The previous column showed that both the Bank of Guyana and the commercial banks need foreign currency assets. While the central bank’s share of total foreign currency reserves is decreasing as we witness the decline of GuySuCo and other state-owned corporations, the commercial banks are gradually increasing their share. Furthermore, we observed that as the central bank’s share of foreign reserves declines, the Guyana dollar devalues (or depreciates) vis-à-vis the US$. The devaluation has been a gradual instead of the runaway type witnessed from 1988 to 1992. A creeping or gradual devaluation presents businesses the time to adjust their pricing and as a result does not engender the kind of rapid unexpected inflation, although there will be an increase in the cost of living for the vulnerable once prices adjust.

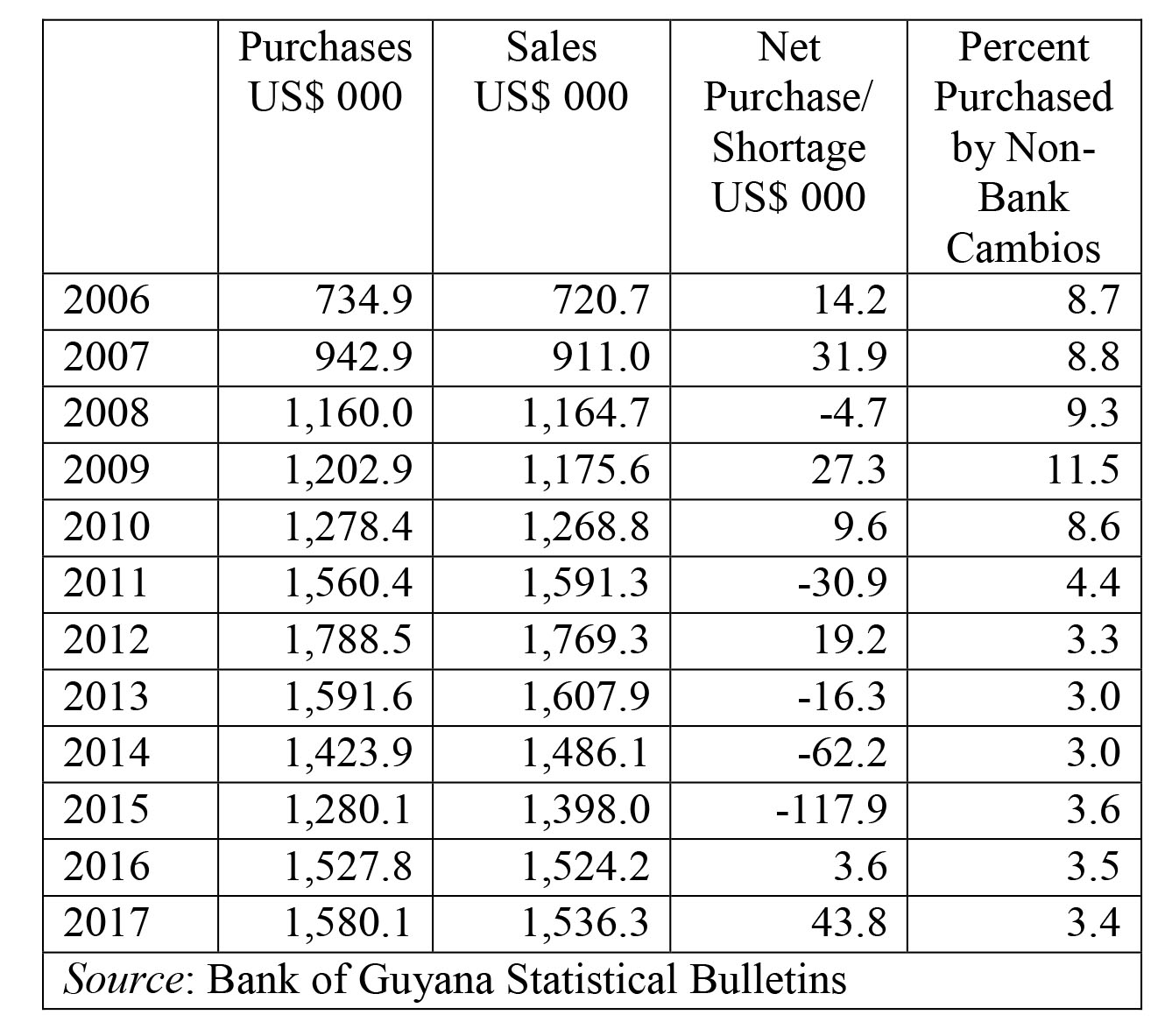

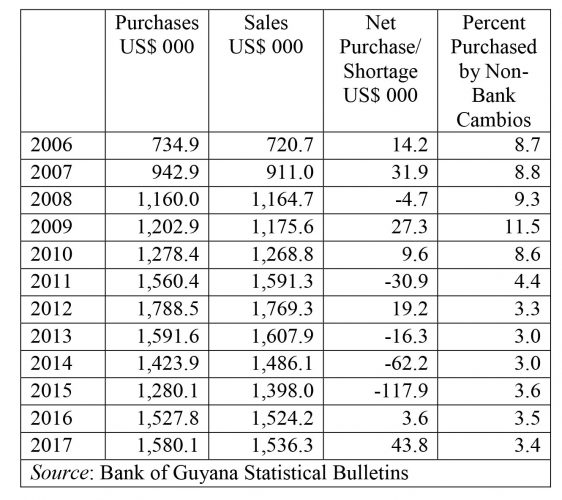

There have been some very interesting trends in the FX market within the past decade. First, there has been a precipitous decline in the share of purchases and sales of foreign currencies by non-bank cambios. For example, in 2009 – the year Roger Khan was jailed – the non-bank cambios accounted for 11.5% and 11.7% of all hard currencies purchased and sold, respectively, in the local market. The percent share has declined significantly since that peak year. As at the end of 2014, the non-bank cambios only accounted for 3% purchases and 3.1% sales of all foreign currencies: American dollars, Euros, Canadian dollars and British pounds. By the end of 2017, the non-bank cambios only accounted for 3.4% purchases and 3.5% of sales of all foreign currencies. The Table below shows the percent of all purchases accounted for by non-bank cambios. The rest is accounted for by the commercial banks since there are only bank and non-bank cambios licensed to trade hard currencies.

Therefore, the commercial banks are increasing their monopolistic hold on the market, a situation that is not necessarily a negative outcome. It means the Bank of Guyana can still maintain some control of the rate by using moral suasion. Moreover, given the vast loan portfolio of the commercial banks in Guyana dollars, it is not in their interest to see a rapid devaluation. This also explains why the central bank might have been successful in targeting the G$3 spread between the buying and selling rates for the US$. Finally, this trend does not support the hyper speculation implying hordes of drug traffickers dominate the economy. It is certainly there, but it appears as though the rumour mill is planted by a few in government and some of its supporters as the excuse for targeting legitimate businesses. More of this in a later column.

