Jitters

There are jitters about the Guyana economy and some observers have moved towards the view that the economy is in recession. This viewpoint should never be ignored by a government even if there is evidence to the contrary or the government can deflect the blame to some other party. It must be kept in mind at all times that the behaviour of an

Partners

Despite standing on opposite sides of the counter, the introduction to this article reminds us that consumers and businesses are partners in an economy. They fuel each other’s existence. The consumer provides labour, and in some cases building stock and money that are used by businesses while the businesses provide income to the consumer or worker. The mutual dependence of the two participants in the economy does not stop there. The consumers spend the money and make the income and the profits of the businesses possible. When consumers do not spend all of their money at once, the savings are made available to businesses through the process of financial intermediation and portfolio investment.

Important spender

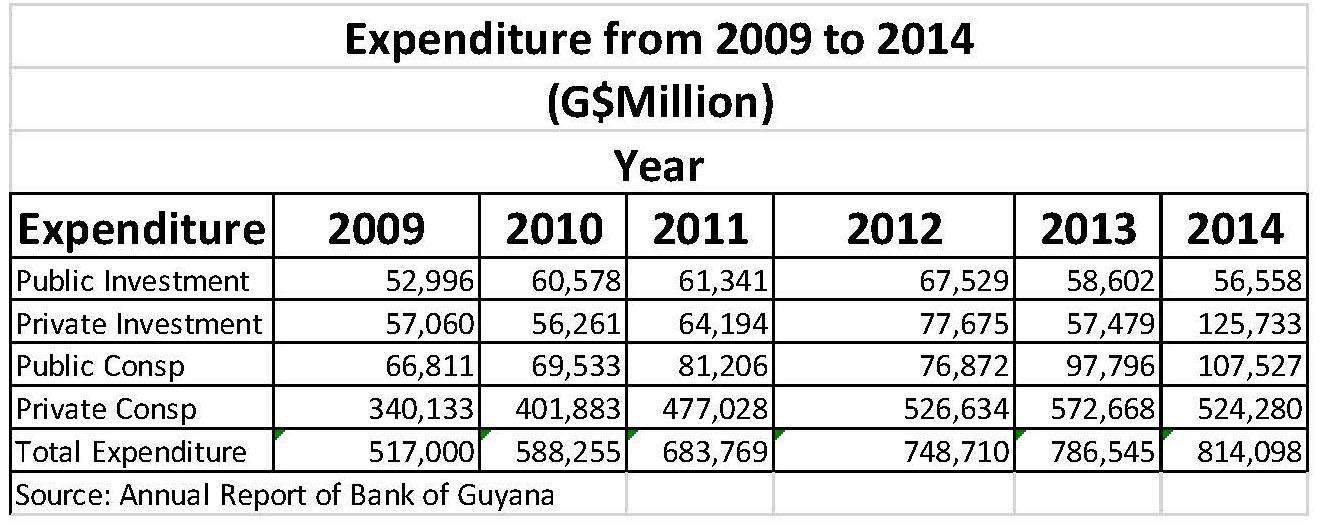

One swallow does not make a summer, but since many Guyanese are worried about current economic conditions, it is reasonable to identify what happened in the last year to bring Guyanese to their current mood about the economy. There were indications from since mid-last year that the economy was not performing as well as it could, particularly in the mining sector and the wholesale and retail sector, when the PPP/C was in charge. Unfortunately, things remained that way all through to the general and regional elections in two areas that directly touch the lives of Guyanese. The most important spender in the Guyana economy is the consumer. Judging from the level of spending since 2009 to the end of last year, the Guyanese consumer was responsible for 70 per cent of the money that was spent in the economy over that time period. This meant that with every one per cent increase in spending by the consumer, one would expect the economy to expand in nominal terms by at least 0.7 per cent. The impact on the economy is not quite the same when the consumer decides to hold on to his or her money. It slows the rate at which the economy expands. For those who are following the behaviour of the economy, one of the first things that must be recognized is that the spending by consumers slowed considerably in 2014 as against 2013 as could be seen from the Table below.

