Control

About a year ago, a report on an ambitious “green jobs” programme, which is supported by the Spanish government, was released by the Universidad Rey Juan Carlos. Conceived as a way to help Spain meet its targets under the Kyoto Protocol, the programme involved an aggressive drive to build a competitive and viable renewable energy sector. Due to this effort, Spain now has third place among nations for installed wind energy capacity, and second place for solar. Inspired by Spain’s seeming accomplishments in the field of renewables, President Obama seeks to institute a similar project in the United States. However, the report by Universidad Rey Juan Carlos does not paint a rosy picture of the Spanish effort at all. The renewable programme was heavily subsidized and that expenditure was found to be an economic failure. According to the report, it eliminated 2.2 jobs for every job created and drove up the costs of electricity as a whole, resulting in further job losses and wasted government subsidies. Equally surprising was the conclusion that only 10 percent of the new jobs were permanent in nature. This raises serious questions regarding Guyana’s Low Carbon Develop-ment Strategy (LCDS), intended to boost the economy without releasing too many greenhouse gases in the process. Guyanese ought to be concerned because, like Spain, Guyana’s own government, and not the private sector, is at the centre of the strategy. Their control could be more detrimental than helpful.

Encouraging Signs

First impressions regarding Guyana’s LCDS give encouraging signs. While Spain’s green jobs programme was centred around power generation using renewable energy, Guyana’s LCDS mainly focuses on forest conservation, ecotourism, information technology and flood damage mitigation – a wise move for a poor country. Additionally, the forestry initiatives ensure that the forest could be “reused,” ensuring a steady flow of money from traditional services such as logging, mining, and ecotourism. Finally, the strategy emphasizes Guyana’s strengths by seeking to re-engineer its “traditional sectors” rather than striking out into totally unfamiliar territory. The only power generation being talked about with any gusto is hydroelectric, which has a proven track record. Overall, such an approach has a much greater chance at fostering economic growth and provides opportunities for improved efficiencies and increased competitiveness at a relatively low cost.

Poverty Reduction

However, the strategy has weaknesses of its own; weaknesses which could make Guyanese suffer disappointments similar to the sort yielded by Spain’s renewable energy programme. Guyana’s programme is not as specific as that of Spain’s which focused on adjustments in the energy sector. The centre-piece for Guyana is forest management. A foremost weakness is Guyana’s poverty and the administration is playing a central role in poverty reduction. Since a large part of the LCDS involves forest management, the government must be able to monitor forest usage. However, despite the intake of substantial tax revenues, Guyana has had great difficulties accomplishing this task on its own and relies on international help. This unwillingness to engage broadly the national interests through community and civic institutions is already placing negotiated national interests at odds with poverty reduction efforts of individuals and communities. Much of the poverty reduction effort relies on the traditional usage of land and low-cost resources as in small-scale agriculture, small-scale mining and the purchase of processed wood for low-cost housing. The LCDS is yet to address these and similar issues in a meaningful way.

Time to Canvas

Greater emphasis has been placed by the administration on acquiring technical data about the forest and its carbon contents than on understanding the interests of the people of Guyana and what is important to them in a LCDS. Canada, for example, has taken the time to canvas a wide cross-section of its population to gain a proper understanding of their environmental concerns. That understanding is intended to serve Canadian negotiators well in trade talks with Guyana and other CARICOM countries. The US listens to the concerns of its coal and oil constituencies to calibrate public policy and private investments. Instead of seeking to understand the interests of Guyanese, the administration has chosen to do things without allowing Guyanese sufficient time to gather their thoughts on the issues impacting the LCDS.

