In reading about the economic transformation of the Southeast Asian region, one often wonders what lessons Guyana can learn from those countries. This writer believes that their success at export and economic diversification holds the key to a similar transformation for the economy of Guyana despite the emergence of oil as part of the latter’s economy. This article seeks to provide some evidence that economic diversification remains a central requirement to the unleashing of Guyana’s economic potential.

Marvel

One could pick almost any Southeast Asian economy and marvel at the progress that it would have made over the past 50 years. Two such economies that have done remarkably well for themselves were Singapore and Thailand. Not so long ago Singapore was a country with very little going for itself. Like the Republic of Korea, it does not have any natural resources of its own. Economic life was made up of handling the goods of other countries and then transshipping them to other parts of the world. The one advantage that the country had over others was a deep water harbour. As a result of these circumstances, those who studied the economic progress of Singapore observed that the tiny Southeast nation became highly active in several economic spheres out of necessity. Singapore’s economic activity, including shipbuilding and repair, tin smelting, and rubber and copra milling were the consequence of the production of other countries. It processed many products and then sold them for a living. Experts pointed out too that export revenues of Singapore were frequently shaken by major fluctuations in commodity prices. Yet, today, Singapore has the second highest per capita income among independent countries when measured using purchasing power parity.

Within the same geographic vicinity one finds Thailand, formerly known as Siam. Fifty years ago, Thailand was still a primitive economy whose main output was agricultural products, particularly rice. In an overview of the Thai economy, it was pointed that agriculture accounted for 32% of the total GDP of the country in the sixties. At the same time, the share of manufacturing was only 14%. Because of the dominance of rice in the Thai economy, it was often described as the ‘rice-economy’. The picture of the Thai economy is somewhat reversed nowadays. The proportion of agricultural products in the total GDP of Thailand has declined significantly and represents about 12% of the country’s total output, while manufactures have grown to over 35% of the economy.

Same strategy

It was not so long ago that Guyana celebrated 50 years as an independent country, but its story is quite different from those of the two aforementioned countries that are often described as Asian Tigers. The transformation of the Singapore and Thailand economies is a story about export and economic diversification as it is about private investment and entrepreneurship. The two countries relied on the same strategy but did not follow a similar path.

Thailand covers an area of 513,120 km2 or more than twice the size of Guyana with a population that is 65 times larger than that of Guyana. The challenge for a country like Thailand to meet the needs of its people is huge. Even though Thailand was never colonized, it has suffered significant political setbacks. The internal difficulties might have slowed the economic progress over time, but it did not stop it. As such, by 2015, Thailand was ranked as the 20th largest economy in the world with a gross domestic product (GDP) of US$395 billion and a per capita income of US$16,300. Naturally, one would wonder what Thailand did to get to such a prosperous economic point in life. The story is simple. Thailand believed in free trade and proceeded to use this economic philosophy to its advantage. The country depends on international trade to grow its economy and set about making international trade work for it. Through international trade, Thailand was able to diversify its exports and its economy as a whole.

Despite periodic financial hiccups like the 1997-financial crisis, Thailand pursued a rational approach to industrialization. It employed the combined power of export diversification and economic diversification to get to where it is today. While they can go hand-in-hand, they can occur separately. Export diversification is the change in the composition of a country’s export destinations or product mix. In other words, a country can export the same products but can do so to a greater number of markets or countries. Such a strategy only reduces the risks from the loss of markets or market share. The country can also expand the range of products that it exports. Rice is no longer the dominant product in Thailand’s export structure. Unlike 50 years ago, one can easily find computers, delivery trucks, cars, refined petroleum and clothes among the export products of Thailand. The country’s initial effort in the direction of economic diversification was based on a strategy of agro-processing.

Singapore did not have that luxury. Without any natural resources of its own, Singapore had to move straight to a strategy of economic diversification to survive and prosper. Singapore, once described as a “poor little market in a dark corner of Asia”, is one of the most thriving economies in the world. Singapore occupies an area of 697 km2 which is about 300 times smaller than Guyana even though its population is five times larger than that of Guyana’s. Singapore had no choice but to diversify its economy if it wanted to change its economic circumstances. That it did and by 2015, Singapore was ranked as the 19th largest economy in the world with a GDP of US$292 billion and a per capita income of US$85,400. It is reported too that 17 percent of the population has more than US$1 million in cash savings. Singapore also had its share of internal upheaval characterized by political conflict, ethnic strife and labour conflicts. Yet, it managed to break through all of its internal troubles to construct one of the richest economies in the world.

