Dear Editor,

Since the Granger administration came to office, its economic policies have led to the systematic weakening of the system of respect for private property. The foreign exchange control regime just imposed on the licensed cambios is just the latest example of this dis-respect. This will result in two things, a greater portion of the foreign currency trade going underground and the return of the parallel foreign exchange rate.

The next move expected from Team Jordan is price controls as foreign investments and the net foreign reserves in the Treasury dry up.

Hard-won confidence in the currency market built up since 1990 under Hoyte and continued under all of the post-1992 PPP governments, is today being undermined by a variety of reckless public policies, causing a poor opening to 2017. The buck for this economic tragedy stops somewhere, if not at the Minister’s desk, then the political responsibility rests with President Granger.

We analysts watch for trends, and it is very clear to me after engaging in discussion with some private sector personalities that investors are concerned that the authorities have run out of options. I now have to ask myself daily whether things are worse than I thought, and if this loss of confidence could tip into a recession after two Christmas seasons of unsatisfactory trading activities.

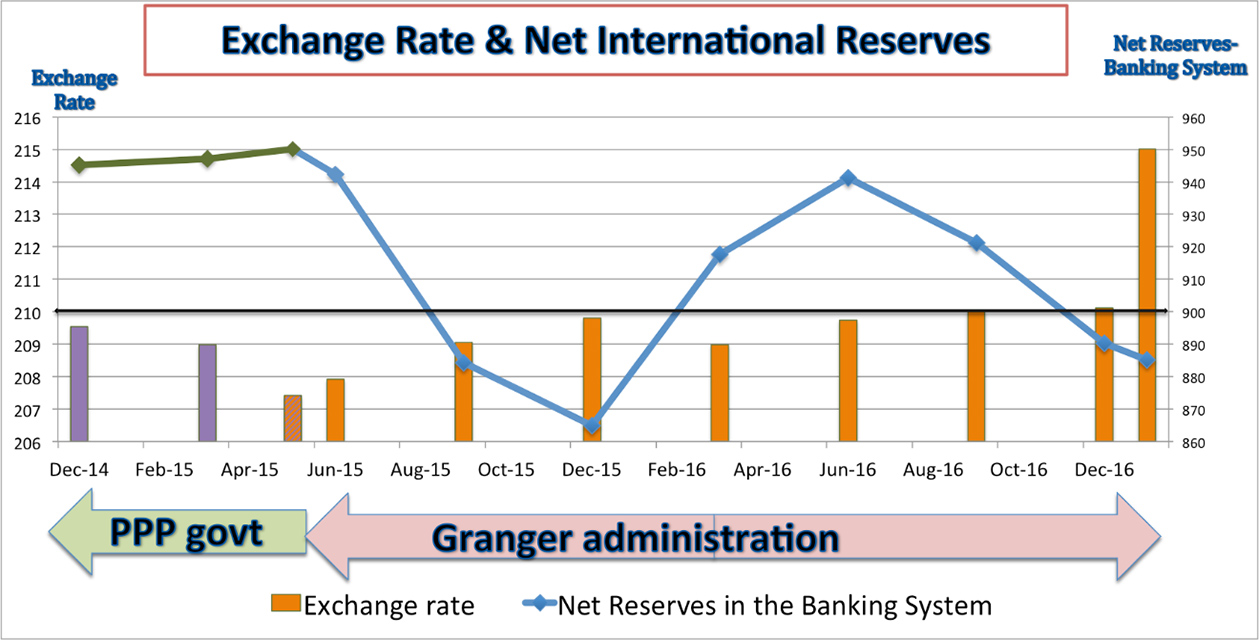

The immediate eye of the foreign currency market storm is the stock of the foreign reserves available to the banking system. As the graph above illustrates, from a period of relative stability between December 2014 and June 2015, with net foreign reserves generally above US$940M, it took an unfortunate US$85M dive for the worse in between May-December 2015 to US$865M. However, because of the praiseworthy amounts of foreign inflows from the rice and sugar sectors in 2015 as a result of the creditable production of 687,784 tonnes and 231,145 tonnes respectively, the net stock of foreign reserves recovered by June 2016 as a result of the lag between production and actual inflows.

However, by then the management of the rice and sugar industry had tipped for the worse with the approach by the geriatrics running these industries totally devoid of innovation. To compound this high tech level of incompetence, one also had to observe a very hostile attitude by the Minister of Agriculture towards the actual wealth creators in these two industries. To understand the gravity of the situation, one only has to be reminded of the subject matter around the non-payment of the legally due API to the workers and the comments of senior functionaries in the Granger administration that gave power to this reprehensible statement “payment to rice farmers was a private issue”.

These are just two of the anti-progressive policy actions emanating from the powerful people in the Granger administration since 2015, and the end product only had one outcome. Both the rice and sugar production plummeted in 2016 to 599,990 tonnes and 183,615 tonnes respectively, driving the loss of US$60M in foreign reserves since June 2016.

This shortage of foreign currency compounded by an increase in demand to fund the capital flight in progress is nothing but an economic Molotov cocktail. The economist will tell you that in such a situation the exchange rate will increase and the hardship on the local consumers will multiply as the cost of essential imported products on the shelf increases more than the expansion in basic wages. In the final analysis, all of Guyana’s current economic problems are management related. All fingers are pointing to the office of the Minister of Finance and the Granger cabinet. The people have every right to react to the policy paralysis emanating from the office of the Minister of Finance and the Granger administration. At this point in time, all the conditions are in place for a further decline in the production of rice and sugar in 2017, which means further hardship on the poor and the working class in using an intellectually bankrupt strategy of tax and spend rather than empowering and incentivizing to grow the economy.

Guyana is all ‘awe own’; it does not belong to any one class, any one race, any one group or any one group of friends and family. I will do all within my power to oppose and expose and even depose anyone who put the lives of the poor and the working class at risk; that is my mandate. Better must come in relation to how we think and act when we are leaders. It is not an opportunity to work overtime to get a bigger pension and a bigger mansion, but to truly serve the people.

Yours faithfully,

Sase Singh