Collection entity

For a government to carry out its work or execute the policies that it has adopted for the management of the country, it needs money. The typical collection entity is its revenue agency. But governments collect money through several other entities depending on the emphasis of its development. For example, in Guyana, in an effort to achieve development of the forestry resources, responsibility has been given to the GFC to collect royalties, fees and taxes from investors in the sector. A similar mandate has been given to the Guyana Geology and Mines Commission (GGMC) where the mineral sector is concerned. There are two other major entities, the Guyana Revenue Authority (GRA) and the

The discussion will start with the NIS because it collects a smaller share of the revenue than the GRA and its work could be aligned more easily with one of the two popular tax principles. Revenue collection in Guyana takes place under the benefits principle and the ability-to-pay principle. The benefits principle manifests itself in the revenue collection role played by the NIS. It utilizes one part of the tax structure, the NIS contribution and the payroll tax, to collect money which is then used to provide certain benefits to contributors.

The NIS has been doing this for over 46 years having been established in 1969 by the Burnham government to provide a social safety net for Guyanese. The social safety net was set up as a compulsory savings programme which savings would be used to provide maternity, sickness, disability, old age benefits, survivors’ and funeral benefits. In exchange for these benefits, contributors subscribe to the NIS through direct deductions from their salaries. In public finance, under the distributive role of government, these benefits are special to some. They accrue to those persons who contribute to the scheme under the terms of its operations.

Payroll tax

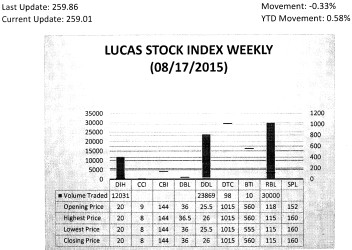

The Lucas Stock Index (LSI) declined 0.33 per cent during the third trading period of August 2015. The stocks of five companies were traded with 66,008 shares changing hands. There was one Climber and one Tumbler. The stocks of Demerara Distillers Limited (DDL) rose 1.96 per cent on the sale of 23,869 shares while the stocks of Republic Bank Limited (RBL) fell 2.54 per cent on the sale of 30,000 shares. In the meanwhile, the stocks of Banks DIH (DIH), Demerara Tobacco Company (DTC) and Guyana Bank for Trade and Industry (BTI) remained unchanged on the sale of 12,031; 98 and 10 shares respectively.

The collection process relies on the pay-as-you-earn (PAYE) system or withholding method. Since the money is taken at source, it is also described as a direct tax. The deduction follows a two-step process. Employers first deduct a part of the employees’ income from the gross salary. That portion of the contribution is referred to as the employers’ contribution. It is also known as the payroll tax because the deduction reduces the income that employees have at their disposal and is identified with the business and not the employee. Businesses are able therefore to deduct the portion that they contribute on behalf of the employee to NIS in order to arrive at taxable income. That is understandable because in reality the employers’ contribution to NIS is a portion of the wages paid to workers.

The second step in the process requires employees to make a contribution to the safety net programme from the remaining portion of their salary. That deduction is also done by their employers on their behalf, except that the income is identified with the employee. This deduction too counts as taxes for the same reasons given above. To many employees, the deduction appears punitive because they do not control how the money is invested. This concern is linked also to the ability-to-pay principle since the income that workers have at their disposal might seem insufficient to meet their basic needs.

Broadened benefit

The previous administration tried to respond to the ability-to-pay concern by paying the increased contribution for workers whose income was below $50 thousand per month. The Granger government is now permitting workers to deduct their NIS contribution in the calculation of their income tax liability. What it now means is that the entire NIS contribution attributable to employees is exempt from income taxation. The action taken by the Granger government enhances the benefits principle. This initiative has actually broadened the benefit of the tax by giving workers earning between the minimum wage and the NIS threshold a substantially higher level of disposable income than they had under the previous regime.

An important difference between the collection responsibility of the NIS and the GRA is that the NIS keeps its collections in order to help the government administer part of its social promise to the nation. So, the NIS is both a collection and an implementing agency.

Consequently, there is a direct correlation between the NIS contribution and the benefits that contributors obtain from the NIS.

Website

A trip to the website of the Guyana Revenue Authority (GRA) would reveal that the authority was established in 2000 following the adoption of the Revenue Authority Act of 1996. It took about four years to give effect to the policy decision of the government which sought to unify the administration of tax collection and enforcement for the entire country. One of them was the Inland Revenue Department and the other was the Customs and Excise Department. The Inland Revenue Department was an independent agency that was responsible for the collection of income taxes and licence fees associated with the establishment and operation of a business. It was also responsible for the issuance of licences for the operation of motor vehicles, radios and, at one time, even bicycles. It was also responsible for the issuance of licences for the sale of liquor and the operation of betting shops. When the surtax existed, this was also collected by the Inland Revenue Department.

Merger

The other independent agency was the Customs and Excise Department. This department was primarily responsible for imposing customs duties on imported and exported items. It was the one that assessed the value of goods that entered the country and applied the tariff rates that were used to calculate the amount of taxes that were due. The excise arm of that department was responsible for collecting the taxes on selected items that were produced in the domestic economy. The GRA therefore brought under one authority the activities of both the Inland Revenue Department and the Customs and Excise Department. According to its organizational structure, the merger of the two entities has resulted in a different type of entity with six divisions.

The role of the GRA is essentially to collect taxes on behalf of the government. Unlike other agencies, it utilizes all the parts of the tax structure. The tax structure of Guyana is made up of the income tax, the property taxes, the production and consumption taxes, the international trade taxes and other taxes that are linked to a miscellaneous set of items and activities. Each of these components of the tax structure is further classified by the tax base to which it is directed. For example, the income is further subdivided into individual, self-employed and company taxes, indicating that they are targeting employment income and business profits. Similarly, the production and consumption component of the tax structure is further subdivided into the value-added and the excise tax. The value-added tax targets the purchases of consumers while the excise tax targets the production of certain businesses.

Progressive system

The ability-to-pay principle applies more to the income of the taxpayer and not necessarily the benefits that taxpayers receive. Those who have higher incomes are expected to pay more taxes than those with lower incomes. Consequently, the ability-to-pay principle is applicable to a progressive tax system. Even though every individual taxpayer uses the same marginal tax rate, the use of the exemption threshold causes the tax system to act like a progressive tax system. One can argue that the income tax component of the tax structure gives rise to the ability-to-pay principle. This perspective is reinforced by the impact that the income tax and the value-added tax have on the income of workers. They both attack the income of employees though at different points. The income tax comes in at the front end while the VAT comes at the back end. The recent decision by the government to reduce the VAT on some items also was in effect a response to the “[in]ability-to-pay” principle.

Customer service

One can observe the impact of each part of the tax structure on revenue collection by reviewing data published in the quarterly reports of the Bank of Guyana. As noted earlier, the GRA also collects fees and licences as well for the operation and sale of alcohol and tobacco. Unlike NIS, the taxes collected by the GRA are required to be deposited into the Consolidated Fund. The GRA is obligated by the very law that created it to do so. It is perhaps the reason people see the GRA as a tough and insensitive entity. It does not have the wherewithal to sustain a penalty and benefits programme with taxpayers. The GRA could only reach taxpayers through the service that it provides. This means that customer service is an important tool in the collection process of the organization.