Rogue drivers

The minibus culture of reckless and indisciplined driving is expected to get worse as time goes by unless the police adopt a more aggressive attitude towards the rogue drivers in the industry. This is the view of some bus operators in a sector that keeps people and industry on the move. The transport sector, of which the minibus service is a part, was able to expand by about three per cent during 2013. But the transport industry has seen a significant increase in competition which might be causing drivers to act in a more indisciplined way on the roads and at the bus parks from which they operate. The increased competition is coming not only from an increase in the supply of buses on the road, but also from the changing demand for passenger transport. Consequently, it is not unusual to see a bus pass drivers of other vehicles on the inside to get ahead of the traffic. It is not unusual also to find drivers making second and third lanes on what is really a one-lane road. Passengers must have their nerves rattled too when buses burst out from the back of a line of vehicles to run a red light or convert turning lanes into forward lanes so that they could keep moving to catch waiting passengers further on.

Tarnished

Too much idle time

The advantage that the rogue drivers enjoy is even used at the bus park. Buses are supposed to follow the first-in first-out principle (Fifo). They are supposed to enter designated areas at the bus park and wait their turn to get to the head of the line. Some drivers feel that the Fifo method leads to too much idle time and leaves them with insufficient opportunity to meet all of their daily financial commitments. It might be unfair to generalize about the behaviour of the police but they were accused of colluding with touts to thwart the Fifo method of organizing the buses at the bus park. The police are accused of feeding information about police campaigns in real time to touts who then pass that information on by cell phone to drivers. Instead of being caught soliciting passengers outside the designated line, the drivers are in motion when the police arrive. Some drivers therefore operate with impunity.

Economics as the cause

The minibus industry is plagued by all sorts of problems, but economics seem to be a major part of the underlying cause of the many ills associated with the industry. To get a true sense of the specific problems afflicting minibus services, an in-depth study of the transport sector is required. Such a study would cost time and money. In the meanwhile, a World Bank study offers some insights on the issue for countries with economic circumstances similar to those of Guyana. The study identified bus utilization as the most important measure of bus problems in low to middle-income countries. It found that uneven demand patterns during certain times of the day, crime, corruption, and excessive driving speeds were the major causes of poor and inefficient bus service. Where Guyana is concerned, one could add the constant bickering between the government and industry operators over the fares to be charged on different routes.

The fares charged are a real and valid concern for minibus operators considering the movement in prices for many elements that are important to the successful operation of the bus.

The World Bank study suggests that minibus operators have to use as much as 65 per cent of revenues to cover fixed costs which include minimum amounts to be paid to bus owners. Owner-operators of buses are more fortunate and use just under 50 per cent of revenues to cover mandatory financial commitments. Keeping the buses fit and operable creates severe headaches for drivers. According to the World Bank, the inputs of fuel, lubricants, tires and spares could eat up between 30 to 50 per cent of revenues. World Bank indicators on transport in Guyana show that gas prices rose 16 per cent from 2010 to 2013 and by nearly 29 per cent from 2007 to 2013. Industry insiders also point out that the cost of spare parts has risen as much as 45 per cent during the same period. In the meanwhile, the real change in fares charged by minibus operators for short drops rose by 16 per cent from 2008 to 2011.

The economic pressure on minibus drivers is also coming from significant changes in the structure of the transport sector, and the minibus industry might have difficulty coping with the extent and impact of the changes. One source of the change could be gleaned from the following table.

The table in reference is an index of the vehicles that have been acquired for use in the hire car and trucking components of the transport sector and vehicles that have been acquired for personal use. It offers a crude indication of likely changes in demand for minibus services. It could be seen that since 2003 there has been a significant rise in the amount of hire cars and personal vehicles on the roads of Guyana. The number of hire cars increased nearly 134 per cent in 2013 continuing a six-year trend of increasing acquisitions from 2008. Over the 10-year span from 2004 to 2013, the annual increase ranged from 85 to 98 per cent. The acquisitions bumped up in 2007 no doubt in anticipation of demand for Cricket World Cup. The purchase of hire cars really took off after 2008 with an average annual increase of 98 per cent for the six-year period 2008 to 2013 and is probably linked to the economic and social activities that accompanied the rising fortunes of the gold and rice industries.

The purchase of private cars was even more dramatic. The number of private cars increased 351 per cent in 2013 reflecting an equally impressive expansion of the industry. Over the 10-year span from 2004 to 2013, the annual increase ranged from 181 to 240 per cent. The increase in hire cars and personal vehicles suggests that fewer persons are depending on minibuses to get around. The situation might be even more critical owing to the fact that many private vehicles are employed in the hire car industry further expanding the offerings of the hire car service.

Further, it should be noted that the increase in income seen in the transport sector last year was shared with warehousing services. So, not all of the increase could be attributed to the transport sector. Further, even if the transport sector was responsible for the entire increase, it could have come primarily from the services provided by trucks. The trucking component of the transport market saw the number of trucks increase by an annual average of 215 per cent over the past three years. Such a sustained expansion in the demand for trucks is an indicator of the economic strength of trucking services in the economy.

Insights

It is clear that the minibus industry needs to examine itself and find ways to rein in or even punish those drivers who are not playing by the rules. Competition in the industry should lead to improvements in performance and better service, but it would not happen until the police enforce the laws. Until such time, the minibus operators would feel that the road belongs to them and their behaviour could worsen as they seek to earn a reasonable income for themselves in the face of rising operational costs.

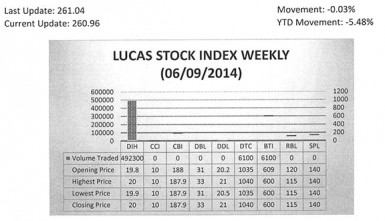

The Lucas Stock Index (LSI) fell 0.03 percent during the second period of trading in June 2014. The stocks of three companies were traded with a total of 509,800 shares changing hands. There were two Climbers and one Tumbler. The value of the stocks of Banks DIH (DIH) rose 1.01 per cent while those of Demerara Tobacco Company (DTC) rose 0.48 per cent. At the same time, the value of the stocks of Guyana Bank for Trade and Industry (BTI) fell 1.48 per cent.