.7 billion. or 33.6% compared with

Budget for the year.

▪ Capital expenditure of $421.8 billion compared with budget of $

$387.8 billion.

▪ Overall fiscal deficit of $227.4 billion compared with a projected

deficit for the year of $193.4 billion and an actual deficit of $177.6

billion in 2022.

▪ Merchandise exports of US$13.2 billion and Merchandise imports of

US$6.6 billion.

▪ Surplus on current account of US$1,980.9 million, compared to a

revised surplus of US$ 3,507.0 million.

▪ A deficit of US$2,027.6 million in the capital account compared to

a deficit of US$3,357 million.

▪ Overall balance of US$34.2 million, compared with projected NFA

of US$150 million. Financed by Bank of Guyana Net Foreign Assets.

Size of the Budget: $1,146 Tn, 46.6% increase

Targets

▪ Real GDP is expected to grow by 34.3%, with the non-oil economy

projected to grow by 11.9%.

▪ Inflation is projected at 2.5%.

▪ Current revenue of $717.8 billion, an increase of 20%.

Current expenditure of $434.8 billion, and interest of $19.7 billion,

representing increases of 17.5 % and 68% respectively.

▪ Capital expenditure of $666.1 billion, an increase of $244.3 billion

or 58.1%

▪ Overall fiscal deficit of $420.6 billion, an increase of 84.9%.

▪ Balance of Payment is expected to register a surplus of US$ 120

million,compared with a deficit of US$34.2 million in 2023.

▪ Merchandise exports of US$18,703.9 million, an increase of US$5726.1 million or 69.38 % over revised 2023 while imports are expected to decline by $1,163 Mn. or 17.5%.

▪ Net Services are projected at a negative US$6,453.4 Mn., compared with US$5,602.3 Mn. or US$851.1 Mn, or 15.2%

Ram & McRae’s Comments

► Crude Oil exports are projected at U$16,821.5 Mn while imports of Fuel and Lubricants are projected at US$1,357.3 – a difference of US$15,464.2 Mn. In fact, Crude Oil exports account for some 89.9% of Merchandise Exports.

► Guyana is well and truly an oil country and needs to manage its economy on the certainty that petroleum is an exhaustible product whose price on the international market is perennially volatile. Growth projections are a function of the international, unpredictable price of oil, as well as increased production.

► A 2.5% rate of inflation has surprised many. As this Focus points out, however, there is a distinction between inflation and the high cost of living. See commentary and analysis. In which the empirical evidence suggests that there is both inflation and high cost of living.

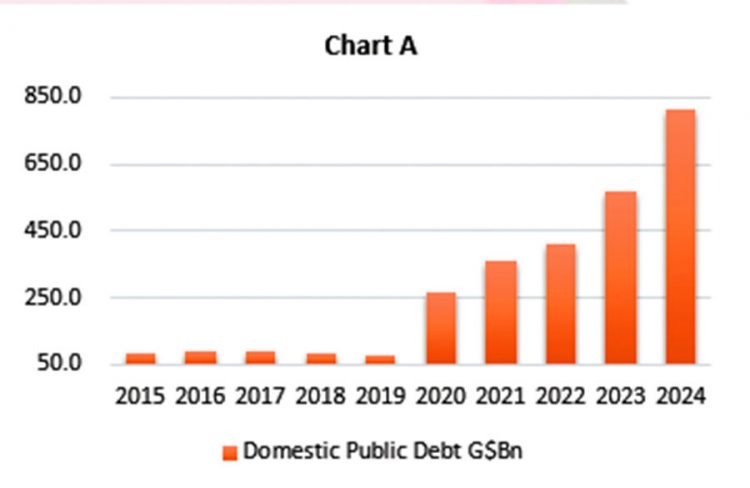

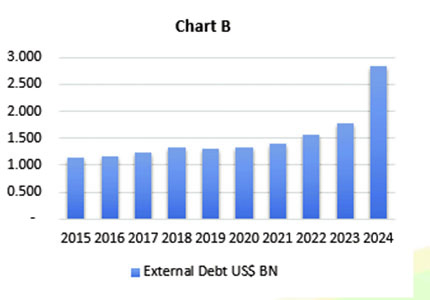

Public Debts

Public debts comprise both domestic debts and external debts, being debts contracted with persons, including governments and companies, not resident in Guyana.

