Anniversary

On June 30, 2013, with all attention on concerns about the expansion of the airport, the future of sugar, legislation about anti-money laundering and financing of terrorism, the price of gold and critical deadlines about the Amaila Falls hydropower project looming, no one noticed that the Guyana Stock Exchange (GSE) had reached an important milestone in its existence. June 30th, 2003 was the day that the GSE opened for business and was doing business for 88 days by the time an official ceremony was held. As such on June 30th, 2013, the GSE had reached its 10th year of existence and had completed its 517th session of trading. The lack of attention to the progress of the fledgling capital market in Guyana is evidence that the trading of shares of companies is yet to become a part of daily life. It is therefore appropriate to talk about the GSE in light of its 10th anniversary milestone.

Organized financial market

The GSE is an organized financial market where persons and institutions interested in buying and selling the shares of the listed companies go to have their trade executed. After 10 years, only one company, Trinidad Cement Limited, is officially listed on the exchange. The other companies which were grandfathered onto the exchange are still pending official listing. The decision however remains that of the companies. With electronic communication available, in-person visits to the brokerage house is not necessary. The most important function of the stock exchange is that it creates a continuous market where the opportunity always exists to buy or sell securities. Investors can sell their holdings quickly and it also means that they are not obligated to hold any of their investments forever. As with all markets, an important component is price. The GSE helps to determine the price at which the shares of the companies listed on the exchange are bought and sold. Price is determined by the buy and sell orders of investors and reflects supply and demand for the securities and the price discovery helps the companies to value their shares.

Grandfathered

Over the 10 years of its existence, the number of companies making up the Stock Exchange has not changed significantly from what it was at the inception. The Exchange started trading activities with 12 companies in its secondary list on June 30, 2003. These companies are there because they were grandfathered onto the exchange. They were allowed on because they were around a long time. While these companies were able to bypass the procedures for being officially listed on the exchange, they have not fully regularized their status. By its 517th session on June 24, 2013, of the 15 companies on the GSE, as said above, only one remained officially listed. One wonders if this is not a deliberate strategy to avoid potential takeover by foreign companies since many are barred by their governments from trading in securities that are not officially listed on an exchange. In a sense, these companies that issue stocks that are not officially listed on the GSE are having a free lunch while enjoying protection and benefits from the local stock market. While companies like Rupununi Development Company Limited (RDL) and Property Holdings Incorporated were added after the launching of the exchange, the Guyana National Cooperative Bank was taken off the list. Though still listed, Globe Trust and Investment Company is now defunct, and J. P. Santos is no longer an independent company. During that period too, the National Bank for Industry and Commerce was purchased by Republic Bank and now carries that name on the GSE. In effect, the GSE has 13 companies in its membership, just one more than when it started doing business 10 years ago. However, the shares of the 12 members that are pending official listing are actively traded at various times during the year.

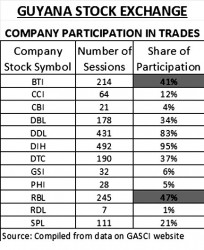

Even at this stage of its life, many observers regard the level of activity of the stock market as disappointing. In trading data kept by the GASCI, the shares of an alarming number of companies trade very infrequently. This reality might be obvious to those Guyanese who monitor the performance of the stock market. But, it might surprise many that the shares of nearly half of the companies on the secondary list have traded in less than 25 per cent of the sessions and nearly 84 per cent have traded in less than half of the sessions, despite most of them joining the exchange from the inception. For example, from the table below, it could be seen that only two companies have participated in more than 50 per cent of the trading sessions on the GSE. These are Banks DIH (DIH) which traded 95 per cent of the time and Demerara Distillers Limited (DDL) which traded 83 per cent of the time. Only two other companies came close to trading at least 50 per cent of the time. These are Republic Bank Limited (RBL) which participated 47 per cent of the time and the Guyana Bank for Trade and Industry (BTI) which participated in 41 per cent of the sessions. Yet, the infrequency in trading ought not to be seen as a negative. The limited number of trades could mean that Guyanese are not willing to part with their shares and are using them as part of their long-term savings. Institutional investors too might prefer to hold the shares of companies rather than acquire assets with lower yields so that the clients that they represent could benefit from participation in the market. Despite the small number of participating companies and limited activity, the GSE could record some accomplishments and point to advantages of participation in the GSE.

Accomplishments

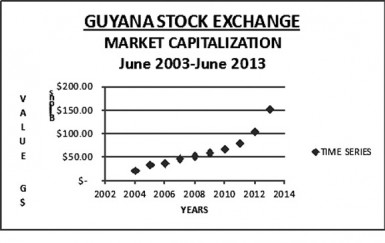

The market value of the stocks on the GSE has grown eightfold since its inception. This is an appreciation in excess of 700 per cent as reflected in the scatter graph below. At June 2003, the stock market was valued at $17 billion. By the end of June 2013, it was worth $152 billion. The annual change represents a growth rate of 24 per cent. This is in addition to the dividend payments that investors would have received for holding the stocks. The market value was equivalent to 30 per cent of the Guyana economy measured by GDP of 2012 and amounted to 40 per cent of the total assets of the commercial banks. These gains might appear small but they actually indicate that there are some positives about the GSE that many Guyanese might be igno/ring to their own disadvantage.

Advantages

According to published articles of the Guyana Association of Securities Companies and Intermediaries (GASCI), there are clear advantages to being a part of the local stock market. The advantages are more obvious to businesses than they are to individuals who might be looking for better returns for their money. The biggest draw for Guyanese businesses is the extent to which participation in the stock market lowers the cost of borrowing money and removes the obligation of having to make obligatory periodic payments to a creditor. By allowing others to own its shares, a company gets access to money and only makes payments in the form of dividends if it makes a profit and decides to distribute some or all of it. Decisions on dividend distribution are left to the discretion of company directors which puts the company in the driver’s seat. In contrast, if a company borrowed money from a bank, it would have to make periodic payments at specific times placing greater restrictions on how it uses its money and the amount available for use. The value of the market to a participating business is not limited to the cost of borrowing. With the setting of a trading price for their shares in the market, companies have been able to obtain a good idea of their market value. Without the market to provide pricing information, companies would have to rely on book value or a reasonable guess as to the true worth of the business. GASCI identifies other benefits which companies can enjoy by trading their shares on the local stock exchange. In addition to attracting overseas and institutional investors, participation in the exchange gives companies free publicity and a chance to enhance their image in the local and overseas market. Among the benefits too are higher rates of return than from a savings account and tax-free dividends and capital gains. These benefits are also applicable to individuals who use the stock market.

Another measure

What the market valuation does also is provide another means by which to measure the size and significance of investments in Guyana. For example, the market valuation indicates that the companies with the 12 actively traded shares on the exchange cannot pay for the Amaila Falls investment. These are among the largest companies in Guyana whose combined market capitalization represents about 30 per cent of the Guyana economy. Private sector investment in the Amaila Falls project would therefore require a joint venture among these companies. If they were to continue as going concerns, the cooperating companies would have to borrow massive amounts of money to carry on their business and invest in the hydropower project. Unless they get foreign partners who are willing to put up a sizable share of the equity, local private sector investment in the hydropower project is a moot point. Otherwise, the Guyana Government has to play a role in the investment. That apart, the GSE could do very little else to increase trading activity. Investments are personal decisions. Placing shares on the exchange are also personal decisions of the companies. They have to decide if they are ready to make public disclosures about their activities and feel strong enough to compete in the local and foreign markets. Until such time, the GSE will keep chugging along.