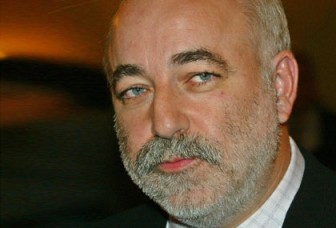

MOSCOW, (Reuters) – Russian billionaire Viktor Vekselberg quit today as chairman of the world’s largest aluminium producer, UC RUSAL, saying the heavily indebted company was in deep crisis after a long battle with rival oligarch Oleg Deripaska.

Vekselberg’s exit widens a rift with controlling shareholder Deripaska, who had sought to build a Russian metals and mining business on a global scale by merging RUSAL with Norilsk Nickel, the world’s top nickel and palladium miner. RUSAL owns the Aroaima, Guyana-based Bauxite Company of Guyana Inc which has had longstanding industrial relations problems with its union. Arbitration was recently ordered by Guyana’s Minister of Labour into a series of matters.

The energy and metals magnate could now mount a legal challenge to Deripaska’s strategy to keep a stake in Norilsk, which, if sold, would almost wipe out the company’s $11 billion debt burden and enable it to look at other merger opportunities.

“I regret to say at this time that Rusal is in a deep crisis, caused by the actions of the management,” said Vekselberg, listed by Forbes magazine as Russia’s eighth-richest man with a fortune of $12.4 billion.

Deripaska shot back, accusing Vekselberg of failing to fulfil his chairman’s role by not attending meetings for a year.

“In this respect, the decision of Mr Vekselberg to resign as chairman of the board preempted the anticipated consideration of this matter by the Board,” a RUSAL statement said.

RUSAL’s shares were suspended after falling 1.3 percent in Hong Kong on Tuesday.

Deripaska, a theoretical physicist who emerged triumphant from Russia’s aluminium wars of the 1990s, bought a one-quarter stake in Norilsk through RUSAL four years ago but the debt-financed deal quickly turned sour when the global crisis hit.

RUSAL was forced into a debt restructuring, killing Deripaska’s dream of a mega-merger. But he has blocked calls by his partners – Vekselberg and billionaire politician Mikhail Prokhorov – to sell the stake back to Norilsk.

DISTANCE

“This escalates the conflict,” said Robert Mantse, metals and mining analyst at Otkritie, a Moscow-based brokerage.

“Although most of the disagreements … are well known, the resignation of Vekselberg shows just how far he and Deripaska now stand apart in the running of the company.”

The shareholder dispute is complicated by the outsized egos of Russia’s resource oligarchs, with the principal players – including Norilsk’s main shareholder Vladimir Potanin – having a long history of often troubled relations.

Russia’s mining sector is highly politicised, and Vekselberg’s resignation follows Prime Minister Vladimir Putin’s victory in a presidential election, in which Prokhorov, running in his first election on a liberal ticket, took third place.

Prokhorov’s investment company, Onexim, declined comment, as did Norilsk Nickel. Vekselberg was not immediately available for further comment.

Deripaska, having failed to secure influence in steering Norilsk, has spurned three offers by Potanin to buy back the stake at a steep premium to its current value.

After paying an estimated $14 billion in cash and stock for the holding in 2008, he turned down a $13 billion buyout offer from Norilsk in December 2010 and rejected two lower offers in March and August of last year.

“If (Deripaska) looked silly for buying it at the top of the market, he could have looked smart now if he’d (sold) Norilsk in the spring of 2011,” said Steven Dashevsky, founder and chief investment officer at Dashevsky & Partners.

“But that required a focus on the value creation of the business,” he said in a recent interview.

DEBT STRUGGLE

RUSAL, which floated in Hong Kong in early 2010, has a market capitalisation of about $12 billion. Its 25 percent stake in Norilsk makes up the bulk of its equity market value, priced at about $9.4 billion.

Analysts and insiders said they see no short-term way out of the deadlock, and that no plans are afoot to sell the stake.

One source close to Vekselberg’s camp said it had “only one way out – to sue Deripaska”.

While Vekselberg’s resignation tightens Deripaska’s grip as CEO of RUSAL, the company faces a struggle to pay off its debt.

Aluminium prices fell sharply last year as China’s economy slowed, although they have recovered this year after global rivals such as Alcoa cut production.

RUSAL’s stock, at HK$6.12, is now 43 percent below its IPO price.

The two have had differing ambitions. Vekselberg is widely viewed as a financial investor who wants quick returns on his investments. Deripaska, on the other hand, has a bullish long-term view on world metals demand and has invested heavily in expanding production at RUSAL.

RUSAL said the board would meet on Friday to appoint an independent director to replace Vekselberg, who had posted his announcement dated March 12 on the website of Renova Group, his investment holding group and a strategic investor in RUSAL.

RUSAL STAKES

The move increases speculation that Vekselberg may sell his 15.8 percent stake in RUSAL, which he owns with partners, although the sources close to his camp said it was out of the question.

Prokhorov has also dismissed suggestions that he will sell his 17 percent stake in RUSAL, which he acquired in a cash-and-stock deal when he sold his one-quarter holding in Norilsk to RUSAL.

He told Reuters in a recent interview that RUSAL and Norilsk should either agree to merge or make a clean break.

“As a former chief executive at Norilsk Nickel, I have a personal opinion that it is better to sit at a table and to make an agreement – who is leaving – or to make a merger of Norilsk Nickel and RUSAL,” Prokhorov said.

Deripaska, through his investment vehicle EN+, owns 47.4 percent of RUSAL but has overall strategic control. According to Forbes magazine’s latest rich list, Deripaska’s wealth nearly halved over the past year to $8.8 billion.