The chart below shows that over the period 2010 – 2024, the stock of public debt stated in USD grew by 5.5% from foreign creditors.

Source: Appendix to Budget Speech 2024 (Appendix VI)

Ram & McRae Comments:

► The debt profile of Guyana is fast changing. The Charts show a stable debt exposure under the APNU+AFC Coalition from 2015 – 2020 during which time the law setting a ceiling on borrowings was not amended once. The current Administration has already increased the ceiling twice since coming to power. The Minister has promised a further increase in 2024.

► This Speech made references to that sustainability but makes no allowance that things can and will go wrong, or in the case of oil prices, go south. The Table above shows that since the end of 2020, domestic debt has increased by 42% and external debts by 60%. In other words, instead of reducing borrowings out of oil inflows, the PPP/C is increasing borrowings.

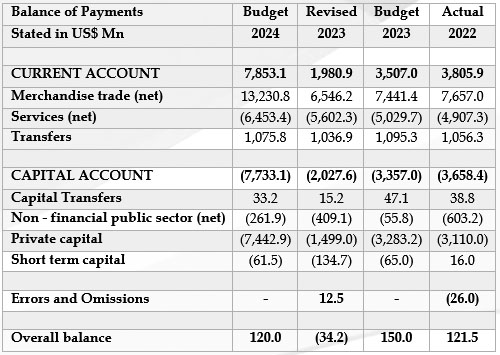

Balance of payments

The Balance of Payments represents the trading account which Guyana has with the rest of the world. It is an economic statement somewhat comparable with the accounting financial statements, except that there are no opening balances. An analysis involves the identification of the changes from the projections and inquiries into those changes. It is comprised of the Current Account, the Capital Account, Errors and Omissions and an Overall balance. See Appendix K to the Volume 1 of the Estimates. Countries would usually aim to have an Overall Surplus which can then translate into increased foreign assets.

Explanations offered by the Minister are in respect of changes over 2022.

Budget 2023 had actually projected a surplus on the current account of US$3,507.0 Mn while the estimated actual surplus was some US$1,980.9 million., a shortfall of US$1,526.1 Mn. Total export earnings grew by 16.9 percent to an estimated US$13, 182.3 million, reflecting higher earnings from both the oil and non-oil sectors. In the oil sector, export earnings grew by 18 percent to US$11,631.5 million, with an estimated 40.2 percent increase in export volume. Meanwhile, earnings from non-oil exports amounted to an estimated US$1,550.7 million, offsetting the lower earnings received from the gold and bauxite sectors.

Imports increased by 83.1% to US$6,636 million in 2023, made up substantially of capital goods (USS$2,472.9 million) and consumption goods expanded by an estimated US$181.9 million with increases across all sub-categories.

The deficit on the capital account declined by an estimated US$1,630.9 million to US$2,027.6 million.

Table showing Balance of Payments

Source: Estimates of the Public Sector (Vol. 1 Appendix K)

The presentation of Balance of Payments based purely on economic theory, shows the urgency with which the Statistical Bureau needs to redefine national economic statistics. The existing arrangement distorts and misleads rather than inform.

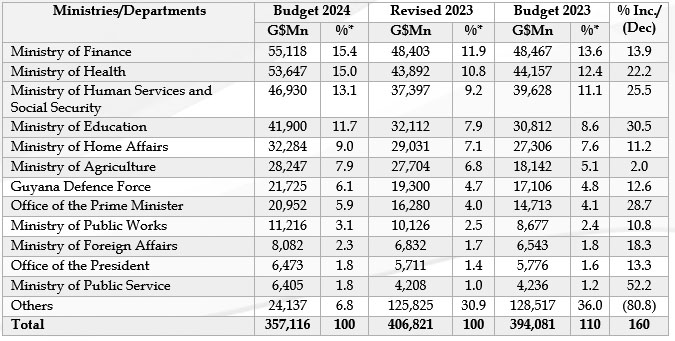

Who Gets What in 2024?