Let us observe the above table, which shows the total purchases and sales of banks and non-bank cambios from 2006 to 2017. The net purchases is calculated by subtracting the total sales from the total purchases. A positive value indicates the market is in surplus and a negative shows shortage. The final column shows the percent purchases by non-bank cambios. The stock of foreign currencies available to the market for purchases comes from exporters, tourists, foreign investors, remittances and some underground economy which I continue to argue has been exaggerated as a political bargaining chip. The cambios, on the other hand, sell hard currencies to importers and those sending funds overseas for various reasons, including capital flight.

The second important observation is two of the three largest years of FX market shortage – 2011 and 2015 – were election years. In 2014 the political uncertainly was evident and the market appeared to have anticipated the PPP/C would lose the election (the expectation channel as they say in economics); hence the deficit suggests heightened capital flight. In spite of its gaping sores and warts and deeply flawed leader, the PPP/C has emerged as the pro-business party, its Marxist-Leninist constitution and all. The APNU+AFC, particularly the PNCR and a few WPAites, was seen by the market as anti-business and therefore anxious investors were getting their funds out, as evidenced by the whopping US$117.9 million shortage in 2015. The market was largely correct given the anti-business actions of the Granger administration, SOCU, SARU and the condescending anti-business language of the Minister of Finance. However, the market went back into surplus in 2016 and 2017. This surplus is necessary because it is the only way the commercial banks and Bank of Guyana can replenish their legitimate foreign assets. However, the economic decline is visible to the eyes and the 2.1% GDP growth could have a massaged component.

Third, one of the things we would observe if hordes of drug dealers were into business, the non-bank cambios would be the main source of the shortage. This is the likely case not because these cambios are corrupt, but because the illegals would want to circumvent the commercial banks and their more rigid record keeping. This is not the case, however. In 2011, while the FX market was in an overall deficit of US$30.9 million, the non-bank cambios sold less than they purchased. The non-bank cambios had a surplus of US$343.7 thousand (not million).

In 2015, the non-bank cambios only accounted for US$2 million of the gaping US$117.9 million shortage. In 2014, they accounted for US$2.8 million of the US$62.2 million shortage. Since these cambios are sole proprietorships, unlike the commercial banks, their owners were themselves spooked and as a result might have held on to some hard currencies for their own use. Who can blame them? Markets and businesses also have a liquidity preference in periods of uncertainty. This was one of the fundamental points Keynes made in 1936.

Comments: tkhemraj@ncf.edu