The path taken by Singapore was also one of economic diversification. It was not a half-hearted attempt at making something out of nothing. Singapore like Thailand embraced free trade. Like Thailand, it also embraced private investment and the government did everything in its power to make it flourish. Singapore encouraged direct foreign investment which is credited with transferring a multiplicity of skills, technology and capital which benefitted the local population and industries. Foreign investment also helped to increase the country’s image as a global leader in air and sea travel and as a place for dependable telecommunications and postal services. With a strong commitment to the success of business, Singapore also began developing its entrepreneurial class which has helped to convert it into a central and major hub of innovation. The success comes with much public investment and a reasonable share of tax expenditures. In one report, it was stated that the Singapore government invested in excess of US$16 billion in research, investment and enterprise between 2011 and 2015 as part of its effort to remain a competitive economy.

The economic diversification of the Singapore’s economy was built on free trade, foreign investment and a robust domestic entrepreneurial class. As a consequence, Singapore ranks among the top exporting countries and boasts an array of products that make up its export trade. There are similarities in the top exports of Singapore and Thailand. Refined petroleum, computers and integrated circuits make up a sizable portion of their exports. But Singapore’s comparative advantage emerges in products like packaged medicaments and oxygen amino compounds while Thailand’s show up in delivery trucks and cars.

Experience

Judging from the experience of Singapore and Thailand, Guyana has to remain faithful to free trade, foreign direct investment and the development of its entrepreneurial class. This means that every effort must be made to widen the private sector. It is clear that after 50 years, Guyana seems stuck in a production and export structure that is neither energizing nor sustaining economic growth. It is obvious from the experience of the two Asian Tigers that through the expansion of the export base, diversification can lead to the expansion of export revenues, enhancement in value added products and lower instability in export. But all of it depends on the willingness of government to let free trade and private investment flourish.

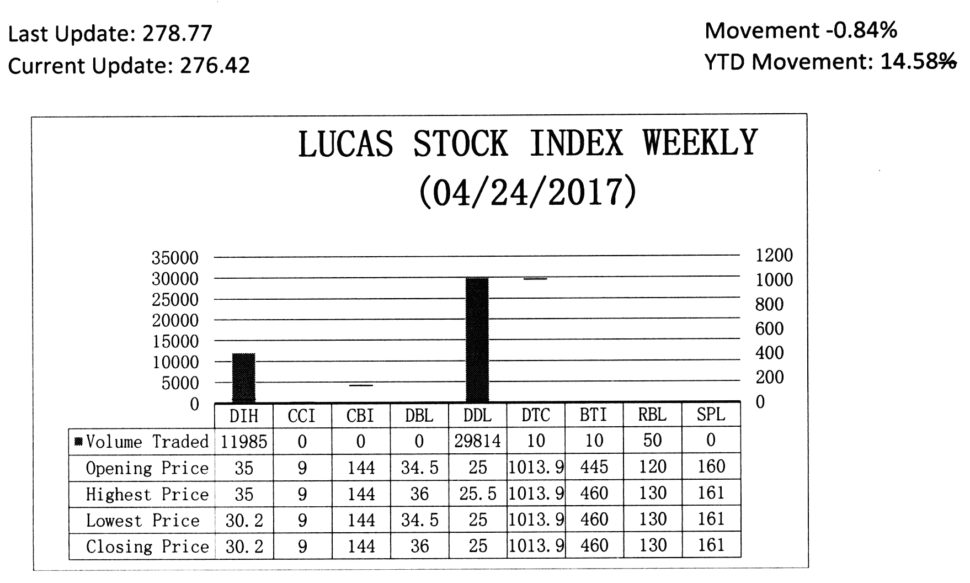

The Lucas Stock Index (LSI) fell 0.84 per cent during the final period of trading in April 2017. The stocks of five companies were traded with 41,869 shares changing hands. There were two Climbers and one Tumbler. The stocks of Guyana Bank for Trade and Industry (BTI) rose 3.37 per cent on the sale of 10 shares while the stocks of Republic Bank Limited (RBL) rose 8.33 per cent on the sale of 50 shares. At the same time, the stocks of Banks DIH (DIH) fell 13.71 per cent on the sale of 11,985 shares. In the meanwhile, the shares of Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 29,814 and 10 shares respectively.