Analysis of expenditure

Source: Tables 6 &7 & Appendix A of National Estimates

Introduction

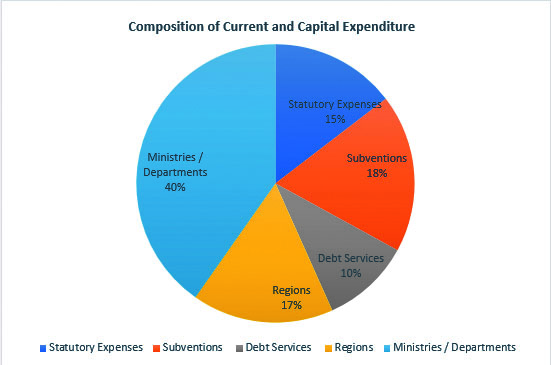

The priorities adopted by the Government as set out in Part 5 Targets for 2024 in the Budget Speech find their place in the Estimates of Revenue and Expenditure. This was discussed in Government of Guyana Financial Plan 2024 of this publication. In this segment of Focus, we summarise and analyse the spending choices by the Cabinet, set out in the Estimates and which are subject to a debate and approval in the National Assembly. As the pie chart above shows, spending is done by Budget Agencies including Ministries and Departments, Constitutional Bodies, Regions and via subventions and subsidies made through various Ministries. Certain spending is automatic and does not require parliamentary approval: as the Constitution states, these are direct charges although in many cases, the actual amount is often a matter of some negotiation.

We identify and discuss the Current and Capital Expenditure of the top five Budget agencies.

Graph showing Current and Capital Expenditure

Source: Appendix A of National Estimates (G$ Millions)

Source: Budget Estimates, Volume 1, Table 6.

Ministry of Finance

The two Programmes under the Ministry of Finance are Policy and Administration and Public Financial Management Polices and Services, budgeted to spend $39,724 million and $8.349 million respectively. The two largest items of expenditure of Policy and Administration are Other Employment Costs and Subsidies and Contributions to Local Organisations.

Ministry of Health

The Ministry of Health has eight programmes for which expenditure of $53,647 million is allocated. The single largest Programme is Regional and Clinical Services expected to spend $28,571 million. The two largest items of expenditure are wages and salaries of $8,680 million and subsidies and contributions to local organisations amounting to $16,234 million, principally to the Georgetown Public Hospital Corporation.

Ministry of Human Services and Social Security

This Ministry has three Programmes and is budgeted to spend $46,930 million. Of the three Programmes, Programme Social Services is allocated $45,464 million while Old Age Pensions and Social Assistance make up the single largest item of expenditure, amounting to $43,142 million or 92% of the amount allocated.

Ministry of Education

The allocation for the Ministry of Education is $41,900 million, divided across six programmes including one each for Nursery, Primary, Secondary and Post-secondary education. The three largest programmes are as follows:

Primary: $14,471 million.

Secondary: $11,180 million.

Post-secondary/Tertiary education: $6,141 million.

Ministry of Home Affairs

The Ministry of Home Affairs has six Programmes, budgeted to cost $32,273 million. Of this sum, the Guyana Police Force is allocated $23,696 million or 73% of the total of which wages and salaries account 46%.

Ram & McRae’s Comments

▪ In 2023, the Government sought from the National Assembly on three occasions for a total of $118,231 Mn, for additional funds for capital and current expenditure. This represented 16% of the Appropriation for the year. In 2022, there were also three supplementary appropriations for a total of $95,952 million or 19.1% of the amount in the Appropriation Act

The top five allocations from the Capital Budget are discussed below.

Ministry of Public Works

The Public Works is allocated $224.9 billion for expenditure. Please refer to Policies and Targets for some of the major projects proposed for the year. The amounts allocated for the major projects are:

▪ Rehabilitation of Public and Main Access: $29.8 billion

▪ Miscellaneous Roads/Drainage: $70 billion

▪ New Demerara River Crossing: $19.7 billion

▪ East Bank – East Coast Demerara Road Linkage: 15.5 billion

▪ Infrastructural Development: $12.9 billion

Ministry of Housing and Water

The Ministry of Housing and Water is allocated a total of $97,092 million. The major projects and allocations are as follows:

▪ Provision for highways, building and infrastructure works: $69.3 billion.

