Size and Visibility

Now that the work of the small business financing organizations is captured in a single report of the Bank of Guyana, it is possible to gain a better understanding of the impact of their work on the life of their customers and the contribution they make to the Guyana economy as a whole. While many efforts of funding small business activities exist, it is the work of three organizations that gain much attention. The three entities are the Institute for Private Enterprise Development (IPED), the Small Business Development Trust (SBDT) and the Development Financing Limited South America (DFLSA). These three entities are of varying size and their visibility reflects the substantive efforts that they make at getting money to small entrepreneurs whose aspirations take them into every sector of the Guyana economy. IPED is the oldest and largest of the three small business lending institutions. Without IPED and company, many members of the small business sector would find it difficult to obtain financing for their activities since the administration had no dedicated mechanism for funding small business operations.

Notable Performance

and in almost all the sectors of the economy. Despite the prominence and notable performance of these entities, the business of small business financing remains small business.

Funding Gap

It is hard to tell this by the good work being performed by the micro lending institutions and the many men and women who have been helped by their existence. Yet, the sad reality is the work of the facilities that lend to small business, as real and as useful as it is, manifests the challenges facing small businesses. Their challenge is whom to turn to for help when they need money. Public officials repeatedly report that small businesses account for over half of the investment in Guyana. This means that in 2009, for example, small businesses spent an estimated G$29 billion in the economy.

This level of participation in the national economy ought to show up in the size of the loan operations and level of resources of the small business lending entities. That however is not the case. In 2009, the entities that gave credit exclusively to small businesses issued G$2.2 billion in loans, an amount equivalent to eight percent of the money invested by small businesses all of last year. With a 92 percent funding gap, it is reasonable to conclude that most small business owners look elsewhere for money to fund and operate their businesses.

Marginal Players

Other measures reveal that, while the micro credit institutions might be doing well for themselves, their scale of operation is nowhere near where it should be to have a real impact on the national economy. For example, the outstanding loans and advances in Guyana exceeded G$97 billion in 2009. Small business loans made up less than 3 percent of this number, indicating that micro credit entities are really marginal players in the credit business.

The miniature scale of this lending operation shows up also in the assets that the three companies hold. Total assets of the lending entities amount to G$258 billion of which the micro credit institutions own less than two percent. The capital and reserves of the credit institutions amount to G$32 billion and the small credit institutions hold about 9 percent of those resources. With small business investment playing a large role in the Guyana economy, entities like IPED, SBDT and DFLSA ought to be playing a bigger role in financing those investments.

Praise and Scrutiny

It is difficult to talk about small business financing in Guyana without singling out IPED for praise and scrutiny. IPED is the oldest and most powerful of the micro lending operators. As the face of small business lending in Guyana, IPED accounted for about 82 percent of the activities and jobs generated by small business lending in 2009. It accounts for 71 percent of the capital held by the three lending institutions and over 54 percent of the assets. Despite its size and the volume of its activities, IPED only holds 48 percent of the outstanding loan balances of the small business sector. By any measure, the company has done very well. It has a diversified portfolio of loans. IPED also operates in all the regions of Guyana. By its count, IPED would have created over 141,000 jobs and given out over 73,000 loans. It accomplished this level of success while holding down the size of potential losses.

Celebration

In less than a year, IPED will be celebrating its 25th Anniversary in the micro and small business lending business. That organization would have much to celebrate and be proud of. In particular, IPED could celebrate achieving the status of self reliance.

The management of IPED reported that the organization does not necessarily have to depend on third parties for financial assistance to carry on operations. After 25 years, IPED must wonder why it does not control a larger share of the small business market. According to newspaper reports, Guyana had an estimated 22,000 small businesses in 2008. With 4,972 borrowers in its portfolio, IPED, in effect, controls about 22 percent of the small business market and eight percent of the loan value going to this category of borrowers.

Even with the help of SBDT and DFLSA, the level of loan activity by the small business lenders represents no more than eight percent of private sector credit. These loans represent money to be spent and, at current levels, make up less than one percent of the money circulating in the economy. This provides yet another example of why small business lending could be regarded as small business.

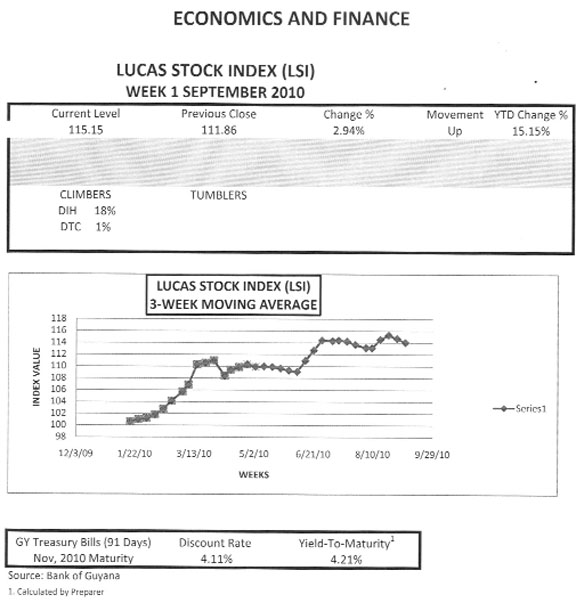

LUCAS STOCK INDEX

In week one of September 2010, the Lucas Stock Index gained 2.94 percent to bring the index to 115.15. The increase in the index resulted from the sharp increase in the price of DIH stocks which rose by 18 percent from its close of the previous week. This increase, along with the 1 percent gain by the stocks of Demerara Tobacco Company (DTC), helped the index to record a gain for the week. The positive movement in the index helped to push yield above three times that of the risk-free Treasuries with maturity in November 2010.