Historic development

The global financial crisis which hit the world four years ago continues to produce aftershocks which are altering the global economic and financial formations. One such post-crisis event, which has been building for some time now, is the slow but steady acceptance of the renminbi, China’s currency, as a unit of account or reference currency in international trade. In what appears as a methodical step-by-step approach to making its currency an international one, China successfully has elevated the status of its currency above that of the US dollar and the Euro in East Asia and even in other parts of the world as one that provides exchange-rate stability. In a recently released paper entitled “The Renminbi Bloc is Here: Asia Down, Rest of the World to Go?”, the authors, Arvind Subramanian and Martin Kessler of the Peterson Institute for International Economics, disclosed that the renminbi was now the dominant currency in East Asia.

Described as a “historic development” in the paper, the authors further point out that far more countries, 34 as against 14 for the dollar and 19 for the Euro, have aligned their currencies with the renminbi within the last four years. It leaves one to wonder where next the China effect will appear. This article does not seek to answer that question. Instead, it merely examines the trend in China’s restructuring of global economic formations that were built up under the Bretton-Woods System, the system of conditional multilateral development aid and balance-of-payments support delivered primarily through the World Bank and the International Monetary Fund (IMF) respectively.

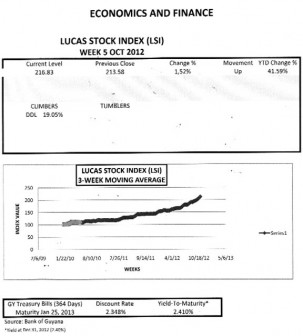

The Lucas Stock Index (LSI) recorded a gain of 1.52 per cent in the final trading period for the month of October 2012. The stocks of Banks DIH (DIH) and Demerara Distillers Limited (DDL) were involved in the trades for the week. DIH recorded no gain while DDL increased its value by 19.05 per cent. The positive movement of the stocks of DDL helped to push the LSI close to 40 percentage points above the yield of the 364-day Treasury Bills.

Greater heights

This development is the latest in a series of moves made by China to solidify its position as the second largest economy in the world and to leverage its trading strength to ascend eventually to greater heights. Guyanese are familiar with the impact of China’s growing economic influence in the country through the participation of its companies and investors in high-profile infrastructure works, asset acquisitions and their quiet dominance of the distributive trade. While the value of these domestic relations are still under assessment, the significance of the investments of China in Guyana pales in comparison to the strategic moves made with other partners in the rest of the world.

Circle of influential friends

Most notable among the other initiatives taken by China with far-reaching consequences for international relations is the decision in 2010 to eschew the use of the US dollar in its bilateral trade with Russia. Shortly after, in April 2011, China, along with Russia, joined with Brazil, India and South Africa, (jointly called the BRICS), in an accord to conduct trade with each other in their own currencies. Each of these countries is a dominant actor in its region. These carefully calibrated moves by China reminds one of a game of chess in which key pieces, each capable of destructive moves, were being positioned to setup the eventual checkmate of the opposing king. Earlier in 2009, China had taken its economic assertiveness to the G-8, the influential countries of the world, which rapidly expanded to the G-20 upon accepting the important role of China in bringing stability and growth to a desperate and troubled international financial and economic system. That assertiveness played out in the IMF which, in 2010, agreed to overhaul its voting and management structures to accommodate China and its circle of influential friends known as the BRICS. Only South Africa of the group is yet to make it to the upper echelons of the IMF’s management structure.

Remarkable feat

It is a remarkable feat for a country that balances the visible hand of central planning with the invisible hand of the market to command global attention, and move support and even sympathies in its direction. Command economies, long disdained by many Asian countries, were not supposed to have the kind of influence that China enjoys in the region. Taiwan, a territory at odds with mainland China, is a major economic participant in the Chinese economy and is among those countries that now peg their currencies to the renminbi. The six powerful East Asian countries of Indonesia, Malaysia, Philippines, Singapore, South Korea, and Thailand have often been suspicious of China. Yet, each of these countries, along with Taiwan, ties their currencies to the renminbi. Experts contend that these developments are attributable to China’s dominant role in Asian trade.

The extent of China’s impact on global economic activity is noticeable in other quarters too. According to information emerging from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and published in several online publications, the renminbi was nowhere to be seen two years ago in international trade. SWIFT now discloses that 10 per cent of China’s foreign trade in July of this year was denominated in renminbi. This development is further evidence of China’s arrival at the front door of the global economic edifice and its initial efforts to force it open wider. Further evidence that the rise of the renminbi is no chimera comes from the additional revelation from SWIFT that the use of the renminbi in global payments increased by nearly 16 per cent between July and August of this year. In contrast, the use of other currencies for similar payments declined by nearly one per cent.

Currency manipulation

China certainly seems firm in its resolve not to let any country dictate how it will manage its economic and monetary affairs, and these currency movements in China’s favour are helping to strengthen its hand in the dispute about currency manipulation. China demonstrates by continually building economic supporters through trade and currency alignments that it will not be deterred by accusations of currency manipulation. These accusations have certainly not dissuaded countries outside of Asia with less affinity to China from also aligning their currencies with that of the renminbi. Subramanian and Kessler noted that nine countries outside of East Asia, including Chile, Israel and Turkey, along with India and South Africa, members of the BRICS, regard the renminbi as a more important reference currency than the dollar. Besides, the case of currency manipulation might not be as strong as suggested by those making the claim. The behaviour of the renminbi has been the subject of study and debate in the corridors of economic power. The IMF has been studying the Chinese currency for a few years now and according to a report released at the beginning of this year, the renminbi has appreciated 25 per cent against the US dollar since 2007. While it still holds the view that the renminbi might be undervalued, the IMF admits that it has to study the issue more.

Still in control

The developments in the foreign exchange arena do not mean that the renminbi has taken over the leading role in global payment settlements. That responsibility still belongs to the US dollar. In an analysis that looks at currencies in use inside and outside of the immediate geographic area, Forbes.com points out that the dollar is still the most important currency. It notes, for example, that the US dollar dominates in 13 out of 15 countries in Latin America. Further differences begin to emerge when one looks beyond a country’s immediate sphere of influence.

The US dollar is influential in 11 of 32 countries beyond its immediate sphere of influence. On the other hand, Forbes.com notes that the renminbi is only that important in four out of 32 countries. Moreover, China will have to do much more before the renminbi could de-throne the US dollar. Most countries and the private sector will only have confidence in the renminbi as a reserve currency when China liberalizes its financial markets and undertakes other necessary reforms.

Yet, one cannot help noticing how China keeps reshaping the global economy and monetary formations with visible and invisible hands.