▪ Provision for coastal water supply systems and payment of retention: $14 billion

▪ Provision for infrastructure development works and housing units: $6 billion

Office of the Prime Minister

The Office of the Prime Minister is allocated a sum of $90.2 billion. The major projects and allocations are as follows:

▪ Gas to Power Project: $80 billion

▪ National Data Management Authority: $4.4 billion

Ministry of Health

The Ministry of Health is allocated $56.5 billion. The major projects and allocation are as follows:

▪ Health Sector Improvement Programme: $33.5 billion

▪ Modernisation of Primary Health Care System: $1.5 billion

▪ Ministry of Health-Buildings: $15.6 billion

Ministry of Local Government and Development

The Ministry of Local Government and Development is budgeted to receive $20.7 billion. The major projects and allocations are as follows:

▪ Provision for community enhancement and infrastructure projects and programmes: $13.4 billion

▪ Provision for community driven entrepreneurial inventions $5 billion

▪ Provision for Capital subventions for municipalities and neighborhood democratic councils: $1 billion

▪ Provision for solid waste management interventions: $1.2 billion

Ram & McRae’s Comments:

▪ One of the defining features of the 2024 Budget is the shift from current expenditure to capital expenditure. Even by the Government’s own admission, it does not have the capacity, nor apparently do the contractors to whom large contracts are awarded.

▪ The allocation to Agriculture may be premised on inadequate information. However, that Minister sees his Ministry as synonymous with Region 3, a PPP/C base.

▪ The Budget is merely a cheque to spend – there will be projects undertaken for which no moneys are allocated in the Budget, and vice versa.

▪ The single largest budget allocation is $80 billion dollars under the Office of the Prime Minister. The source of that funding is uncertain, one of the concerns of that project.

▪ Increasingly, the Ministry of Housing is being assigned responsibility for infrastructural works. It is unclearwhether there is adequate coordination between it and the Ministry of Public Works.

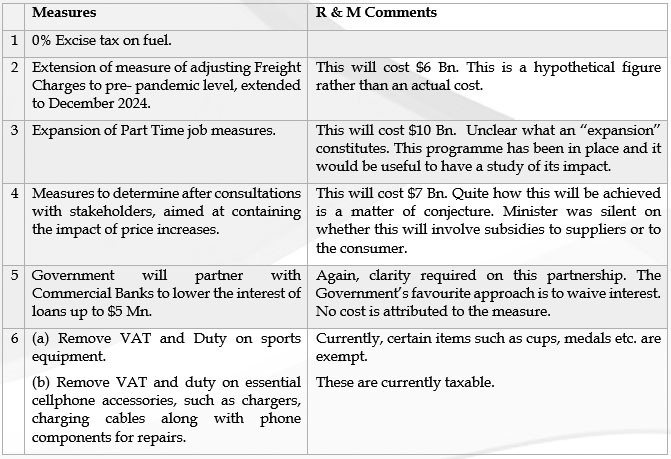

2024 Budget Measures

In this section we address the measures announced by the Minister, analyse them, evaluate their impact and discuss the extent to which they provide useful economic benefits to stakeholders. These are set out in Budget Measures of the Speech. Amendments are necessary to give effect to the respective tax measures and to set the date on which the respective legislation are to take effect.

We now look at these measures and offer our comments.

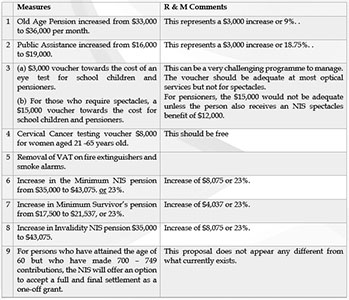

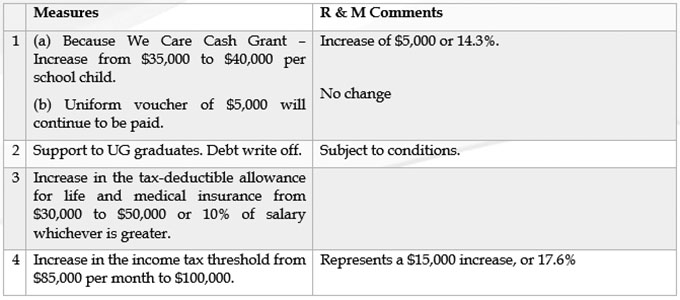

Measures to ease the Cost of Living

Measures in Supporting the Vulnerable

Measures in Increasing Disposable Income

Ram & McRae’s Comments:

▪ Ram & McRae welcomes a number of these measures. The use of

vouchers should help to reduce improprieties, but the measures

will require considerable administration and personnel.