Despite claims of sovereignty, the management of Guyana’s forest resources is being taken out of the hands of its people. Keeping track of its forest is important and requires that a forest area assessment be undertaken. If it cannot keep track of its forests, the linchpin of the LCDS, Guyana cannot judge the success or failure of the strategy. A central component of the management is the monitoring, reporting and verification system (MRVS). According to a report on consultations held with the administration in October 2009, on behalf of Norway, the MRVS envisages playing the central role in the building of carbon stock measurement capacities, conducting research on key issues and guiding the use of forest resources. That is not happening with the oil fields of Trinidad and Tobago and the tar sands of Canada, producers of known climate destroyers. Moreover, since the forest canopy covers almost five eights of Guyana, and given the role of the MRVS, decisions on new land use are no longer an individual or national right. It now becomes subject to international approval.

Rest of the World

Even more interesting is that contract decisions on the LCDS apparently will not be governed by the National Procurement and Tender Administration. The responsibility for evaluating contracts for projects emanating from the LCDS is the preserve of the MRVS. According to a report of the MRVS Steering Committee which was held at the end of March this year, bids for contracts have already started being evaluated. There is no evidence that the National Procurement and Tender Administration was involved. Bids for future contracts are forthcoming and the national institution for public procurement is not expected to be involved. Yet, Guyanese are being told the LCDS is theirs, even thought their institutions to oversee their resources are not involved. The LCDS is clearly for the rest of the world and not Guyana.

Trading Schemes

The LCDS also includes an idea to participate in emissions trading schemes (carbon markets.) Unlike the aforementioned forestry situation, Guyana’s June 2009 LCDS draft report acknowledges weaknesses in such schemes, highlighting its tepid effect on deforestation. In spite of this, Guyana still wishes to participate in carbon markets. Unfortunately, such markets have disadvantages beyond inadequate forest protection: carbon emissions cannot be quantified like most tradable commodities like gold or oil; it must be estimated. Compounding the problem is the fact that the emissions have no value beyond what regulations and laws give them, giving governments an incentive to fudge the numbers, making the prices for carbon permits unpredictable. A business might be able to afford to pollute one day when the price is low, but have to reduce emissions the next day because the price had climbed. Then tomorrow, the permit price tumbles again, meaning that yesterday’s money was wasted. No one can create a long-term plan to reduce emissions based on something so volatile. This is precisely what happened in the EU, and it didn’t even reduce carbon emissions.

Important Stakeholders

Guyana’s aim to produce economic growth from lower carbon emissions is laudable; however, the administration must exercise caution in choosing what to sink its very limited funds into and how to proceed. Doing so without the most important stakeholders, the people of Guyana, could turn a good idea into a bad one. The administration should note that if even rich countries can fall down on their efforts at low carbon development, there’s no reason that Guyana cannot follow their unfortunate example.

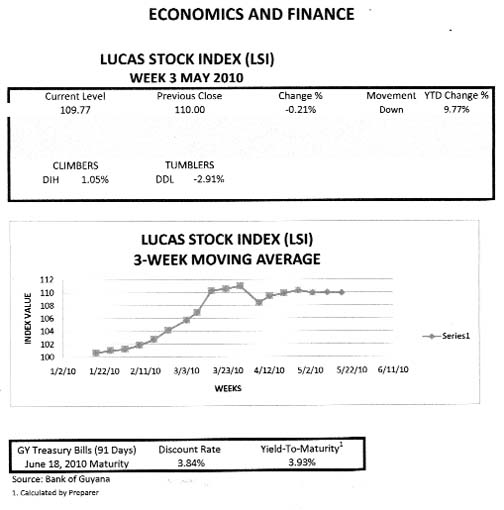

LUCAS STOCK INDEX

In week three of May, the Lucas Stock Index (LSI) declined by one-fifth of one percent. Trading was light during the current period of assessment, but saw differences in the performance of the traded stocks. DIH stocks showed positive gain while DDL stocks experienced a decline. Notwithstanding the decline, the LSI remains in positive territory for the year and reflects a 9.8 percent increase in value since the start of trading in 2010. At its current level, the index shows a yield close to 2.5 times higher than the returns to be obtained from the risk-free Treasuries that will mature in June 2010.