Beginning with this issue the Stabroek Business will be publishing a Caribbean Stock Report which is being made available to the newspaper by the Department of Management Studies of UWI’s Cave Hill Campus.

For the week ended April 15 2011, 24,095,861 shares, valued at $3, 862,747, crossed the floors of the six stock exchanges across Caricom, with 29 stocks advancing, 14 declining and 78 remaining unchanged. Jamaica Broilers was the volume leader with 5,723,230 shares being traded, Angostura Holdings posted the largest gain of 29.7% for the week, while on the losing end, Montego Freeport fell 26.3%. For the week, thirteen of the CSX 30 stocks advanced, six declined and eleven were unchanged. The CSX 30 gained another 12.60 points to close the week at 1,176.7, up 4.02% year to date. On the junior market, four stocks advanced, one declined and five were unchanged. The CJSX advanced 17.52 points to close the week at 1,094.9, down 4.13% for the year. The CJSX was led by Dolphin Cove and Lasco Manufacturing which posted gains of 4.37% and 3.66% respectively. Table 1 provides a summary of the broad market indices for the week as well as some international reference points.

Table 1: Broad Market Indices April 11 to April 15, 2011

Sector Analysis

Table 2 provides a summary of the sector indices, followed by details on the performance of the stocks in each sector.

Table 2: Sector Indices April 11 to April 15, 2011

In the banking group seven stocks advanced, two declined and thirteen were unchanged. Capital and Credit Financial Group, Bank of Bahamas, National Commercial Bank Jamaica and Scotia Group Jamaica all posted strong gains of 27.18%, 9.89%, 8.89% and 3.39% respectively. While Bank of Nevis posted an 8.33% decline. The nett effect was that the CBSX advanced 10.26 points.

In the Communications and Utilities sector, three stocks advanced, two declined and nine were unchanged. While Radio Jamaica posted a 2.18% gain, Dominica Electricity Services and Cable and Wireless Jamaica posted losses of 25% and 8.30% respectively to pull the CCUX down by 5.58 points.

In the Insurance and Investments sector, seven stocks advanced, three declined and seven were unchanged. Pulse Investments, Pan Caribbean Financial Services, Jamaica Money Market Brokers, Mayberry Investments and Scotia Investments all posted solid gains of 15.45%, 8.08%, 3.35%, 3.08% and 2.65% respectively. However, losses of 9.00% by Famguard and 3.33% by Guardian Holdings pushed the CIIX down by 3,89 points. The Tourism and Real Estate and Retail and

Distribution groups group were essentially flat for the week.

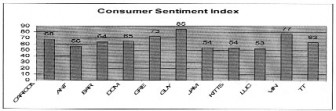

Investing School ( Market Movers “Consumer Sentiment Index” )

At the end of the first quarter of 2011, the Caricom Consumer Sentiment Index stood at 68. The fact that the index value is less than 100 suggests that a majority of consumers are generally pessimistic about their personal financial situation and general business and economic conditions. The pessimism in Caricom is shared by our major trading partners, in that at the end of March 2011 the index stood at 87.3 in Canada, 67.5 in the USA and 38 in the UK.

We attribute these findings to the fact that Guyana and St. Vincent & The Grenadines are among the least tourism and international financial services dependent economies in Caricom. Hence, consumers in those countries may have suffered less from the impacts of the global economic recession and the slow recovery. Consumers in Antigua & Barbuda, St. Kitts & Nevis, St. Lucia and Jamaica are the most pessimistic. In addition to the dependence on tourism and international financial services, Antigua and Barbuda and St. Kitts & Nevis may have been disproportionately impacted by the Stanford debacle, while St. Lucia has had the additional impact of Hurricane Tomas. .

Stocks On The Move

Tables three and four provide some widely used financial metrics on the biggest movers for the week. The five biggest gainers and losers for the week are highlighted. Readers should note that prices are in US dollars.

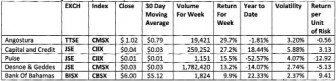

Table 3: Advancing Stocks: April 11 to April 15 2011.

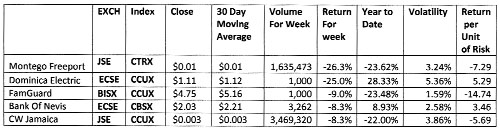

Table 4: Declining Stocks: April 11 to April 15 2011.

Department of Management Studies, UWI Cave Hill.