▪ More targeted benefits might have a greater impact.

▪ Some of the measures identified as easing the cost of living

are in fact significantly in favor of businesses.

▪ The Minister is putting a value on an ongoing exemption.

▪ His number of persons over 60 is significantly inflated.

Commentary and Analysis

The purpose of this section is to draw to the attention of policy makers the issues of interest faced by the country, whether arising out of the Budget presentation or otherwise. Where we consider certain matters of special importance, we may even repeat them, as we have done in the past with Corruption, the National Insurance Scheme and the state of our democracy.

Last year we looked at Double Taxation, Freedom of Information, Gaming Policy and A Short Note on Prescriptive Title.

In this year’s Section we address the following:

1. National Insurance Scheme – Taking the Bull by the Horn

2. The Natural Resource Fund

3. Cost of Living

4. Taxation Evasion Gone Wild – Time for Reform

National Insurance Scheme – Taking the

Bull by the Horn

Among the measures announced in the Budget Speech was an increase in the minimum pension payable by the NIS from $35,000 per month to $43,075, or 23.1%. That increase is higher than the inflation rate since the last increase, so there is real value in this increase. He also announced similar increases for survivors’ and invalidity pension which are less costly to the Scheme. As a measure to support the vulnerable, the Old Age Pension was increased by $3,000 to $33,000 per month. This is not an NIS issue but relevant in the overall pension benefits of the elderly.

These benefits are welcome even though they deserve some comment.

1. The minimum pension is usually linked to the national minimum wage which stands at $60,147 per month. It seems therefore that the increase in the minimum pension without an increase in the minimum wage provides for the non-worker over the worker.

2. Surprisingly, the Minister appears to have been badly advised in relation to the number of persons entitled to the Old Age Pension which he gave as 76,000 persons and costing $2.7 Billion. Based on the official census, that number is just around 40,000. One wonders therefore how the difference will be dealt with.

3. The Minister also announced a one-off grant for persons who have not met the minimum requirement of 750 contributions to qualify for an old age pension. Noting that many employers might have gone out of business and the consequent difficulties in ascertaining contributions, he suggested a one0off grant to bring some 3,800 matters to closure at a cost of $550 million.

The Minister did not indicate how his proposed solution differs from what currently exists under the law. Focus believes that there are options. For example, the Scheme has a bank of uncredited contributions which could be utilised to top up persons who have 700 contributions. For persons who have between 600 and 699 contributions, their eligibility for a pension should be prorated based on the minimum pension. This will have some financial implications for the Scheme, but it is unlikely to come anywhere close to the Minister’s estimate.

In any case, there is in progress an actuarial valuation being undertaken by the Scheme’s Actuary. It would be good if various ideas and options are discussed with him with the request that he makes recommendations in accordance with Social Security principles and the policies of this Administration.

In the recent past, there were legitimate fears that the Scheme was about to go broke. Oil has changed all of that. There is a large body of expatriate employees in the oil sector paying contributions at the ceiling level but who are here for such short periods that they will never qualify for long term benefits, nor will they claim short term benefits. We understand that the Scheme is now in a surplus position, and that this will continue for the foreseeable future.

No doubt the Actuary will also be revisiting some of his earlier projections and recommendations on which successive administrations have sat without making decisions. It is time that major decisions be made, including increasing the minimum pension age. Across the world, changing demographics have necessitated such changes and Guyana should use these good times of the oil bonanza to place the Scheme on a safe and secure future.

As part of that reform, the governing legislation for the enforcement of the law against delinquent employers must be addressed. Focus regrets and laments the decision by the government to appeal what was considered one of the more enlightened and pro-worker decisions in the history of this Scheme. This could hardly be what President Ali meant when he boldly announced the Government’s intention to resolve all backlog matters before the end of 2023.

