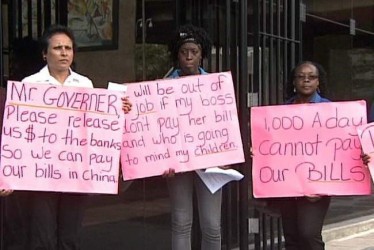

(Trinidad Express) Businesswoman Mary Ramlogan yesterday staged a protest outside the Central Bank of Trinidad and Tobago (CBTT) to highlight the unavailability of foreign currency, which is creating a negative impact on her business.

Ramlogan, managing director of Vision Head Gear Limited, was joined by a few of her employees on Independence Square, Port of Spain.

“The Central Bank is pretending that there’s no problem while our suppliers and partners in China are ready to pull the plug on us,” said Ramlogan. “They do not believe us when we say that we cannot get foreign currency and those who believe us say that if that’s the case then Trinidad and Tobago is not a country to do business with.”

She said her bank, RBC Bank, is currently only allowing customers a maximum of US$1,000 per day, which is insufficient for her to make payment for her shipments from China.

Ramlogan, whose business deals with the manufacturing of belts, hats, handbags, and schoolbags, among other fashion accessories, claims that her business is under threat. “Access to foreign currency was never an issue until recently and we have made many requests to our bankers, but they are telling us that Central Bank is not releasing the money to the banks.”

She called on Central Bank Governor Jwala Rambarran to intervene so that the matter can be speedily resolved.

“If the Central Bank does not know there’s a problem with foreign currency, or refuses to acknowledge that there’s a problem, then the governor and the board of directors should resign and allow competent persons to do the job. For surely it is gross negligence and incompetency if you do not even know or will not acknowledge that whatever you’re doing or not doing is causing me to go out of business,” said Ramlogan.

She said her company was on the verge of rolling out an online operation, but had to shelve plans because of the current situation. Ramlogan added that she’s uncertain how she will be able to pay her 30 employees in the coming months if the problem persists.

“I refuse to go to the black market, although some of my friends tell me it is saturated with foreign currency.”

Ramlogan, who maintained that the black market is not only expensive but also illegal, said the Downtown Owners and Merchants Association (DOMA) should address the issue of members who access US currency on the black market.

“DOMA isn’t doing anything to insist that the Central Bank fix the problem because its members are also profiting from the parallel market, one way or the other.”

She also knocked the bank’s currency distribution policy, describing it as stupid.

“How can you give an allowance of US$1,000 per day to someone who is importing 25 to 35 40-foot containers yearly and give US$500 per day to someone engaged in the suitcase trade.

“We have no problem with small traders as they are our brothers and that’s where we started also, but is it just and proportional to give a trader who is doing ten per cent of the business that another is doing, 50 per cent of the foreign exchange allowance of the larger trader. Surely you’re putting the squeeze on the larger traders. Ramlogan called on all business persons to come forward as they need answers from the Minister of Finance, adding that she hopes the issue of foreign exchange supply will be of high priority for the next government.