Conclusion

Introduction

Today’s column completes a three-part article looking into the operations of this non-bank, deposit-taking financial institution as well as its murky relationship with the brother of a related party. Neither the company nor Mr Winston Brassington has responded to the claim by this column that by virtue of NICIL’s 10% shareholding in the Hand-in-Hand Trust (HIHT/the company) Winston and his brother Jonathan are guilty of using insider information in a substantial share transaction with the company.

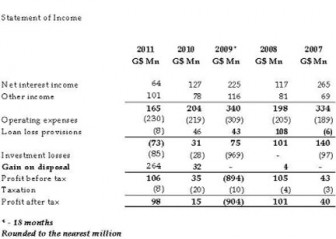

In this concluding part I turn attention to the annual report and audited financial statements of the company Hand-in-Hand Trust Corporation Inc for the years 2007-2011. Here is a summary of the income statement extracted from the audited financial statements.

There are two reasons for considering the gain questionable: one accounting and the other law. The company entered into a sale and lease back agreement with its majority shareholderof its Middle Street premises. Ignoring relevant accounting standards, the company has failed to disclose the terms of that agreement and dismissed my own query to them for particulars of the transaction.

The balance of probability is that this transaction constitutes a finance lease and accordingly, the gain on disposal ought to have been deferred and recognised over the life of the lease. Recognising the $264 million gain therefore appears improper or aggressive revenue recognition and may have been entered into as a device to improve the company’s capital base for purposes of the FIA.

The legal reason is whether or not the company should have sought shareholders’ approval of the transaction under section 140 of the Companies Act which requires both a quantitative as well as a qualitative test for determining whether or not section 140 applies. With Hand-in-Hand Trust and its parent the Hand-in-Hand group sharing a common CEO – Keith Evelyn – the transaction without approval of the minority shareholders, is less than wholesome.

Other income comprises mainly fees charged for the seven pension plans with a combined balance of $14.9 billion at December 31, 2011, mortgage fees and management fees. On the expenditure side, the company has managed its expenditure well with a 21% increase between 2011 and 2007. There was a spike in the 2009 expenses because the financial statements were for an 18-month period, a change not mentioned in the directors’ 2009 report.

The company’s accounts show regular recoveries of doubtful debts and reversal of diminution in value of properties which have mitigated the other substantial losses incurred by the company.

Compensation

The practice among companies paying comparatively larger sums to its key management personnel is evident with HIHT which paid an average in excess of $1.2 million per month to this group, estimated at more than eight times the average of the rest of the staff. Perhaps more significantly is the 8% per annum interest rate which the company charges its staff.

The financial statements do not indicate the actual rate of interest charged on a director’s (sic) mortgage which at December 31 was a whopping $95.9 million compared with staff mortgages of $7.0 million. According to the notes, “[T]he rates of interest and charges have been similar to transactions involving third parties in the ordinary course of business.”

Balance sheet

The balance sheet too raises some concerns in addition to the treatment of the sale and lease back arrangement. One person very familiar with the measurement of capital adequacy has expressed some scepticism about the company’s computation of the Tier 1 capital adequacy which the accounts claim stood at 31% at December 31, 2011 and total tier 1 and tier 2 capital of 35% and the comparative 14% in 2010. What is certain is that a significant part of an increase would be attributable to the sale of the building which released hundreds of millions in capital reserves. A realized gain is obviously more valuable than one that is unrealized.

Nor do I think that the amount of $778.0 million shown as Term Deposits is properly described since a significant portion of this relates to recoveries in CLICO Trinidad, but which are in the form of bonds maturing several years hence. The related parties balance is a sum receivable from the company’s parent for the sale of the building.

Other risks in the balance sheet include some of the investments in which there has either been a judgment or the filing of legal action. These can result in some losses to the company. On the other hand, if the stock market in the US does improve then some of the Smith Barney losses will be reversed, creating a gain.

The company’s non-accrual loans to total loans has declined from 28.8% in 2007 to 5.2% in 2011, allowing the company to reduce its loan loss provision from 8.4% to 1.5%. That percentage is as good as most other financial business in the country. As Darren Sammy would say, that is a good thing to take into 2012. Deposits have declined from $7,206 million at June 2008 to $5,708 million at December 31, 2011, a decline in excess of 21%. The company also saw the number of pension schemes under management reduced by one during the period.

I must also comment again on the issuing of preference shares and their redemption within one month of the balance sheet date. As noted last week, there is some doubt whether the redemption met the statutory requirements.

Conclusion

In mortgages, the company competes with the New Building Society which enjoys tax exempt status, and the larger financial houses with a far greater income base over which to spread their expenditure. For its trust business to succeed, it will have to attract what are called high net worth individuals. In this regard, its main competitor is probably Trust Company Guyana Limited which has the benefit of being a member of the DDL group which includes two public companies, of which one is a successful bank.

There also seems to be a lot of room for improvement in ethical and governance conduct at the senior level. It was dismissive if not insincere in its response to my written questions while itself having been treated very kindly by the regulator which has not been known for strict insistence on accounting and reporting. Even as the company seeks to expand its income base by entering the lending business, it needs to consider its risk profile and to learn from its Stanford experiences from which it still has not recovered. And at a wider level, the company must be hoping that the high real estate prices can be sustained.

The company faces a challenging future.