The poor 74-year-old Mr. Sheriff Zainul and others like him will languish because of the fear of “opening the floodgates”. It is nothing more than a legal artifice to deprive them of their benefits and consign them to a state of poverty in their remaining years. And when they die, their claim will not be pursued. That may indeed be the subliminal wish of the NIS.

The Natural Resource Fund

In December, writing in his oil and gas column in the Stabroek News, civil society activist Christopher Ram disclosed that the Natural Resource Fund is overstated by $274,765 Mn. He explained that this arose out of a failure by the Natural Resources Ministry to account for the taxes paid to the Guyana Revenue Authority in accordance with the 2016 Petroleum Agreement. Ram called for this to be addressed as a matter of urgency.

The Vice President described Ram’s disclosure as a storm in a teacup, while the Attorney General

in his Facebook page suggested that the NRF Act superseded the Agreement. Neither of them has addressed the issue of where the money has come from to pay the taxes of the oil companies to enable the GRA to issue to the oil companies a certificate of taxes paid. The Minister joined in that silence.

Meanwhile, the Minister announced that the Government intends a revision to the NRF withdrawal rule involving two conflicting effects: an increase in withdrawals while increasing the share of the inflows into the NRF! After touting the superiority of its version of the Natural Resource Fund Act (NRF) in 2021, the Government is now proposing to overhaul its own Act far as withdrawals are concerned.

This dangerous proposition is all part of the spending extravaganza and more directly, the possibility that the expected loan to support the gas-to-shore project may not materialise. Focus shares the view of both the IMF and the Inter-American Development Bank concerning the structure and operations of the NRF. The Fund is already structured to allow substantial sums to be withdrawn before sums are retained as intergenerational savings.

Calculating the Ceiling on Annual Withdrawals

Source: Compiled by Ram & McRae using the Schedule for the NRF Act. (US$ Millions)

The IMF Report further noted, using the shorthand term fiscal policy, that government tax and spending policies have a direct impact on economic conditions and that in ensuring that Guyana’s oil wealth is managed effectively and equitably, the Government is advised not to ignore long-term fiscal and debt sustainability. That was prescient but instead of heeding the sensible caution, the Government is now proposing the very opposite of what the two MFIs warned about.

It is of course merely a footnote that the Minister and his technical people also avoided addressing the concerns about withdrawals for the payment of taxes raised by Ram. Focus will reserve final judgment until the Minister brings the proposed amendment to the National Assembly and the oil companies publish their audited financial statements.

Cost of Living

The Minister announced inflation for the year at 2.5%, following an increase of 7.2% in 2022. The announcement has had mixed or no reaction. As one of the issues identified for attention as an issue of significance, this essay looks at a survey on cost of living begun by the Stabroek News in October 2022. The feature is titled How the Cost of Living is affecting People and has now been covered in fifty-eight articles, arising out of interviews conducted by Stabroek News reporters.

Given the personal nature of the responses, verification was not possible. Focus has access to the monthly purchases by Ram & McRae made from independent sources in Region 4 and the purchase of fruits and vegetables from the markets. Our own experiences reflect those of the respondents to the survey.

Indeed, as the following Table shows:

From these figures not only have prices not fallen from the highs of 2022, but with a few exceptions, they have kept going upward. In other words, the relief measures announced in the Budget have not done much to reduce the high costs from supply chain problems arising during the COVID -19 Pandemic. We note too the difference between cost of living and inflation. Unfortunately, the empirical evidence is that the lower income class are suffering from both these ailments. Back to the Stabroek News series.

The geographical breadth, demographic depth of the coverage and range of products and services were sufficient to make some useful conclusions and recommendations. Guyanese were not only not afraid to speak but were willing to be photographed as well. That probably reflects the severity of their plight.

Respondents shared their personal stories about the difficulties they face on a daily basis, such as being unable to afford basic school supplies for children, challenges in affording nutritious food, and the constant struggle to balance budgets. This concern appears corroborated by a recent joint report by UNICEF, WHO and the World Bank that Guyana ranks among leading Caribbean in various forms of child malnutrition.

Significantly, respondents did not identify any single cause of the increases as predominant, with some attributing the factors as including global events such as the COVID-19 pandemic, shipping costs, wars and climate change. Vendors and business owner respondents, while not accepting any responsibility for price gouging claimed that they themselves face the challenge of in balancing rising costs with maintaining reasonable prices for customers.