Other participant

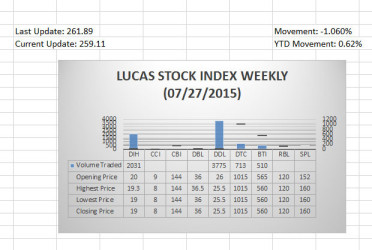

The Lucas Stock Index (LSI) fell 1.06 percent during the final trading period of July 2015. The stocks of four companies were traded with 7,029 shares changing hands. There were no Climbers and three Tumblers. The stocks of Banks DIH (DIH) fell 5.0 percent on the sale of 2,031 shares. The stocks of Demerara Distillers Limited (DDL) fell 1.92 percent on the sale 3,775 shares while the stocks of Guyana Bank for Trade and Industry (BTI) fell 0.88 percent on the sale of 510 shares. In the meanwhile the stocks of Demerara Tobacco Company (DTC) remained unchanged on the sale of 713 shares.

The other participant in the economy whose spending is significant is that of the government. Inflation and the higher cost of borrowing are two major reasons that governments are not encouraged to spend larger amounts than private consumers and investors. However, the International Monetary Fund and the World Bank have come to realize that investment spending by government can have a positive effect on an economy. Over the period 2009 to 2014, the government was responsible for 20 per cent of the spending. While that spending grew by an annual average of about 6.5 per cent from 2009 to 2014, it grew by less than five per cent last year. Government spending, though smaller than that of the consumer, was still important. The danger to the economy increased in 2015 when Parliament was prorogued and the New Year arrived without a budget in place. This lacuna meant that a significant stimulant to the economy was not in place and the uncertainty over its availability was prolonged with the scheduling and holding of national and regional elections.

These developments took place during the period that the PPP/C was in control of the economy. No one could blame the new government for what the PPP/C was responsible for, but the new government must be conscious that it has the reins of the economy now and that people’s expectations for a better economy have risen. This means that it is required to do better than the previous administration.

Not totally challenging

For this, the new government must know that the situation might not be as totally challenging for all businesses as the mood of some might suggest. Evidence towards this viewpoint could be gleaned from the performance of the companies on the Guyana Stock Exchange that are part of the weekly stock index that is prepared by this writer. The stock exchange reports market capitalization (cap) or the weighted price of the stocks of all companies in the exchange at the end of every month. Despite the limitations of the stock market, the market cap to GDP metric makes it possible to see potential trends in the Guyana economy long before government makes its data available. Since the government’s data is often historical, it hardly allows businesses to develop good early warning signals for future events. This is where the stock index plays a useful role. As a leading indicator, the LSI provides some indication as to how the economy could behave in the future.

Large

The companies in the LSI are those of firms that would be considered large by Guyana’s standards. They make a significant contribution to the national economy in terms of taxes, employment and corporate social responsibility. For example, estimates indicate that these nine companies contributed between six to 10 per cent of the tax revenues of the government in 2014. This would include income taxes, payroll taxes, as well as excise and value-added taxes. As at the end of June this year, the market cap of the companies on the exchange was reported to be about $154 billion. Within the year from June 2014 to June 2015, the market capitalization of the companies on the Guyana Stock Exchange rose 0.13 per cent. In addition, the LSI rose 1.86 per cent from January to June 2015. The inference that one could draw from these observations is that the large companies in Guyana had positive thoughts of the economy and were likely to keep investing in the growth of their businesses. The additional good news here is that these companies represent tremendous portfolio investment opportunities if they were to expand their operations further and were looking for external financing.

This optimism might not be sustainable when the data is disaggregated. The LSI reveals that the nine companies that make up the index collectively lost about four

per cent of their value from June 2014 to June 2015. Almost all the manufacturing companies in the index increased their market cap. At the same time, almost all the commercial banks lost market value. While one has to exercise a measure of caution in using this metric, the reduction in the market valuation of the commercial banks was likely telling Guyanese something. The implication here is that banks believe that economic activity could slow down further if consumer, government and private investment spending do not pick up. This viewpoint is worth considering given the links between the banking industry and the rest of the economy.

Necessity

As indicated earlier, consumer spending has the biggest impact on the economy. So the fastest way to stimulate the economy is to increase the disposable income of consumers. The private investor in times of uncertainty tends to adopt a wait-and-see posture on both consumers and the government. The burden for making things better rests with the government which must sustain or increase the confidence levels of both the consumer and private investor. It is therefore a good thing that the budget for 2015 will be presented soon. Additional government spending will help to stimulate the economy. It is significant also that the budget will contain a proposal to have the value-added tax reduced. To most of the country, the reduction of VAT has long stopped being a campaign slogan and now appears to be a necessity. With its budget, the new government can therefore pick up the pieces of the economy and move on.