Take stock

The old year is over and a new one has just begun. Like any business, one has to take stock of the past activities before going forward into the new business year. For something as large as a country’s economy and without ready access to critical data that task becomes challenging early in the year. In the interest of time, it is best to perform the assessment one sector at a time. With gold production falling, public officials took to talking about the construction sector in late 2014. Leaders of the country have cited the presence of new buildings with different architecture as proof of economic progress in the country. The showcasing of these structures has been taking place in an apparent effort to convince Guyanese that the country is doing well and by inference they are doing well. Indeed, construction is a very important economic activity in any country and in Guyana’s case, construction has been responsible for an average of 10 per cent of output since 2006. An important part of this sector is building construction, especially for housing and business purposes.

Basic need

Housing is regarded as a basic need and many experts identify it as the single largest and most important investment of a family. An IMF article points out too that building construction plays key roles in an economy. Adequate housing could facilitate labour mobility and influence how households use their savings. At one point in time it was felt by business analysts that internet business transactions would lead to the disappearance of large quantities of the traditional bricks and mortar store. That has not happened and reminds one that neighbourhood shops and shopping malls serve as important social and economic meeting places. As a consequence, this article seeks to examine the impact that building construction has had on business investment and expansion in Guyana.

A good source of data is the 2012 preliminary census report. This report shows the changes in the building stock from 2002 to 2012. Those changes mean little unless placed in the context of investment and economic opportunity. The rate of the change offers an idea of how fast buildings are being erected in Guyana. Eight buildings per day, 265 per month and 3,181 per year is what the 2012 preliminary census report suggests took place in Guyana from 2003 to 2012. Assuming a constant rate of growth, then by the end of 2014, Guyana should have 38,176 new buildings.

Building use

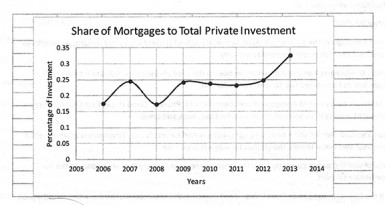

Share of private investment

It should be kept in mind that the construction of new buildings is considered a private investment activity irrespective of whether the building is being used as a residence, an office, a factory or a warehouse. The importance of building construction to the economy therefore could be seen also from the share of private investment that it commands. The price of a building for home or business is usually beyond a single pay period of workers. As a result, most persons buy a house with the use of a mortgage. One of the best ways of measuring the level of investment in buildings is to use the value of mortgages issued by financial institutions. The number of new mortgages issued could be used as a proxy for the number of new buildings constructed and the value of the mortgages could be used as the level of investment.

Based on what the Guyana Bureau of Statistics has reported in its annual reports dealing with finance, there were 14,804 mortgages recorded from 2003 to 2012. With the use of a forecast function, it was projected that the number of mortgage recordings would have increased in 2013 by 1,703 and in 2014 by 1,742 units. The average annual value of the mortgages associated with the new buildings was $11 million. This represented a stable 22 per cent of total investment spending from 2003 to 2012. However, for the year 2013 that figure is estimated at 32 per cent of private investment spending and was expected to go much higher in 2014 as implied by the graph below.

Returning to the 2012 preliminary census data, the number of new units outstrip the new mortgages by 1,701 annually. This gap is suggesting that 53 per cent of the new buildings are being erected with money that is not coming from financial

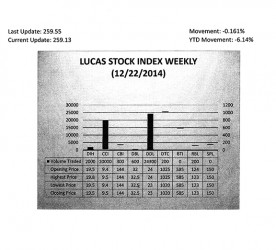

The Lucas Stock Index (LSI) fell 0.62 per cent in trading during the final period of December 2014. The stocks of seven companies were traded with 47,600 shares changing hands. There were two Climbers and three Tumblers. The value of the stocks of Caribbean Container Incorporated (CCI) rose 1.06 per cent on the sale of 20,000 shares. The value of the stocks of Demerara Bank Limited (DBL) rose 1.56 per cent on the sale of 600 shares. The value of the shares of Demerara Bank Limited (DBL) fell 4.17 per cent on the sale of 24,300 shares. The value of the stocks of Demerara Tobacco Company (DTC) fell 0.48 per cent on the sale of 200 shares while the value of the stocks of Republic Bank Limited (RBL) also fell 0.81 per cent on the sale of 200 shares. In the meanwhile, the value of the stocks of Banks DIH (DIH) and Citizens Bank Incorporated (CBI) remained unchanged on the sale of 2,000 and 300 shares respectively.

institutions. This difference raises the issue of whether 53 per cent of the investment in the building stock is not being counted in the official data reported for private investment. This is an important question to ask in light of the significant increase in the share of private investment in buildings in total investment spending. Despite the change, it still leaves about half of the new buildings to personal financing and the likely under measurement of private investment.

A few insights

The housing data provides limited information with respect to business use. Information on the total square footage of business space would have given a better picture of production capacity that was available and how much was idle due to low economic activity. The data however makes it possible to gain a few early insights into the importance of building construction to the economy.