The key constant in the series was:

a) Almost all basic goods and supplies have food items keep getting

more expensive.

b) Salaries and incomes are not keeping pace with the rate of inflation.

c) The high cost is having social and economic effect on ordinary people, leading to frustration and anger.

Focus notes with considerable disappointment that the national minimum wage has not changed since 1st of July 2022. An increase in the tax threshold does nothing to someone who is paid 30% less than that threshold. A minimum wage of $60,147 per month is simply unacceptable, insensitive and uncaring.

We need benefits that genuinely target the unemployed and the working poor. This is a task for the social and economic and finance ministries. It should come as no surprise therefore that despite all the talk about diaspora projects and helping the poor, no dent is being made on the net migration rate.

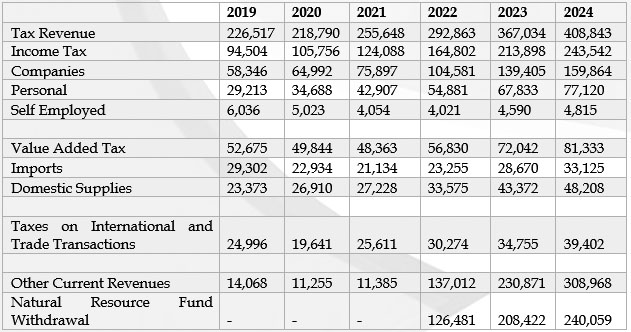

Tax Evasion Gone Wild – Time for Reform

Some thirty years ago, in association with Ernst & Young, Christopher Ram & Co had a one-day seminar on the topic Managing for Economic Recovery. At that seminar, a paper was presented by the local firm on Tax Reform: A vehicle for Economic Recovery. That Paper emphasised the lack of compliance by the self-employed, particularly with reference to the professional class. Nothing it seems has changed over the thirty years.

In Budget 2024, the Minister spent some time discussing “tax administration and reducing tax compliance gaps across all categories of existing and potential taxpayers.” Whether by “gaps” he meant tax evasion is uncertain, but there appears to be a gap as wide as the Demerara River when it comes to some categories. The Estimates show an appropriation for the GRA of $11,732 million, of which $9,232 million is for Current Expenditure and $2,500 million for Capital Expenditure.

On the surface, collections by the GRA appear fair. VAT on Domestic Supplies has increased from $33,575 million to $43,371 million, an increase of 33.6%. Company taxes have increased from $104,560 million in 2022 to $139,404 million on 2023, an increase of 33.2%. These are two different types of taxes administered by different departments. Contrast these with the tax paid by the self-employed rice farmers and millers, accountants, doctors, lawyers, contractors and miners and loggers. In 2020, the tax collected from this category amounted to $5,023.5 million. In 2023 that number had declined to $4,589.9 million.

Professionals may consider themselves a special group and enjoy special licences. But surely, this does not extend to making them immune from prosecution for tax evasion. It just cannot be right that the employed persons must pay their taxes at source while doctors, lawyers and accountants, some of whom hold important positions in our country, have a free ride. As for the contractors, the PPP/C recklessly and without consultation, repealed the APNU+AFC tax measure for a withholding tax on payments greater than $500,000 to contactors.

It should be noted that tax evasion by this category of persons is considered a serious offence under the AML. One can only wonder how contractors, accountants, doctors, and lawyers obtain certificates of tax compliance on a regular basis.

As we did thirty years ago, we must restate the case for tax reform. Unfortunately, this call may go unheeded by the PPP/C whose own conduct and lack of understanding have contributed to the exacerbation of tax evasion. They regarded as a virtue the removal of the 2% withholding tax on contractors who make little contribution to the coffers to the country.

This in no way exonerates the GRA from doing a better job. Regardless of who has friends in the government and in cabinet, they must administer the law fairly and without fear or favour.

Table showing Revenue Breakdown

Conclusion

This Budget makes history, not all for the right reasons. It is the largest Budget ever – by far -much of it in capital works. It is all about spending and borrowing. The Minister has given no explanation for the levels of spending and borrowing. Even if this Government can bring inefficiencies down to 10%, we will have a loss over 100 billion dollars, before any later supplementary provisions.

Because of a change in how the Estimates are constructed, the exact starting balance in the Consolidated Fund is indeterminable. In other words, the Government will be spending from a fund whose balance is unascertained. The Ministries, Departments and Regions have demonstrated no financial capacity or capability to handle the kinds of sums for which the Minister seeks parliamentary approval.

The Capital Budget is now $666.1 billion dollars or US$3.1 billion, without an independent planning authority. Volume 3 of the Estimates identify close to 400 projects many of which bear nebulous names and descriptions. One common factor is that many of them have not been subjected to any serious evaluation. Indeed, many bear the hallmark of slush funds. Here are a few examples.

Regional Economic transformation is allocated $5 billion while Community Infrastructure Improvement Project is allocated $13.4 billion. The Low Carbon Development Programme is allocated $50 billion while the Amerindian Development Fund is allocated $4.6 billion dollars, even though it is highly that such a fund in fact exists. Another $3.3 billion for Industrial Estates and Payment of Retention is allocated under the Ministry of Tourism while under Agriculture there is the Integrated Agriculture Development Programmme for $6.7 billion to cover enterprise and agriculture development initiatives. The list goes on and on.

The Gas to-Shore project is facing an uncertain funding situation, and having so committed itself, the Government may have to rely on the Natural Resource Fund for salvation. Hopefully, this will be mutual support and not anything else.

The legislative performance of this Administration is sorely lacking. There can be no excuse for the fact that most of the Ministers have failed to produce even a single piece of secondary legislation, let alone primary legislation. It is hard to put this down to absorptive capacity. President Ali has to recognise that this reflects on him, and he needs to demand more from his ministers. But he himself needs to lay put his policy agenda in the National Assembly and not have this communicated by some third party on a Thursday.

There is a modest increase in the allocation for State Audit despite its substantially greater responsibilities while the Budget has increased by approximately 46.6%. The country’s accountability framework is not helped by the tardiness of the Public Accounts Committee. The guardrails for transparency and accountability are being systematically dismantled.

As usual, the Budget has received commendation from the Private Sector Commission which could hardly produce a Budget Submission to the Minister. FITUG also praised the Budget but then its own General Secretary sits on the board of directors of the NIS which agreed to take up a legal challenge against a 74-year-old ex-carpenter.

The list of unfinished business is long and getting longer. The Courts are already scheduling court hearings to the second half of 2024. The prisons are overcrowded with persons awaiting their trial.

This Focus includes an essay on the shocking level of collections by the GRA from the army of self-employed persons. The fact that we are forced to raise a matter to which we drew attention thirty years ago causes us deep concern. It is time that the talking ends and for the GRA to act against lawyers, accountants, doctors, contractors and all others who treat the tax system as some voluntary arrangement.

If the exchanges between the Minister of Finance and a few of the Opposition members during the Speech is any indicator, the debate starting next Monday will be bitter and acrimonious. In the final analysis, with the security of its one-seat majority, the Estimates are as good as passed, as usual.

Appendix A

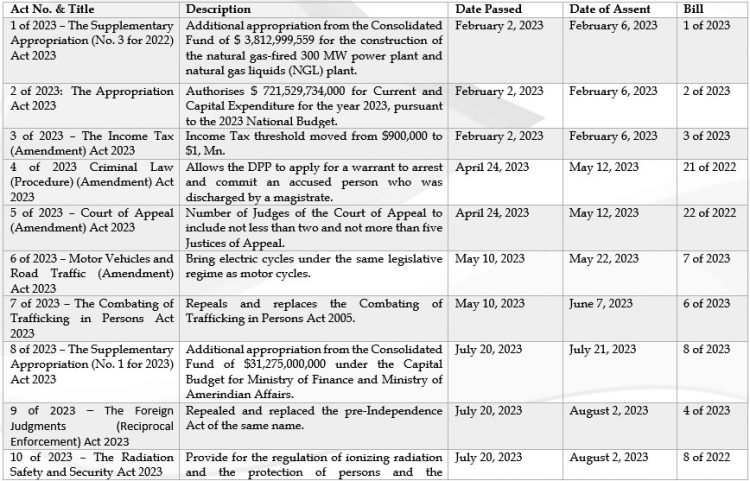

Acts Passed in 2023